Since the election, the SP500 index has risen about 10%. A broad bond composite has lost about 3%. Investors are clearly willing to take on a bit more risk. Prices are generally a good indicator of trend, but let’s take a few minutes to look at the flows of money into various investment products to understand the shifts in sentiment and confidence. In the first two weeks of February the flows of money have been staggering.

The Investment Company Institute (ICI) tracks (Stats) the money flows into long-term equity and bond mutual funds as well as hybrid funds that contain both stocks and bonds (Target date funds, for example). ICI also includes data on ETFs that can be bought and sold like stocks during the trading day. To avoid confusion, I’ll use “products” to describe combined data of mutual funds and ETFs. These long-term products reflect investors’ broader outlook on the market and economy rather than a short-term trading opportunity. For most of 2016, investors withdrew money from equities. Since the election, there has been a surge of $45 billion into equity products, causing a surge in prices.

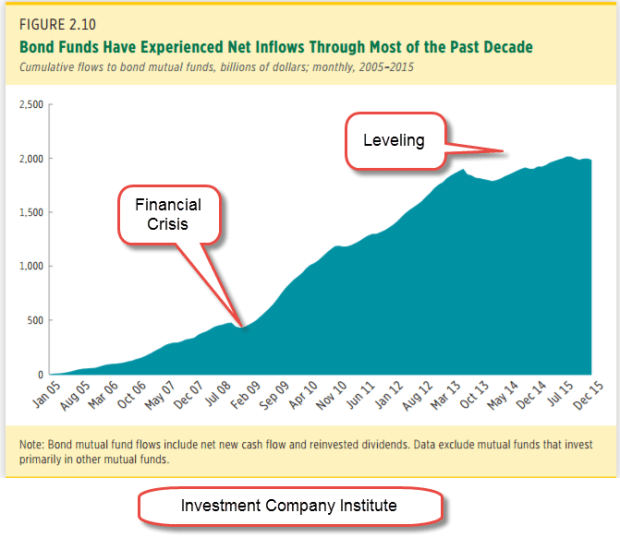

Financial advisors recommend some combination of both stocks and bonds for most investors. Let’s look at the money flows into bond products over the past year. When investors withdraw money from stocks, they tend to put them in bonds or money market funds, a shift from risk to safety.

Older people are more cautious and have more of a preference for the price stability and dividends of bond products. The aging population and the painful memories of the financial crisis prompted a rush into bond mutual funds. The cumulative money flows into bond funds has increased from $500 billion in the summer of 2008 just before the financial crisis to over $2 trillion in 2015. (ICI chart)

In the chart below we can see inflows into bonds during 2016, counterbalancing the outflows from equities. Since the election, investors have shifted $17 billion from bonds to riskier equity products. Not shown here was a further outflow of $20 billion from balanced hybrid products containing both stocks and bonds.

Let’s review those totals. In November and December, there was a net INflow of $8 billion. Compare that with the $43 billion OUTflow in November and December 2015. Clearly, there was an increased appetite for risk. In 2015 and 2016, inflows into stock, bond and hybrid products declined rather dramatically from 2014’s totals.

In the first six weeks of this year, that lack of confidence has disappeared. Investors have pumped $63 billion into stock, bond and hybrid products, almost as much as the $74 billion invested in ALL of 2016. Should that pace continue – unlikely, yes – the inflow would be about $550 billion, far outpacing the inflows of 2014. Over $40 billion of that $63 billion has come in during the first two weeks of February. That is a $1.1 trillion annual pace. Where has this 2 week surge of money gone? Half into equity – about $20 billion – and half into bonds -about $20 billion.

Had that money surge gone mostly into equities or mostly into bonds, I would be especially worried of a mini-bubble. As I wrote last week, I am concerned that anticipated profits have already been priced in. Somewhat reassuring is the Buddha-like balance of flows – the “middle way.”

///////////////////////////

Tools

I have added some resources on the Tools page. You can click on the menu item at the top of this page to access. If you have any suggestions or additions, please let me know.