Matt brought up some good questions and comments yesterday. I’ll look at one aspect that he brought up – the stagnation of wages for the past 35 years.

Over the past 3 to 4 decades, the U.S. economy has been transitioning to an almost entirely service based economy. In 1953, manufacturing was 28% of the economy, a post WW2 high. By 1995, it was only 16% of the economy, and by 2007 it had sunk to 12%. How has this decades long shift affected the nation’s GDP?

Below is a graph of U.S. GDP 10 year averages since WW2 and the averages for the periods 1946 – 1972 and 1973 to 2009. (Click to enlarge)

Source: Bureau of Economic Analysis

As you can see, average GDP growth has declined in the last 35 years by 12% from the 25 year period after WW2. I have heard Ben Bernanke, chairman of the Federal Reserve, say that they like to see an overall 3.0% average growth of GDP for a healthy economy – not too hot, not too cold. For the past 35 years, we have been just shy of that.

In this next chart, I combined data from the Bureau of Economic Analysis and the Census Bureau to show real GDP per capita growth in 2009 dollars.

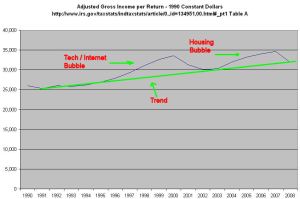

In this next chart, I’ve drawn trend lines to show the various “speeds” of real GDP per capita growth over the past 60 years. As you can see, the growth trend of the last 30 years or so has been below the growth trend of the 1960s. The data also reveals that the 60s was an anomaly – a decade of robust growth that was partially fueled by military spending. Yet it is this decade that some use as a baseline of comparison – a golden age of increased productivity and increased wages.

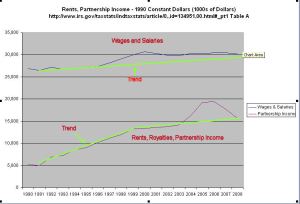

Although the growth of the past 3 decades might not be what it was during the 60s, it still averages 2.8%. Have workers seen any of those gains in growth? According to the BLS, the 1987 average hourly cost, including benefits, for workers in private business was $13.25, or $26.37 in 2009 dollars. In March 2010, the BLS reports the average hourly cost at $29.71. Over the past 24 years, companies have seen their real employee costs rise by only 13%, or about 1/2 percent a year.

During that same period, benefits have risen from 27% of total employee cost to 30%. Despite a 50% increase in inflation adjusted costs for health care in the past decade, businesses have managed to hold their labor costs down. How have businesses managed this? By reducing average wages. In 1973, average hourly earnings for employees in private business was $4.14 ($20.00 in 2009 dollars). In 2009, average hourly earnings were $18.62. In real inflation adjusted dollars, workers have gained a tiny bit in benefits and lost about 5% in wages over the past 35 years. Workers have simply not enjoyed either the gains in GDP growth or the gains in productivity over the past 3 decades or more.

But the pain felt by hourly and salaried workers is aggravated by the decline in work hours. The BLS reports that average weekly hours was 36.9 in 1973. In 2009 weekly hours averaged only 33.1. The reduced hours has affected the average worker’s weekly total. In 1973 it was $152.77, or $738 in 2009 dollars. In 2009, it was $617, a real drop of 16%.

How have business owners been able to keep a lid on worker wages for these past 35 years? Supply and demand. As I noted above, GDP growth has lessened over the past three decades, reducing demand. During that period, the supply of labor has increased. In 1973, the BLS reports that there were 64 million in the civilian workforce, 40 million men and 24 million women. The civilian workforce was 30% of the population of 212 million. In 2008, the total civilian workforce had almost doubled to 125 million, 67 million men and 58 million women. This workforce was 41% of the total population of 304 million. Look at the ratio of men to women in the workforce. In 1973, there were almost two men for each woman. By 2008, the ratio approached a one-to-one ratio. As more women entered the workforce, they put downward pressure on wages, which induced more women to enter the workforce to make up for lost household income. This cycle will continue for the next two decades unless this country decides to implement policies that will return some of the lost manufacturing capacity to this country.