March 13, 2022

by Stephen Stofka

As I was waiting for the car to drink its fill at the gas station, I got to thinking about prices. Their role is to convey information about resource availability but prices are not a conversant sort. They grunt monosyllabic phrases, relaying only the information that something has changed. A person who paid not the slightest attention to the news would wonder what happened when they filled up their car.

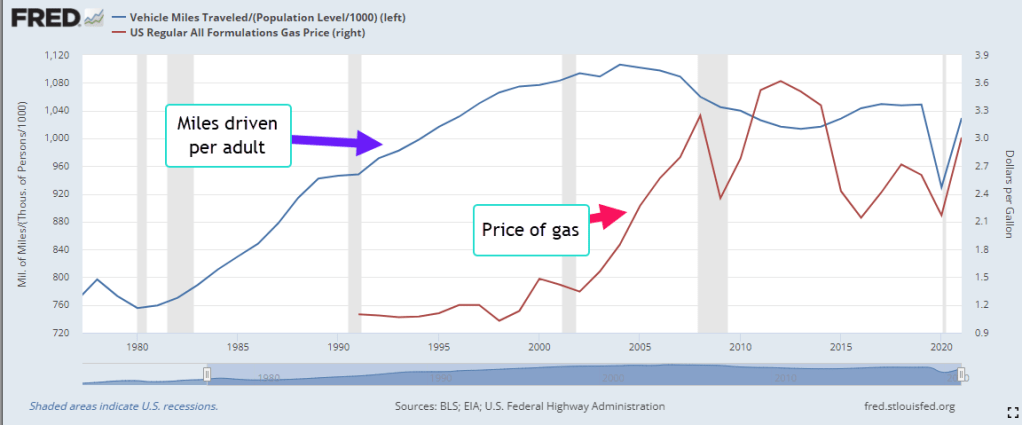

When prices decrease, do we buy more of a good or service? Sometimes. We usually pay attention to prices when they increase. In response, we substitute a cheaper good if we can, smoothing out the price changes. Most of us don’t drive more when gas prices decrease. Annual miles driven per adult have fallen as the large Boomer generation has aged (FRED Series TRFVOLUSM227NFWA/CNP16OV). The oldest of the Boomers passed 55 in the mid-2000s when per capita miles peaked.

Prices may not change as quickly as global conditions. When there is a poor coffee harvest in Brazil, the price of coffee in the grocery store may take several months to respond. Not so with gasoline, a global commodity so vital to the global economic engine that gas prices respond quickly to geopolitical events.

Many countries subsidize or control the price of some goods but too much control and prices no longer relay information between producers and consumers. The U.S. government subsidizes the farmers who grow corn to make the ethanol blended into gasoline. It subsidizes dairy, peanut and cotton farmers. Countries with state owned industries may keep a lid on prices to gain and keep political power. This year Kazakhstan lifted price caps on liquified petroleum gas which most people use to fuel their vehicles. Thousands of citizens protested (Neuman, 2022). In 18th century France, people rioted over the price of bread. Gasoline is today’s bread.

The ancient Greek philosopher Protagoras said that man was the measure of all things. In past centuries, essential food commodities that kept people alive were a yardstick of value. Anyone who has to drive to work or drives for a living feels that way about the price of gasoline. Larger firms that depend on predictable prices use the futures market to smooth gas prices but an independent Uber driver bears the full impact of rising gas prices. Should the U.S. subsidize gas prices for those who depend on the fuel? Those policies, politically popular in countries like Venezuela and Kazakhstan, foster political corruption and weaken the economic system. Why? One group of taxpayers subsidizes another group of taxpayers. The price of gasoline is closely linked with the price of power.

Competitive pricing is a hallmark of capitalism but such pricing minimizes profits. Large companies prefer to set a price which maximizes their profits within a competitive environment where other large firms use the same strategy. The result is an entire aisle in a grocery store filled with breakfast cereals that are priced at 10 times their cost. With the milk subsidies, the cereal becomes more affordable. Developed countries have learned to tame the prices of essential items without keeping those prices in a cage. We want our prices to communicate essential resource allocation information but we want well-behaved prices.

In our modern global economy we have many more goods and services available to us. Multiple sources of food products help lower prices but we are subject to the geopolitical risks of a global economy. The Covid pandemic and the war in Ukraine has reminded us that risks accompany benefits. The Russian people are beginning to experience the isolation of being cut off from the international system of trade, money and assets. Like prices, it is better when we are connected to each other.

////////////

Photo by Clint Adair on Unsplash

Neuman, S. (2022, January 8). There’s chaos in Kazakhstan. here’s what you need to know. NPR. Retrieved March 12, 2022, from https://www.npr.org/2022/01/08/1071198056/theres-chaos-in-kazakhstan-heres-what-you-need-to-know