December 11, 2022

by Stephen Stofka

This week’s letter is about biological and monetary evolution. Darwin proposed that biological evolution is a process of adaptation to one’s environment. Herbert Spencer, a contemporary, coined the phrase “survival of the fittest” and Darwin adopted it but came to regret it. His theory argued that species survived not because they were the strongest or most able but because they fit the environment. Sean Carrol (2006) titled his book The Making of the Fittest but his book could have been more appropriately titled The Making of What Fits. The genetic process does not produce a series of super species because such a species would overwhelm or consume its environment. A species develops attributes that help it cope with its genetic defects and this adaptation helps it find a niche within its environment.

As an example, the skin of dogs and cats cannot synthesize Vitamin D from sunlight. They must get it from their diet, from other creatures who can store Vitamin D (Zafalon et al., 2020). Dogs and cats partnered with a species who provides a steady diet of meat directly or indirectly. People store grain which attracts rodents and small mammals, a source of Vitamin D for cats and dogs. Cats and dogs have a far greater range and sensitivity of hearing and seeing, making them excellent sentries and hunters of small animals. Money is not a species, but a direct mechanism of exchange and an indirect property relationship. Still it has and continues to evolve.

Gold and other “hard” currencies have survived for centuries. Gold is durable yet malleable but so is iron which people have made into tools since the first cities and towns formed many millennia ago. Iron is a common element but in metal form, it oxidizes. Gold does not, but it is found in few places on earth, a characteristic defect that humans adopted as a money. However, the inflexible supply of gold produces deflation, a rise in its exchange value and a fall in the price of goods. Because of this, gold does not adapt well to growing economies. Investors are hesitant to support new ventures if the price of their produced goods are likely to fall. In Part 2, Chapter 2 of the Wealth of Nations Adam Smith noted the critical shortage of hard currency in the growing economies of the American colonies. In 1764 Parliament had passed a law making the issue of paper money illegal and this rightly angered the colonists. Because they were unrepresented in Britain’s Parliament, they had no say in policymaking.

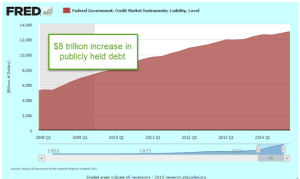

Paper or fiat money solves the supply problem of hard currency. However, it’s characteristic defect is the opposite of hard currency – inflation brought on by the supply of too much money. That apparent ease of supply is deceptive. Fiat money requires a framework of financial institutions, a number of supervisory institutions to monitor the system and an enforcement force to punish counterfeiters. These institutional costs offset the relatively inexpensive cost of fiat money. To respond to inflation a central bank can increase the price of future money or credit. A sixty year regression of a key interest rate, the Federal Funds rate, and inflation shows that they respond to each other.

The model for Bitcoin (specifically, not just any digital currency) is more organic, exhibiting an S-curve growth path like rabbit populations and anything that is bounded by the resources of its environment. Bitcoin enthusiasts tout its strength as an exchange mechanism without the enabling framework of central bank and a network of financial institutions. It is democratic and trustless. Critics point out that the broader digital currency market is riddled with manipulators like Sam Bankman-Fried, the CEO of FTX and co-owner of Alameda Research, both of which owe billions to depositors. SBF has agreed to testify this coming Wednesday at both House and Senate committee hearings. Bitcoin advocates counterargue that crises unfold regularly in the current fractional reserve banking system because it is subject to fraud and poor risk management.

Unlike fiat money, Bitcoin and gold share the characteristic defect of deflation. A rising exchange value of gold or Bitcoin attracts investors who support mining ventures for more gold or Bitcoin. When supply meets or exceeds demand, the exchange value falls and the miners may not be able to repay their loans. Robert Stevens (2022) at Yahoo! Finance details the debt crisis of several Bitcoin miners who borrowed heavily to finance the purchase of mining machines during the crypto bull market but held onto what they mined. Clean Spark is a miner that sold more than two-thirds of what they mined. While the more aggressive firms may default on their loans, those like Clean Spark with cash can buy a mining machine for 10 cents on the dollar.

Like fiat money, Bitcoin exchange requires a global electronic and communications network. The mining of Bitcoin requires a vast network of suppliers of mining machines and a less expensive supply of electricity like hydropower or nuclear, both of which are in far greater supply than gold. Although Bitcoin is not physical, its shared location means that it is impervious to fire and easily portable. Like the U.S. Constitution, the rigidity of Bitcoin’s supply model gives it stability but makes it an inflexible instrument to address economic or social change.

Fiat money and gold have evolved together because they have opposite defects that complement each other. Fiat money depends on a trust in a government authority, is easily portable and tends toward inflation. Gold is physical and durable, does not rely on trust and tends toward deflation. Bitcoin is a mule, sharing characteristic defects with both fiat money and gold. Bitcoin shares gold’s tendency toward deflation, but is not physical. Bitcoin cannot replace gold until it can be made durable like gold. Bitcoin is more easily transported than fiat money but does not rely on trust in an authority. Bitcoin cannot replace fiat money unless it can be made to tend toward inflation. In the next century, fiat money, Bitcoin and gold may evolve together without replacing each other.

///////////////

Photo by Krista Mangulsone on Unsplash

Stevens, R. (2022, December 9). Bitcoin miners took on billions in debt to “pump their stock,” leading to a crypto catastrophe. Yahoo! Finance. Retrieved December 9, 2022, from https://finance.yahoo.com/news/bitcoin-miners-took-billions-debt-113000061.html

Zafalon, R. V., Ruberti, B., Rentas, M. F., Amaral, A. R., Vendramini, T. H., Chacar, F. C., Kogika, M. M., & Brunetto, M. A. (2020). The role of vitamin D in small animal bone metabolism. Metabolites, 10(12), 496. https://doi.org/10.3390/metabo10120496