This Labor Day weekend is the eye in the storm of the Republican and Democratic conventions. As we listen to all the rhetoric and half-truths (at best) coming out of both conventions, it might be best to take a long term view of government spending. The two biggest components of federal spending are defense and what is called human resource spending, which includes federal Education and Training Programs, Medicare, Medicaid, Social Security, various social safety net programs and veterans’s benefits (functions 500 – 700 described here ). Data is from the Office of Management and Budget (Source), Table 3.1, Outlays by Function and Super-function.

The 70 year average (1940 – 2011) of total government spending is 20.6% of GDP. The 30 year average from 1981 to 2011 is 21.2%. During the Obama administration, spending has increased to 24.1% of GDP. Each 1% of GDP is about $150 billion at current levels of GDP. (Click to enlarge in separate tab)

Defense spending has doubled in the past decade.

This spending figure includes only active defense spending. Outlays for Veterans benefits, education and job training for vets are included under the Human Resources superfunction. Housing benefits for veterans are included under another superfunction, Physical Resources. The total outlay is estimated at over a trillion dollars and that figure has been acknowledged by Senator John McCain, a long time supporter of strong defense spending.

As a percent of GDP, however, active defense spending has remained below 5%. Putting this increase in spending in historical perspective puts the lie to the contention by some liberals that our budget problems are mostly due to defense spending.

Human Resource spending includes Social Security payments, which comes out of current taxes and a trust fund surplus of $2.7 trillion (Source). Since most Social Security payments come out of a tax that has been dedicated to those payments, I have deducted them from total Human Resource spending to get a more accurate picture of the trend in spending on the social safety net.

When financial conservatives on both sides of the aisle warn of this upward trend, this is what they are talking about.

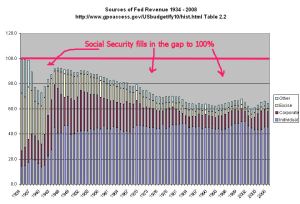

What too many Republicans won’t acknowledge is that we have had and continue to have a severe revenue problem.

Since I listen to and read a lot of “conservative” media each day, I repeatedly hear the mantra that Reagan lowered tax rates and revenues increased. This is the justification for pushing for continued tax cuts. Reagan and a Democratic Congress lowered tax rates. The president signs bills that are passed by the Congress. This is not a one man show. Total revenues, including Social Security and Medicare taxes, did increase because Social Security taxes were increased 12% during the Reagan years (Source). When we look at tax revenues without Social Security taxes, revenues as a percent of GDP fell, just as anyone would expect when tax rates are reduced. Since WW2, tax rates have been gradually reduced, and, as expected, tax revenues as a percentage of the economy have fallen. There is no magic formula here. Lower tax rates = lower revenue.

In this ongoing battle of ideologies, there are three real issues. Should we spend more than 5% of GDP on active defense spending? Should we spend more than 10% of GDP on social safety programs (excluding Social Security)? Can we expect to ever live within our means if we collect only 10% of GDP in income and excise taxes? We can not do all three.