July 31, 2022

by Stephen Stofka

Inflation around the world is high but the primary contributors to rising prices vary by region. In the U.S., heightened demand has outpaced supply. In Europe, supply and rising costs have had the most influence on inflation. Price growth is outpacing wage growth, adding pressure to many household budgets. This week the first estimate of GDP growth in the second quarter was -0.9%, the second consecutive quarter of negative growth. Economists offered varying definitions of recession while politicians threw blame and accusations for the economic downturn. Only Japan and Germany have lower unemployment rates than the 3.6% rate in the U.S. (OECD, 2022). In the fall of 2019, Mr. Trump bragged when the rate was that low. Political messaging is founded on diversion, delusion and doubt.

Let’s start with the inflation rate, a crucial factor in the calculation of real GDP, the headline GDP numbers that are highly publicized. The inflation rate is deducted from the quarterly growth in nominal GDP to arrive at an inflation-adjusted measure of output. The higher the inflation rate, the lower the real GDP growth rate. In the 38 developed countries that comprise the OECD, average inflation in the 2nd quarter was 9.6% and GDP quarterly growth was 0.2%, a flatline in growth. Stuck in a three decade economic malaise, only Japan had a reasonable inflation rate of 2.4%. Here are the inflation rates in a few selected countries: U.S. 9.1%, U.K. 8.2%, Germany 7.6%, Italy 8.0%, France 5.8%. The 19 countries of the Eurozone are averaging 8.9% inflation and GDP growth of 0.5%. Only 40% of OECD countries have growth greater than 1% and those countries have relatively small economies (OECD, 2022).

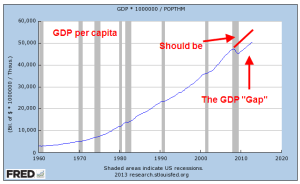

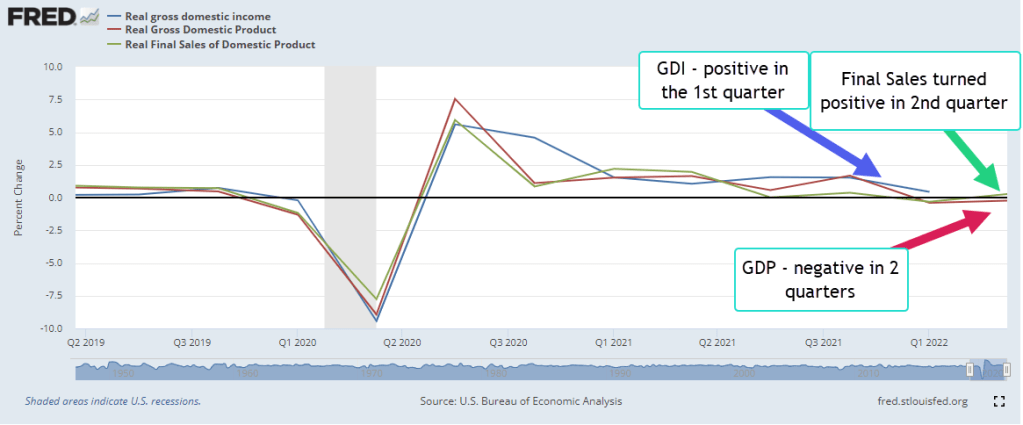

Gross National Product, GDP, is the most widely publicized measure of economic activity but there are alternative measures. GDP emphasizes production within a country’s borders regardless of ownership. If a Japanese firm owns an auto plant in Tennessee, that production is counted even though the profits are flowing to Japanese investors.

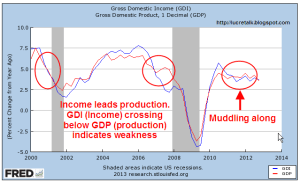

Gross Domestic Income, GDI, includes income from all American owned production around the world but would not include income to the Japanese owners of the Tennessee plant. Ford co-owns 50% of Changan Ford Automobile Corporation, Ltd. in China. GDI would include income from that production. U.S. companies have large investments around the world so GDI captures that global presence.

The two measures capture different aspects of a country’s economy. The graph below charts the quarterly growth in real, or inflation-adjusted GDP and GDI (BEA, 2022). Notice that GDI quarterly growth remained positive in the 1st quarter. The Bureau of Economic Analysis (BEA, 2021) won’t release 2nd quarter data for Gross Domestic Income for another month. A third measure, Final Sales of Domestic Product, excludes inventory adjustments and it turned positive in the second quarter.

(BEA, 2022)

Major League Baseball uses high frame rate cameras to capture the second-by-second action on the field. With the advantage of multiple angles and slow motion, a review committee in NYC overturns almost 50% of disputed calls (AP, 2020). While the players and fans wait for that review, they argue the call.

In the U.S., the final arbiter of recessions is a recession dating committee at a private, non-partisan organization called the National Bureau of Economic Research (NBER, 2022). The committee requires several months to gather enough data to determine the start of a recession. They announced the start of the 2001 recession at the end of that recession. In the FAQ accompanying the announcing the committee warned that two quarters of negative growth do not always count as a recession because the committee uses monthly data (NBER, 2001). Neither the Fed nor political parties can wait for all the information. The Fed makes monetary decisions in real time. An opposition political party uses even the hint of recession in an election year to sow doubt in the minds of voters.

On June 3, 1980, five months before the Presidential election, the NBER (1980) declared a probable start to a recession in January of that year. That announcement gave Republican challenger Ronald Reagan momentum against incumbent Jimmy Carter. In 1992, as unemployment continued to rise following the 1990 recession, challenger Bill Clinton suggested that we might be headed for another recession and called for a change in leadership. In their campaigns, John F. Kennedy (1960) and George Bush (2000) suggested that the economy might already be in a recession as the election neared. Both called for a change in leadership. This year Republicans will run on economic issues conveniently summarized with one word – inflation and recession. Democrats can highlight historically high employment gains and a low unemployment rate and will certainly run on individual rights.

In baseball, the MLB central review office makes the final call on disputed calls. In national accounting, the recession dating committee at the NBER makes the determination of the start and end of recessions. In disputed decisions among lower courts, the Supreme Court makes the final determination and rule. In presidential elections, the electoral college makes the final call. We may not like the calls but we agree to live by them. Following the 2020 election, former President Trump and his allies broke that agreement and on January 6th tried to overturn the final call by violence. There’s a single word for that – coup.

///////////////////

Photo by patricia serna on Unsplash

AP. (2020, July 21). MLB doubles camera angles for video reviews of umpires. Tampa Bay Times. Retrieved July 29, 2022, from https://www.tampabay.com/sports/rays/2020/07/21/mlb-doubles-camera-angles-for-video-reviews-of-umpires/

BEA. (2022, June 29). Gross Domestic Income. Gross Domestic Income | U.S. Bureau of Economic Analysis (BEA). Retrieved July 29, 2022, from https://www.bea.gov/data/income-saving/gross-domestic-income

U.S. Bureau of Economic Analysis (BEA). (2022). Real gross domestic income [A261RX1Q020SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A261RX1Q020SBEA, July 29, 2022.

U.S. Bureau of Economic Analysis (BEA). (2022). Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1, July 29, 2022.

U.S. Bureau of Economic Analysis (BEA). (2022). Real Final Sales of Domestic Product [FINSLC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FINSLC1, July 29, 2022.

NBER. (1980, June 3). Business cycle dating committee announcement June 3, 1980. NBER. Retrieved July 29, 2022, from https://www.nber.org/news/business-cycle-dating-committee-announcement-june-3-1980

NBER. (2001). Business cycle dating committee announcement November 26, 2001. NBER. Retrieved July 29, 2022, from https://www.nber.org/news/business-cycle-dating-committee-announcement-november-26-2001#:~:text=of%20this%20memo.-,FAQs,the%20recession%20in%20March%202001.

NBER. (2022). US business cycle expansions and contractions. NBER. Retrieved July 29, 2022, from https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions

OECD. (2021, May 25). OECD welcomes Costa Rica as its 38th member. OECD. Retrieved July 29, 2022, from https://www.oecd.org/newsroom/oecd-welcomes-costa-rica-as-its-38th-member.htm

OECD (2022), Inflation (CPI) (indicator). doi: 10.1787/eee82e6e-en (Accessed on 29 July 2022)

OECD (2022), Quarterly GDP (indicator). doi: 10.1787/b86d1fc8-en (Accessed on 29 July 2022)

OECD (2022), Unemployment rate (indicator). doi: 10.1787/52570002-en (Accessed on 29 July 2022)