October 4, 2020

by Steve Stofka

This has been a week of surprises. Sunday night, the NY Times released the details of President Trump’s tax documents which he has sought to keep hidden under the pretense that an IRS audit prevents him from doing so. We learned that Mr. Trump’s wealth is a ruse, like that of Bernie Madoff. We discovered the reason for the IRS audit: a $72 million refund that Mr. Trump was paid in 2009 under a dubious interpretation of rules in the Recovery Act following the 2008 financial crisis.

The report contains many instances of rule bending if not outright fraud. It serves as an example of why Republicans have repeatedly cut funding for the IRS. With fewer people, the IRS is unable to monitor the shenanigans of Mr. Trump and his accountants.

The last two decades have seen the largest accounting scandals, and most of them happened while Republicans controlled the majority if not all of the federal government. Enron, Tyco and Health South in the early 2000s were just the prelude to the 2008 financial crisis. The Enron scandal exposed the misdeeds of one of the largest accounting firms in the world, Arthur Anderson, who was forced to surrender their license in 2002. During these past twenty years, Republicans have consistently fought to undermine the mission of all government monitoring, to bend the rules in favor of large industry. Mr. Trump called us working stiffs suckers for paying taxes.

On Tuesday’s debate between both Presidential candidates, Mr. Trump’s interruptions broke debate protocol and the rules he had agreed to. That’s not a surprise. He is a notorious cheater at golf and has a motor mouth. He is an entertainer, not a statesman or a gentleman. The surprise was that Mr. Biden met the verbal assault without fluster. Afflicted with stuttering since he was a child, Mr. Biden has learned to speak with deliberation, a common strategy taught to stutterers. Kids around the country, watch Mr. Biden. This is how you stand up to bullies.

The announcement late Thursday night that Mr. Trump had tested positive for Covid surprised those of us who wondered how the disease had not caught up to the President, who has played the tough guy and pooh-poohed caution. Mr. Trump has several comorbidities, his physician said, without being specific. A lack of prudence might be one of them. Several hours later, Mr. Trump was taken to Walter Reed hospital out of “an abundance of caution.” With a month left before the election, Mr. Trump had a busy election schedule, which is up in the air for the next two weeks, at least. More on that at the end of this post.

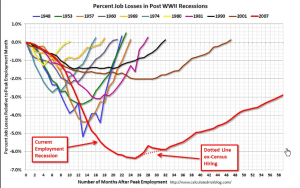

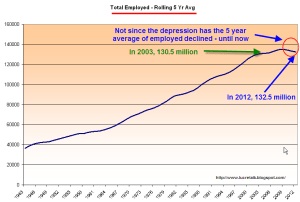

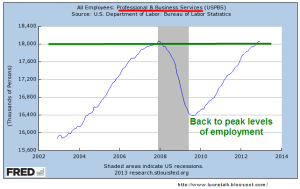

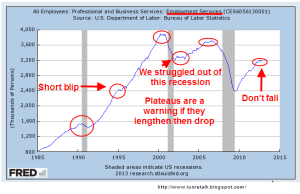

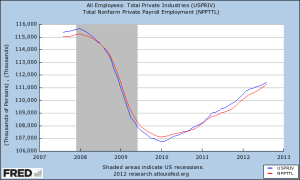

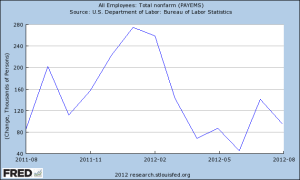

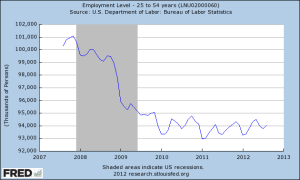

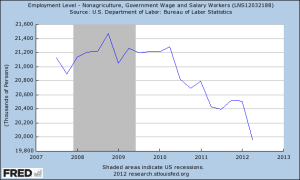

The surprise in Friday’s monthly hiring report was the weak job recovery. The employment population ratio is 56.6%, significantly down from 61% in February, before Covid. In February, 1.5 people working supported each person not working, including children. Now it is 1.3 people supporting each person not working.

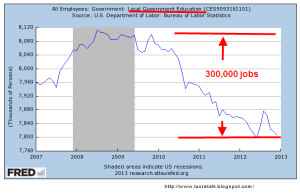

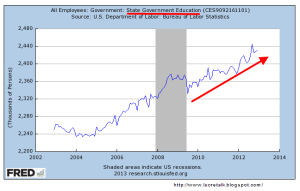

The growing debt of the Federal government has relieved some of the burden on workers, because, in times of crisis, the rest of the world wants to buy U.S. Treasuries. State and local governments are squeezed. Governments laid off 216,000 workers in September. Who will they turn to except the Federal government? Senate Republican Leader Mitch McConnell balks at aid to the states, particularly the “blue” states.

In the past weeks, airlines and other industries have been announcing permanent layoffs. Older people may be taking early retirement. The four industries that have not suffered during this crisis are utilities, consumer staples, technology and health care. The effect of tech on the stock market has been dramatic. The SP500, weighted by market cap, is up 7% since January. An evenly weighted SP500 index is down 17%. That reflects a general economic misery.

The week was still not done. On Saturday, we learned that the President had known earlier that he had Covid. He met with prominent Republicans and did not tell them he had the disease. Former NJ governor and campaign advisor Chris Christie has now tested positive for the disease. Mr. Christie is younger but is obese, the chief co-morbidity leading to death. Kellyanne Conway, Mr. Trump’s White House advisor, has also tested positive. The White House is doing a trace of all people who came into contact with Mr. Trump. He hates his enemies, but he doesn’t spare his friends either.

//////////////

Photo by Jens Johnsson on Unsplash