November 27, 2022

by Stephen Stofka

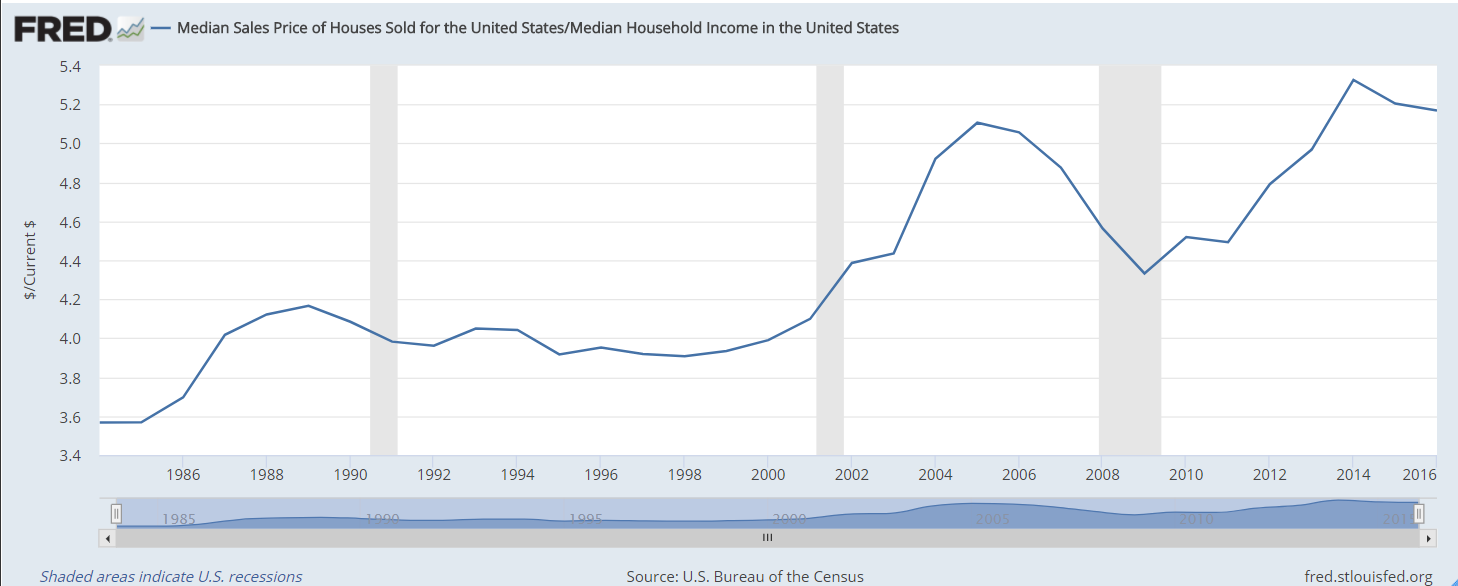

Hope everyone had a good Thanksgiving. This week’s letter is about a type of income that we don’t often think about, how that affects asset values and a proposal to increase homeownership. With left over buying power, people purchase assets in the hope that the buying power of the asset grows faster than inflation. There are two types of assets: those that produce future consumption flows and collectibles whose resale value increases because they are unique, desired and in limited supply. An example of the first type is a house. An example of the second type is a painting. Let’s look at the first type.

House Equals Future Shelter

A house is a present embodiment of current and future shelter. The value of that utility depends on environmental factors like schools, crime, parks, access to recreation, shopping and entertainment. These affect a home’s value and are outside a homeowner’s control. A school district’s rating in 2042 may be quite different than its current rating. Our capitalist system and U.S. tax law favors home ownership in several ways. The monthly shelter utility that a home provides is capitalized into the value of a property. Every consumption requires an income, what economists call an imputed rental income. Two thirds of homes are owned by the person living there (Schnabel, 2022) and a little more than half are mortgage free. Unlike reinvested capital gains in a mutual fund, this imputed income is not taxed to the homeowner. Let me give an example.

If the market rate for renting a similar home were $2000 a month, that is an implicit income to the homeowner. Because there is no state or federal tax on that income, the gross amount of that $2000 would be about $2400. That’s almost $30,000 a year. After monthly costs for taxes, insurance and maintenance, the annual implicit operating income of the property might be $25,000. At a cap rate of 5% (to make the math easy), the capital value of the property is $500,000. Each year, Congress requires the U.S. Treasury to estimate the various tax expenditures like these where Congress excludes certain income items from taxes. The implied income on owning a home is called “imputed rental income” and in 2021 the Treasury (2022) estimated that the income tax not collected was $131 billion. How much is that? A third of the $392 billion paid in interest on the public debt. If we did have to pay taxes on that imputed income, it would lower the value of our homes. For many decades, Congress has not dared to include that implied income.

Mutual Fund Capital Gains

Let’s return to the subject of reinvested capital gains in a taxable mutual fund held outside of an IRA or pension type account. Some of what I am about to say involves tax liability so I will state at the outset that one should consult a tax professional before making any personal buy and sell decisions. When some part of a fund’s holdings are sold, a capital gain is realized from the sale and paid to the investor who owns the mutual fund. If the investor has elected to have dividends and capital gains reinvested, the money is automatically used to repurchase more shares of the mutual fund. The balance of the account may change little but there is a taxable event that has to be included in income when the investor completes their taxes for the year. Many mutual fund holdings recognize capital gains in December.

Mutual fund companies provide the tax basis or unrealized gain/loss for each fund but often do not include that information on the statement. The unrealized gain is the price appreciation has not been taxed yet. For example, the dollar value of a fund may be $50,000 and the unrealized gain $5,000. This is more typical of a managed fund than an index fund which does not adjust its portfolio as frequently as a managed fund. If an investor were to sell the fund to raise cash, they would pay taxes on the $5,000, not the $50,000. The unrealized gain in an index fund might by 70% of the value of the fund. If the fund value is $50,000, the unrealized gain could be $35,000 and the investor would owe taxes on that amount. An investor can minimize their tax liability with a judicious choice of which fund to sell. Again, consult a tax professional for your personal situation.

Affordable Homeownership

Let’s visit an imaginary world where people do not have to pay property taxes outright. Each year they can elect to sell a portion of their property to the city or other taxing authority. Cities sometimes place tax liens on properties when a tax is not paid. This would be like a voluntary lien making the city a temporary part owner of the property until the homeowner sells it.

Imagine that a homeowner owns a home worth $400,000. For ten years, they have elected to have the city deduct an annual $2000 average property tax from the value of the home. Over the ten year period, the accrued sum is $20,000 plus an interest fee that is added to the principal sum of the tax. These voluntary tax liens would be visible to a lending institution so that the sum would lower the home’s value for a HELOC, or second mortgage. The city would report that annual amount each year as an imputed income to the homeowner and the homeowner would have to pay income taxes on it. At a 20% effective federal and state tax rate, the out-of-pocket expense would be about $480 on $2000. After the 2017 tax law TCJA, property taxes are no longer deductible so the homeowner has to earn $2400 to pay the $2000 tax outright. There is a slight change in income tax revenue to the various levels of government. When a home is sold those tax liens would be paid back to the city.

Why don’t we have such a system in place now? In the U.S. private entities own most of the capital. Some people would be uncomfortable knowing that a government authority had some legal claim to their property but they could opt out. In a pre-computer age, the accounting would have been a nightmare. Such a system is feasible today. Mutual fund companies have demonstrated that they can track the complex capital positions of their customers. Cities can do the same.

Such a system would make home ownership more affordable for a lot of people without affecting those homeowners who preferred to pay the property tax outright as we do under the current system. Investment companies would be eager to amortize those voluntary tax liens held by city governments. In the event of another financial crisis, a decline in housing prices and a rise in foreclosures, the city would be first lienholder, first in line to get paid when the property is foreclosed. Interest groups that advocate for affordable housing would be joined with investment and pension companies who wanted to underwrite the bonds for such a program.

A Capitalist System of Greater Inclusion

Some blame our capitalist system for the inequities in our society. The fault lies in us, not the capitalist system. Feudalism, mercantilism, capitalism, socialism, communism and fascism are systems of rules that embody a relationship of individuals to 1) property and the manner of production, both current and future, 2) the society, our families and communities, 3) the government that recognizes those relationships. The capitalist system is the most versatile ever invented and yes, it has been used to exclude people just as the other systems have been used to weaken some classes of people. The capitalist system can be extended to include and strengthen more of us. This homeownership policy could broaden that inclusion.

////////////////

Photo by Hannah Busing on Unsplash

Schnabel, R. (2022, August 19). Homeownership facts and statistics 2022. Bankrate. Retrieved November 24, 2022, from https://www.bankrate.com/insurance/homeowners-insurance/home-ownership-statistics/

U.S. Treasury . (2022, October 13). Tax expenditures. U.S. Department of the Treasury. Retrieved November 24, 2022, from https://home.treasury.gov/policy-issues/tax-policy/tax-expenditures. Click FY2022 for the current year PDF estimates.