November 24, 2024

by Stephen Stofka

This is part of a continuing series of debates on economic and political issues. Substack users can find last week’s debate on climate change here. WordPress and other users can visit my web site innocentinvestor.com here. Wishing everyone a good Thanksgiving this next week.

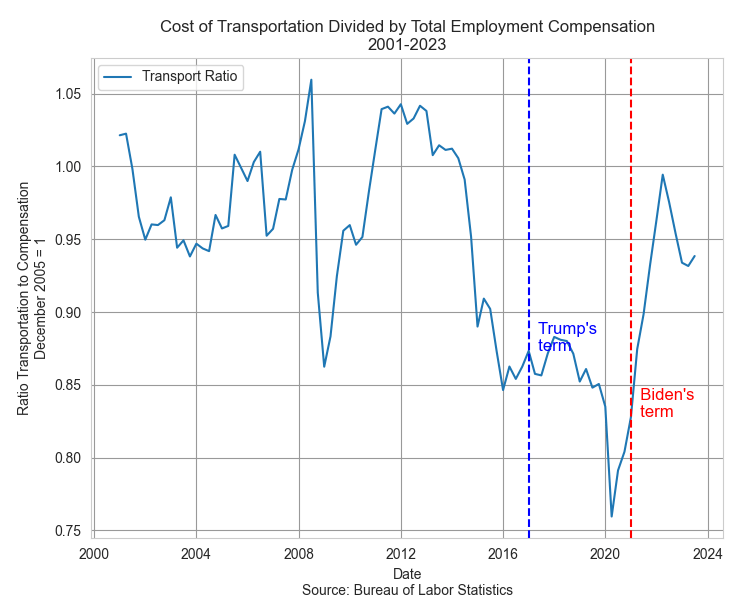

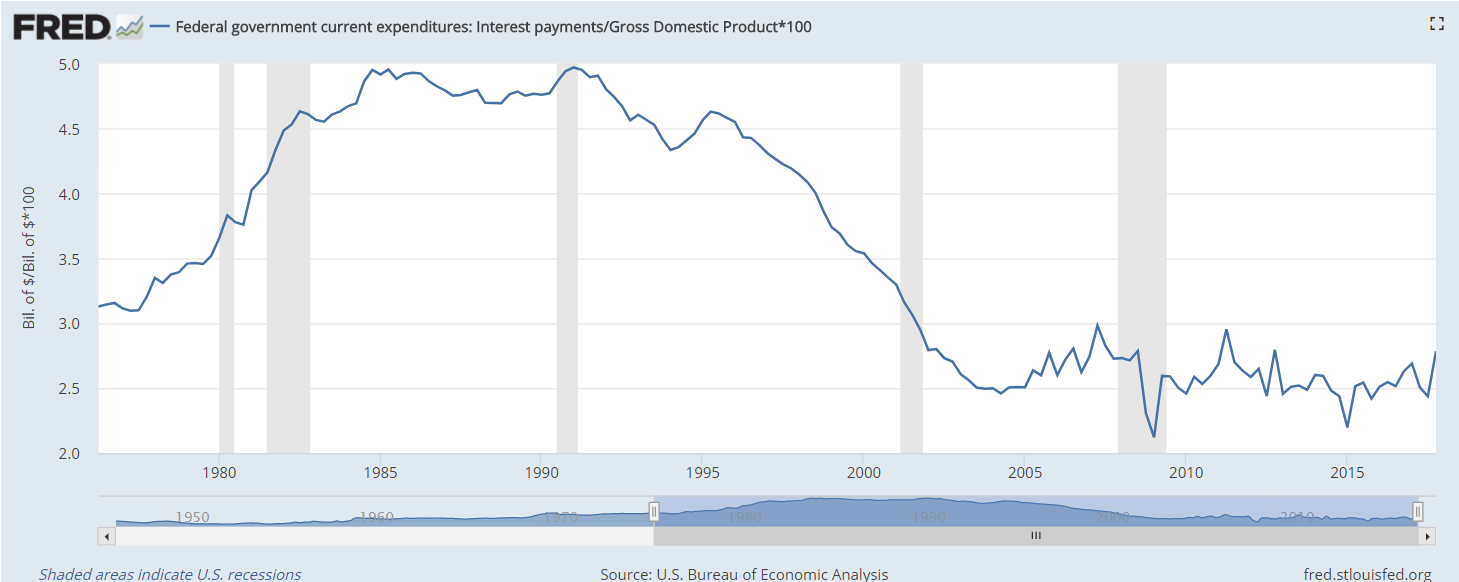

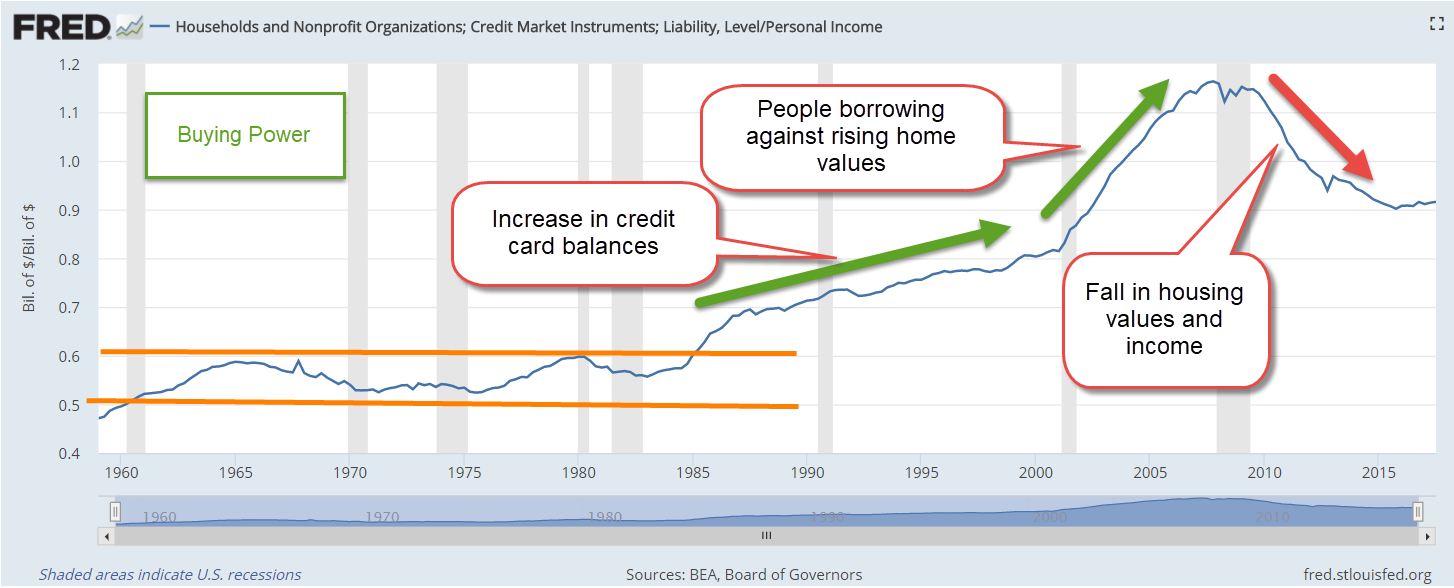

This week’s letter is about the price system, continuing an imagined conversation that began with last week’s letter. What is a price? Is it a measure? If so, it is not a good one because prices keep changing from year to year. Let’s imagine a haircut from the same stylist that costs 5% more in 2024 than in 2023. Did the quality of the haircut change? No. the service delivered is the same but not the price. So, what is price? It must be a good in and of itself – a commodity like wheat. A good that “evaporates” like water in the sun. The CPI calculator at the Bureau of Labor Statistics indicates that a $1 in 2024 buys what $0.50 did in 1995. Any interest earned on savings has barely compensated for the loss of buying power (see notes).

And now the conversation between Abel and Cain continues:

After the usual pleasantries, Abel said, “Last week I pointed out market failures where the price system in a free market does not control a negative externality like pollution. Another flaw in the pricing system is its inability to cope with social justice issues. Your group favors policies that emphasize growth. You claim that more growth will benefit everyone, including minorities. What about rent control? Land can’t grow. In densely populated cities like New York, the only way to grow the housing market is to build up. Zoning policies restrict the height of many residential areas, and the current residents prefer it that way.”

Cain replied, “Rent control is a price control and our group does not favor price controls in any form. They distort the supply and demand dynamics of a market. Rent control encourages landlords to make only those repairs which will avoid regulatory fines from housing authorities. The quality of the housing stock declines and that only contributes to the problem. Housing authorities must devote more resources to inspect properties, handle tenant complaints and regulate landlords.”

Abel interrupted, “So what’s your suggestion? In crowded markets like New York, the housing supply is too rigid, so it doesn’t shift to meet demand like in a supply demand model. If prices were allowed to find an equilibrium on their own, many working people would be priced out of the market. They would have to move further away from the city and drive long distances to get to work. This would choke an already overtaxed traffic and transit system. What’s your group’s answer? Let people move to another state? The tri-state area has already become a giant metropolis because families have tried that solution. The problem persists.”

Cain nodded. “Yes, there are choke points where circumstances or political interests constrict supply. The first question politicians should ask is ‘How can we adapt the price system to help manage this particular market?’ If we look at improperly maintained housing as a pollutant, perhaps policymakers could use a permit system or tradeable credits, the same system that has been successful with some pollutants.”

Abel asked, “How would that work? Make available a number of permits to not maintain housing units to safe health and safety standards? Housing can’t be turned into a lab experiment.”

Cain responded, “Each city may devise different pricing solutions. Some may work better than others, allowing competing policy frameworks to be tested in different circumstances. The point is that regulations and rent control should not be the first tool that policymakers reach for.”

Abel asked, “Has anyone used an incentive-based strategy using the price system to tackle the problem of affordable housing in a dense urban area?”

Cain replied, “Not that I am aware of.”

Abel argued, “Proves my point. Some issues cannot be resolved through the price system. People tolerate many inconveniences in a big city because there are many factors that induce them to stay.” Abel ticked them off on each finger, “Jobs, family, public transportation and infrastructure, civic associations with people having similar interests, schools for the kids, sports teams, the availability of internet, public institutions like libraries, internet, parks, museums.”

When Abel paused to take a breath, Cain interjected, “I get your point. A home of some sort in a city gives people access to amenities that are not available in a rural district with 2,000 residents. People want availability to all that stuff and pay as little as possible.”

Abel interrupted, “Are you saying that working people who spend half of their income on a place to live in New York City are freeloaders? It’s the upper income people that employ them who are freeloading. The rich are getting labor at an affordable rate. If working people could charge enough to cover their living expenses, they would get paid a lot more than they do.”

Cain argued, “It’s the rich people who are paying most of the state and local taxes that pays for all those amenities. The rich are subsidizing these institutions that the working class take advantage of.”

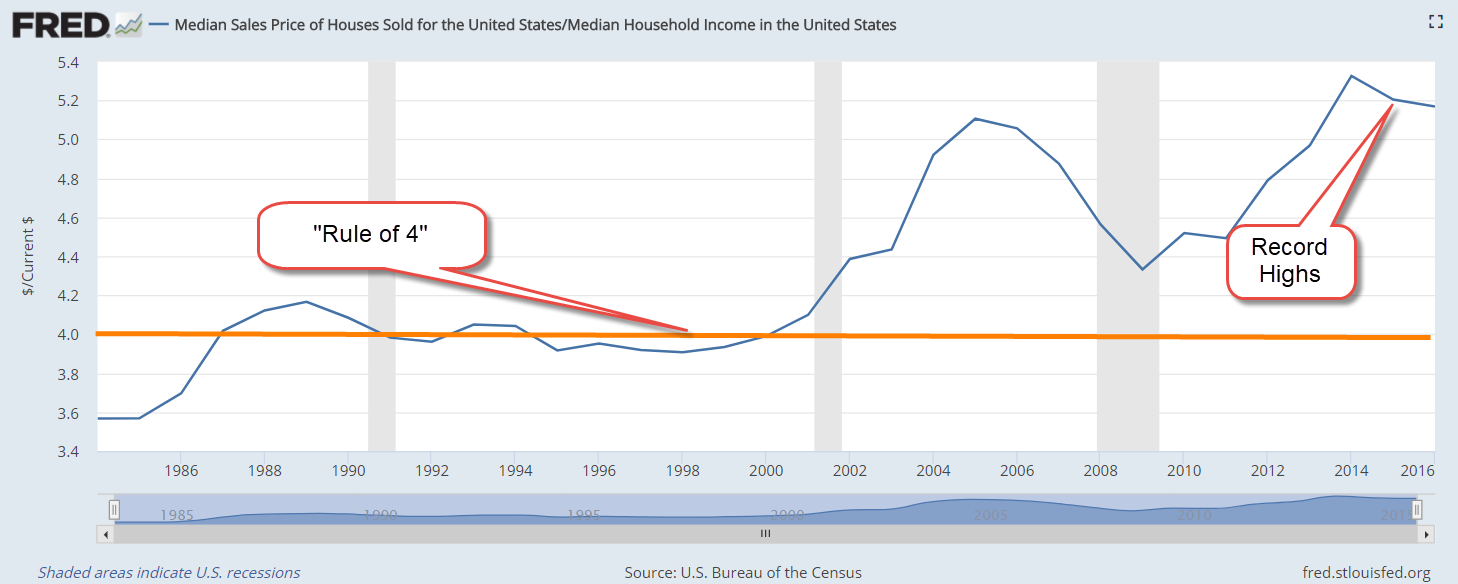

Abel said, “The median rent in the Bronx is 60% higher than the national average, according to an analysis by Zumper. The average monthly rent for a 2-BR apartment is almost $3500 and the Bronx is one of the more affordable of the five counties in New York City. The national median annual wage for warehouse workers is $38,000, according to the BLS. That’s almost $3200 a month. A couple working two blue collar jobs would be spending more than half their gross income on rent. A prudent percentage is 30%, or less than a third of gross income. If New York City policymakers were to require employers to pay 60% above the national average, those warehouse workers would make almost $61,000 a year, or $5100 a month. Two incomes at that wage would total over $10,000 and that $3500 median rent in the Bronx would be about 34% of income.”

Cain dismissed Abel’s argument. “Those New York City employers wouldn’t be able to compete with other companies in surrounding regions with lower costs. They would leave or go out of business. There would be fewer warehouse jobs. That couple would have to compete with others for blue collar jobs. The increased supply of labor competing for jobs would further lower the market wage and make the couple dependent on social welfare programs. The city would have less tax revenue because those warehouse employers have left the city. Less property tax, less income tax, less tax on business income. The city could not afford to pay more benefits and might declare bankruptcy like it did in the mid 1970’s. A complex negative feedback loop. Policymakers who tinker with natural market forces only make the problem worse.”

Abel objected, “If that couple followed the signal of those market forces, they would move to a lower cost area in a nearby state. There would be fewer workers in New York City, driving up wages. As the couple tried to find work, they would drive wages down further in that nearby state. Those lower costs would enable employers to reduce their prices and put the New York City companies out of business.”

Cain responded, “In order to survive, those New York companies would also leave the city. Anyway, capital relocates faster than people. As soon as policymakers announced a law mandating that employers pay premium wages, a lot of blue-collar companies would relocate out of the city. Our blue-collar couple would be out of a job. Just as with a previous scenario, the couple would be dependent on the government for aid. The price system promotes independence.”

Abel protested, “Paying higher rents than the national average does not promote worker independence. A dense housing market is a seller’s market, a landlord’s market. Without some laws in place to protect renters, they would be entirely at the mercy of landlords. Market prices in a dense housing market like New York only promote independence for those with capital and access to capital like landlords.”

Cain shook his head. “Once again, your group and mine can’t agree. Your group blames capitalists for everything.”

Abel replied, “That’s overstating our objections. Capitalists promote a dynamic economy that responds to changing circumstances. But capitalists can’t operate only in the framework of the pricing system. In some markets, price dynamics often make the problem worse. As Keynes and other economists have shown, an unguided free market system can settle at equilibrium points that are below the productive capacity of a nation’s people and businesses. There is no automatic mechanism to move an economy to an optimal equilibrium of productivity.”

Cain turned to go. “Well, our group disagrees. The free-market system promotes growth, and it is growth that generates a productive equilibrium.”

Abel replied, “I know your group believes that, but belief doesn’t make it so. The housing market in New York City is just one example of market failure, the inability of prices to allocate resources. It is one of many.”

Cain replied, “Maybe we should talk about market failures next time we meet. Behind every market failure is a policy failure, believe me.”

Abel responded, “See you next time.”

///////////////////

Photo by Shehan Rodrigo on Unsplash

Buying power note: Inflation has averaged 2.76% annually since 1995. The interest on a 1-year Treasury note (FRED Series DGS1) is similar to a 36-month CD rate and has averaged 2.6%.