“Sell in May and go away” is an old maxim for stock traders and is based on the sentiment that in most years the summer stock market either goes down or sideways. For the long term investor, would the summer “doldrums” be a good time to make one’s annual IRA contribution?

The S&P500 index is a familiar benchmark for the U.S. stock market as a whole. I ran three scenarios: 1) investing $3000 on July 1st of each tax year; 2) investing $3000 on Jan. 31st of the following year for the previous tax year (year end bonus?); and 3) waiting till the last minute, April 15th, to make one’s contribution.

I expected a big KA-CHING! for those investing on July 1st of each year. Not only would an investor capture a supposed lull in the market in July but would have the additional benefit of having one’s money invested several months longer each year. I was surprised at the relatively small advantage that a July 1st contribution gives the investor. Below is the number of shares an investor would have accumulated during the 17 tax years 1993 – 2009. (Click to open in separate tab)

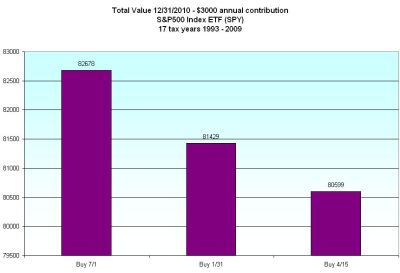

At the end of 2010, the value of the shares bought during those 17 tax years is shown below. The investor contributing each July has 2.5% more value than the person waiting till the deadline the following April. But no Ka-Ching!

For nine tax years, an investor contributing on July 1st, got a good deal. There were six years in which the investor got a better deal by waiting till January or April of the following year to make their contribution. In two years, it didn’t matter which of the three dates an investor made the contribution.

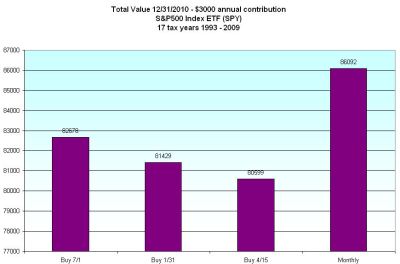

Then I examined the frumpy, boring method of IRA investing – a monthly contribution to a mutual index fund that mimics the performance of the S&P500 index. Below is a chart of the shares accumulated by investing $250 each month.

KA-CHING! While the July investor accumulated 2.4% more shares than the April investor, the monthly investor has 7% more shares than the wait-till-the-last-minute investor. At the end of 2010, those extra shares totaled $3400 more than the July investor, and almost $9000 more than the April investor, an extra return of three years of contributions!

It may be possible for an investor to gain additional return by “timing” one’s contributions to a retirement account. One could backtest any number of longer term trading systems, keep a vigilant watch on the market and possibly achieve higher returns. That would be the exciting way to build an IRA nest egg. Waiting till April 15th each year to fund an IRA is another dramatic approach. These solutions make for good stories to tell family and friends. The third approach – I’ll call it the Third Way to make it sound more exciting – may be the (yawn) monthly system.

Whatever system one chooses, the charts above illustrate the returns provided by regular investment. An investment of $51K during the 17 years of this example returned an additional $30K to $35K if valued at the end of 2010. Even at the market low of July 2010, the monthly investor would still have “made” $18K, or six years worth of contributions, on their savings. A good scout helps old people across the street, don’t they? Regular, disciplined contributions to a retirement account is like being a good scout to our future selves, a helping hand across the street of retirement. No, there is no badge, just some ease of mind.

excellent post, very informative. I wonder why the opposite experts of this sector do not realize this.

You must continue your writing. I am sure, you’ve a great readers’ base already!

LikeLike