February 18, 2024

by Stephen Stofka

This week’s letter continues to take a historical look at survey data. Every July the polling organization Gallup publishes a mid-year assessment of sentiment toward political institutions like Congress and the President, and the civic institutions that help bind our society together. These include our schools, the medical system and organized religion. Institutions are a set of rules and relationships, of rights and responsibilities. The company provides historical tables of these surveys that show a declining trust in our institutions.

Graphing the positive responses against a background of seminal events like 9-11 and the start of the Iraq war reveals the volatility of the public’s confidence in the president. Over 50% of respondents to Gallup’s survey expressed a “great deal” or “quite a lot” of confidence in George Bush before and after 9-11. His ratings fell sharply after the invasion of Iraq. The justification for the war collapsed when the public learned that there were no WMD, or weapons of mass destruction, in Iraq. By the end of 2006, positive sentiment was just 25%, less than half the results at the start of the Iraq war. In 2007, the Bush administration committed troops to ensure security in the capital city of Baghdad and this helped turn the momentum of the war. The success of this strategy called the surge helped lift confidence in the president. Notice that confidence in Biden’s presidency is about the same as the confidence in the Bush presidency in 2006.

According to Ballotpedia, 94% of Congressional members are re-elected yet survey respondents have a low confidence in Congress as an institution. On a bipartisan vote 22 years ago, Congress authorized the Iraq war. Within a year, confidence ratings sank and have never recovered. Today positive sentiment is less than 10%. The rules of both the House and Senate are designed to let a few key people in either body control the flow of legislation to the floor of each chamber. Party leaders are more concerned about their own power and reputation than the voices of the people who elected the members of the House and Senate. Almost 250 years after fighting the British over taxation without representation we have lots of taxation and little effective representation.

Medical

The Affordable Care Act (ACA) was supposed to restore public confidence in our very expensive and bloated medical system. Judging by the responses to this Gallup survey question, the creation of this bureaucracy in 2010 has had little effect on the public’s confidence in the system as a whole. Many of the provisions in the act known as Obamacare rolled out slowly and the marketplace for insurance did not open until the beginning of 2014. When the online public exchange opened, its inability to handle the surge of applicants was a humiliation for the Obama administration. Despite the improving functionality of the public exchange and the greater access to health insurance, there was little effect on public confidence. In the initial months after the Covid-19 shutdown, confidence spiked but fell again to its former level the following year.

Schools

Gallup’s 2020 survey of confidence in schools also saw of surge of support that declined to a pre-pandemic average the following year. The decline in confidence began after the onset of the Iraq war and continues to this day. At 26%, positive sentiment is only two-thirds of the level at the start of the Iraq war and matches a low set during Obama’s second term.

Banks

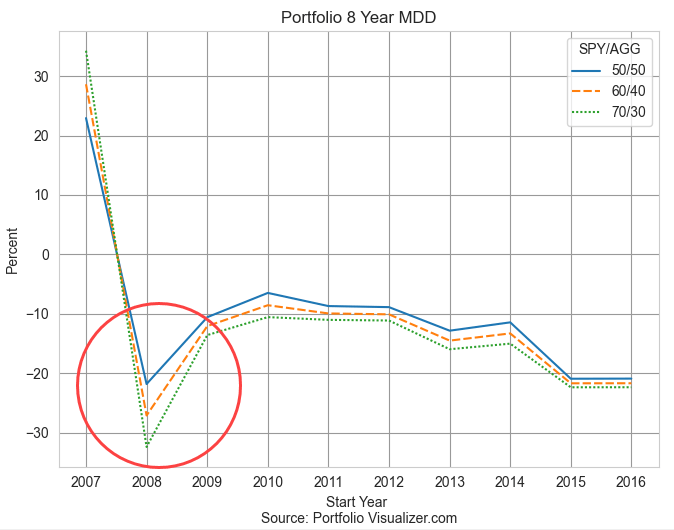

At the height of the housing bubble in 2006, almost 50% of survey respondents expressed strong confidence in banks. In the following two years, confidence plummeted and has barely recovered in the 15 years since. This lack of confidence may explain the growing support for a digital currency alternative like Bitcoin.

What is the takeaway? A declining confidence in institutions can spark a revolution just as it did in the Progressive era a century ago. As people become discontent with the rules that govern their daily lives, they look to change the institutions that embody those rules. The people within those institutions are regarded as corrupt. Groups turn to violence in an attempt to restore the integrity of those institutions as they perceive it. In the years leading up to World War I, there were hundreds of bombings of prominent buildings and frequent riots to protest working conditions for adults and children, as well as living conditions within America’s growing cities. People were beaten and jailed for wanting freedoms that we now take for granted. Sixty years ago Bob Dylan wrote The Times They Are A-Changin’, heralding an era of protest and reform in the 1960s. This may be another seminal moment when people will demand a change in the rules because the old rules are serving so few.

/////////////////

Photo by Sean Pollock on Unsplash

Keywords: Congress, President, schools, banks, medical, healthcare