April 26, 2015

Housing

A few months ago sales of new homes per 1000 people climbed above the low water mark set during the back to back recessions of the early 1980s. In a more normal environment, new home sales would be closer to 800,000, not 500,000.

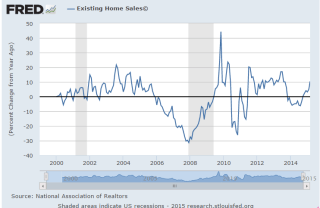

This past week came the news that new home sales fell more than 11% in March. The good news is that they were up more than 10% over this month last year. The supply of new homes is still fairly thin, less than half a year of sales, so builders are unlikely to slow the pace of construction. As new home sales were climbing this winter, sales of existing homes – 90% of all home sales – languished. The process flipped in March as existing home sales surged, up 10% year over year.

************************

Long Term or Short Term

Somewhere I read that all investment or savings is a loan. Loans are short or long term, principle assured or not. When we deposit money in a checking or savings account, we are loaning the bank money, principle assured. When we buy shares in an SP500 index mutual fund, we are loaning our hard earned money to “Mr. Market,” as it is sometimes called. Principle not assured. We hope we get paid back with a decent rate of interest when we need to cash in our loan. Most of us probably think that this type of investing is long term but, in this model, most stock and bond investments by individual investors are liquid, which is by definition short term. Every month that a person leaves their money in a stock or bond fund, it is a decision to roll over the loan. The value of our asset loan depends on the willingness of others to roll over their loans to that same asset market. Occasionally many lenders to the stock and bond markets shift their concern from return on principal to return of principal and call in their loans. When phrased this way, we come to understand the inherent fragility of our portfolios.

Because pension and sovereign wealth funds may carry a sizeable position in a market, the entirety of their position is not liquid. Substantial changes in position will probably affect the price of the asset. Even in a large position, however, there is a certain amount of liquidity because the fund can sell so many thousand shares of an asset without a material change in the price. A family’s decision to leave their 401K money in a stock fund in any month, to roll over the loan, joins them at the hip with a sovereign wealth fund in Dubai or CALPERS, the California state employee pension fund. They are all participants in the short term asset loan market.

In March 2000, at the height of the dot-com boom fifteen years ago, many investors were still loaning money to the NASDAQ market (QQQ). This past month investors who had bought and held QQQ finally broke even on the nominal value of their loans. The relatively small dividend payments over the years hardly compensated for the 27% loss of purchasing power during those fifteen years.

Taxes

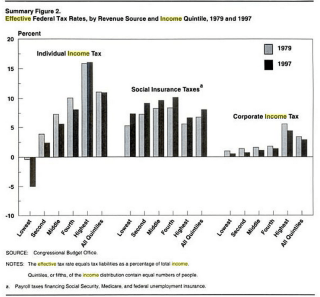

Every facet of our culture seems to get a calendar month, so I guess April is tax month. In that spirit, let’s look at some historical trends in income taxes. In 2001, the Congressional Budget Office did an assessment of changes in Federal tax rates by income quintile for the years 1979 – 1997. These are effective, not marginal, rates. If someone makes $100K gross and pays $15K in Federal income tax, then their effective rate is 15%.

Effective corporate income tax rates went down for all quintiles while Social Security and Medicare taxes went up for those at all income levels. The top 20% of incomes saw little change in their effective rates during this 19 year period, while everyone else enjoyed lower rates. The reason why the top 20% saw little reduction was that their income grew faster than the incomes of those in the other quintiles.

The negative income tax rate for the lowest quintile was due to the adoption of the Earned Income Tax Credit and the increasing generosity of the credit given to low income families. (In 1979, a worker with three children received $1400 in 2012 dollars. In 2012, they received $5,891, a 400% increase)

*********************

International Currencies

This graphic from the global financial nexus Swift com shows just how much the US dollar and the Euro dominate international trade. For those of you interested in international currency wars, you might like this Bloomberg article.

Bank analyst Dick Bove thinks that it is unlikely that the Fed will raise interest rates this year. The U.S. dollar has gained so much strength that a raise in interest rates has too many dangerous implications for other economies and would destabilize global trade.

A well written, informative and entertaining read is James Rickards’ Currency Wars (Amazon). The author, a former CIA agent, weaves a coherent and interesting narrative that connects a lot of information and events of the past one hundred years.