May 31, 2015

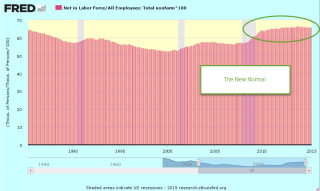

Although the unemployment rate has fallen below 5.5%, the labor participation rate is still rather low and wage growth is slow, prompting renewed calls for government stimulus. A 2010 article laid out the justifications for more government borrowing to spur the economy. Let’s review a few points made by these economists.

“Spending by the federal government always creates new money in the system, while taxation destroys it.”

The nature of money and the government’s relationship to money is certainly beyond the scope of a blog post. In short, money in all its forms is a claim. A central bank (called the Federal Reserve in the U.S.) is a government created institution which regulates and administers the supply of money and credit within a country, and manages the reserves of foreign currencies held within that country. It acts as the government’s banker and is the lender of last resort both to the public and the government. If the public will not buy all of the debt issued by the Treasury of a government, the central bank steps in and buys it, a practice known as “printing money” although there is no new money printed.

In a fiat (unbacked by any hard metal or asset) money system, a sovereign government has the power to create and destroy money claims at will. As the 2010 article notes, all taxation is a destruction of money. A $100 tax voids a taxpayer’s ability to make a $100 claim for some good or service. A thief takes money with no promises. A government takes money with some implied promise or threat but no exchange of value at the time of the taking. Taxation is not an exchange, but a taking, a destroying, like letting a little bit of air out of a balloon. As long as the government pumps in the same amount of air that it took out, the size of the balloon changes only in proportion to the change in population.

In 1960, two economists, Gurley and Shaw, coined the terms Inside Money and Outside Money to capture this unique license of government (Federal Reserve paper on this subject). Treasury bills and forms of government debt are claims on government, and termed outside money, as in outside the private marketplace. Money exchanges between people and companies in the private sector are termed inside money. Each dollar of inside money represents a debt by someone else within the private sector. When government spends more than it taxes, it borrows and pumps outside money into the private sector balloon. Many of us might think inflation is the net change in the size of the balloon but it might be more helpful to imagine that the size of the balloon, or volume, is the size of the population and grows slowly and constantly, about 1% in the U.S. Inflation, then, is a measure of the pressure inside the balloon. (Boyles’ Law and other fun facts with gases)

Various economists in this article asserted that the government should pump more outside air into the balloon, which will cause the economy, the molecules inside the balloon, to speed up. Is there any limit to the amount of outside money that a government can pump into the balloon?

“[A] government cannot become insolvent with respect to obligations in its own currency.”

If a government can make up money out of thin air, why not just give $100K to each of the 300 million citizens in the U.S.? People who couldn’t afford a newer car could buy one, which would boost the sales of car manufacturers. New homes, new appliances, vacation trips – a shot in the arm for so many industries. Unemployment would practically vanish. Imported goods into the U.S. would soar, helping the workers and businesses in other countries. People could pay off their credit card and student loan debts but banks might suffer because not as many people would want loans. Stock prices would soar in value as families searched for a place to invest some of their windfall. People who had already owned stocks and other assets before the boon would see their net worth increase exponentially. Housing prices would climb as more people could afford to buy a house.

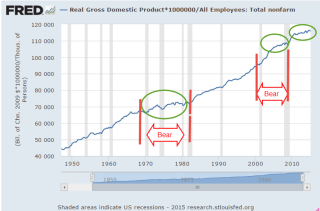

What about inflation? Well, the government has already pumped in $8 trillion since the recession started in late 2007.

$8 trillion divided by a 300 million population is almost $27,000 per person. Contrary to predictions of runaway inflation, it has been moderate or below the 2% target rate. In fact, if we use the method of calculating inflation used in the Eurozone, we have had deflation in the first quarter of this year. So any inflationary effect from a one time $100K boon would be less than disastrous. Even if inflation climbed to a 1990s level, about 4 – 5%, what is the harm?

Most of us instinctively look at this scheme, furrow our brow, and get suspicious. But why? Why can’t a government with a fiat money system simply create heaven on earth?

Stay tuned till next week….