An August 2005 NY Times article reported Robert Shiller’s – the Shiller in the Case-Shiller housing index – clarion call that the housing boom would soon bust. Since we are now in the future, we know how that prediction turned out. What interested me was Shiller’s brief 400 year history of housing prices.

Month: January 2010

The Commons

Several hundreds of years before Adam Smith wrote his seminal work “The Wealth of Nations” (full text ), England wrestled with the Problem of the Commons, which is the title of a book by Gordon Marshall.

“The use of commons (publicly available land on which farmers graze their cattle) becomes a problem when one such farmer reasons that he or she can expand his or her herd since this small addition to the total stock will contribute little harm to the available pasture. However, if other farmers reason likewise, these incremental additions to the stock using the land lead to overgrazing and thus the destruction of the resource itself. In other words, if each individual in this situation rationally pursues his or her own short-term interest while disregarding others similarly pursuing theirs, then the long-run consequence is that everyone loses their share in the collective resource.” (GORDON MARSHALL. “Problem of the Commons.” A Dictionary of Sociology. 1998. Encyclopedia.com. 23 Sep. 2009)

Communism and other forms of collectivism try to solve this thorny problem by eliminating one of the sources of the conflict, private property. In an ideal form, free market capitalism denies the existence of the commons, thereby eliminating the other source of the problem.

Between those two extremes lie various attempts to form societies to manage, not solve, this enduring struggle, allowing the two competing interests of private and public to wrestle.

The Labor Force

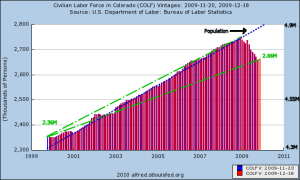

Here’s a time series graph of the Colorado civilian labor force, which includes everyone over 16 not institutionalized or in the service and who is either working at least a few hours or looking for work. If a person is retired, they are not in labor force. Nor is a person who has given up looking for work and no longer bothers to register with the state unemployment office after running out of benefits.

I have added some approximate numbers in the graph to highlight the employment – or rather lack of it – problem. The difference between the upper green line and lower green line is about 100,000 decrease in the number of people counted in the labor force in the last 15 months or so. Despite that decrease, the graph shows an increase of 300,000 in the labor force over the past decade. Until the latter part of 2008, Colorado enjoyed a low unemployment rate, meaning that most of that net 300,000 growth was new jobs being created. So, what’s the problem? New jobs are good, right?

This past week came the announcement that Colorado’s estimated population had crossed the 5 million mark, meaning that, in the past decade, the population has grown by approximately 700,000. Colorado has a relatively younger population. In a healthy economy, the ratio of those in its workforce to those not in the workforce is about 55 to 45, higher than the national average of 51 to 49. As a comparison, Florida has an older population and its ratio has averaged 49 to 51 over the decade.

With the population increase scaled to this ratio and overlayed on the graph (blue line), we can see that the growth in the labor force matched the growth in the population until the past year or so. With an total estimated population of 5 million, a healthier labor force would total about 2.75 million. We are about 80,000 short.

Future Fun Facts

In 1950, life expectancy at birth was about 67 years. In 2003, it was 80 years. That dramatic increase in life expectancy over a span of 50 years is less dramatic when we look at a comparison of life expectancy for a 65 year old. During that same 50 years, it had gone up only 3 years, from almost 78 years of age to 81 years of age.

Although less impressive in years, those three extra years of life equals 36 additional months of collecting Social Security and that’s one problem: old people getting older and continuing to collect Social Security.

The way to fix that problem is to have more workers contributing to Social Security. That’s the second problem. Not enough young people and we can blame parents for that. People are just having fewer kids, leaving fewer workers to pay for the old people continuing to collect Social Security.

How to fix that problem? Immigration. Relaxed immigration standards will allow more workers to come into the country and contribute to Social Security. That’s the third problem. Immigrants may require more social services than what they contribute in taxes and Social Security and eventually those immigrants will get old and start collecting Social Security themselves.

A 2006 Congressional Research Service (CRS) report projected that, by 2075, an average life expectancy for a 65 year old to be about 86.5 years of age. That’s an additional 66 months of Social Security payments.

The solutions to the relentless march of these demographic numbers are politically unpalatable so we can expect that our elected representatives will do everything else before finally adopting them.

First, expect retirement ages to increase. Older workers will not like that. Second, expect the Social Security contribution rate to increase. Workers of all ages will not like that. To avoid their anger, politicians will “soak the rich” by increasing the amount of income that is subject to Social Security tax. Those in the upper income brackets get far less in return for what they contribute and they can expect to pay more and get less. Third, expect Social Security payments to decrease or to increase at a slower rate. Retired people vote and they will not like that.

These are the fun facts of the future. Maybe the “Future Fairy” will take away these problems and leave us a quarter.

Money Ratios

A Denver investment advisor, Charles Farrell, has just written a book titled “Your Money Ratios” that should be part of a course for high school seniors. Mr. Farrell gives clear, simple guidelines for personal savings goals and debt ratios based on your income and age. The book lays out a game plan for making the transition from laborer to capitalist, from working for money in your twenties to having your money work for you to support you in retirement.

In simple language, Mr. Farrell explains many financial products that a person will encounter during their lifetime: stocks, bonds, various forms of insurance. He gives clear guidelines for mortgage and education debt as a ratio of your income and age. He compares the long term costs or savings of buying a house vs. renting.

His ratios are age-adjusted signposts, easy to understand and easy to use as a financial fitness check.

Social Security Wage Index

Every year we get a statement from the Social Security Administration (SSA) listing our wage history and an estimate of the monthly SS benefits we will receive when we retire. Our past earnings determine our future benefits. But how do they do that? Social Security Wage Indexing Factors. The SSA adjusts each person’s past wages for inflation, then takes the best 35 years as a benchmark for determining benefits.

If you have an extra half hour or so and want to look at your wage history in today’s dollars, go to the factor’s page at the SSA. Set the year to 2010. Copy the resulting table of years and index factors (two columns) into a spreadsheet. For each year, type in the reported earnings from your SSA statement into a third column. In a fourth column, set the formula to multiply each year’s actual earnings in the third column by the index factor in the second column. The result will be the inflation adjusted amount of your earnings for that year.

You may find a few surprises in the data. I did.

Concentrated Wealth & Taxes

As the new year gets under way, it’s time to visit everyone’s second favorite topic after death: taxes. Conservative commentators and politicians have pointed to a disturbing trend in the past two decades: the increasingly smaller percentage of taxpayers paying an ever increasing share of income taxes in the U.S.

The Tax Foundation reviewed a mid-year IRS report on income and taxes. In 1980, the top 1% of income earners paid about 20% of total personal income taxes. In 2007, that same top 1% paid 40% of the tax bill. (Table 6) It is a concern when the tax burden is shared disproportionately by a small percentage of the population. A dangerous trend is that the bottom half of income earners pay almost nothing in income taxes. Why the danger? An ever increasing number of taxpayers who pay little in taxes will be more likely to vote for more government spending and more entitlements. Why not? It doesn’t cost them anything.

As valid as those concerns are, there is an equally alarming increase in the disparity of incomes. In 1980, the top 1% of earners in the U.S. reported 8.5% of the total income (AGI). In 2007, almost thirty years later, that top 1% reported almost 23% of total income. (Table 5) That three-fold increase in the proportion of income earned by the top 1% is overshadowed by another startling statistic in the IRS income tables: that the top 5% earned 60% of the total income in this country in 2007.

The increasing concentration of wealth in any country has been a harbinger of a downfall in a dominant economy. In “Wealth And Democracy” Kevin Phillips examined the history of the financial empires of Spain, Holland and England, which all lost their economic dominance as the wealth concentrated in the hands of the few. The U.S. is on the same path as those previous dominant economies. Will history repeat itself? Probably.

Health Horror Stories

In 2007, USA today reported several horror stories of individual health policy revocations. These stories highlight the root conflict of interest in private health insurance. In case you might wonder why other forms of insurance don’t have these problems, they do. Business liability insurance has its own horror stories. I know of several smaller contractors, newly in business, who simply could not get liability insurance from the more reputable insurance companies for their line of work in construction. The public hears little of these stories. They are told on job sites and in trade journals.

Cat Crushes Costs

At the beginning of this year, employees of the large equipment manufacturer Caterpillar were able to walk into Walgreen’s or Walmart pharmacies and get many generic drugs for free instead of paying a $15 co-payment. Many big companies like Caterpillar normally employ a prescription benefit manager (PBM) to handle and negotiate discount deals with drug manufacturers. The PBM then tacks on a percentage which it charges to its client. By negotiating directly with Walmart and Walgreen’s, Caterpillar will save 30 – 35% on many common drugs. It is a win-win-win for the employees, Caterpillar, and Walmart and Walgreen’s.