May 12, 2024

by Stephen Stofka

This week’s letter is about our perception of investment risk, and the subjective and objective aspects of risk evaluation. Our journey will take us several hundred years in the past and several decades into the future. The triennial survey of consumer finances indicated that less than half of people nearing retirement have $100,000 in liquid financial assets like savings accounts, stocks and bonds. Half of all working households have no savings, leaving them vulnerable to specific circumstances or a general economic shock. In our 20s, retirement looks remote with many years of work ahead of us. As we near retirement, we look in the other direction, to the past, and wish we had saved more. We confront the reality that we feel today’s needs more urgently than tomorrow’s possibilities. A $100 saving has a $100 impact on our current consumption but is only a faint light compared to the many thousands of dollars we will need in the future. We may not understand the underlying mechanism of saving.

We rely on what is visible to our senses to develop a flow of causality. We press on our car’s gas pedal and go faster, convinced that our action is adding more fuel to the engine. What the pedal controls is not fuel, but the air flow leading into the combustion chambers of the engine. The increased flow of fuel occurs in response to the change in air pressure. Prior to the 1980s cars used carburetors and mechanically employed this process called the Bernoulli principle, the idea that faster moving air induces a lower air pressure, a vacuum effect that sucks fuel toward the engine. Today’s fuel injection systems use air flow sensors that direct a computer to adjust the fuel flow. So, what does this have to do with risk?

Bernoulli’s principle is named after Daniel Bernoulli, the son of a noted Swiss mathematician and the nephew of Jacob Bernoulli, a 17th century mathematician who developed foundational concepts in probability like the Law of Large Numbers. Jacob maintained that people perceived risk in two ways. The first was an objective measure, an estimate of the probability of some event. The second was a subjective measure that depended on each person’s wealth, an inverse relationship. The first is visible, like the pressing of a gas pedal. The second is less visible, like the change in air pressure. Imagine that two people agree to flip a fair coin for a $100 bet. Person A has $1000 in her pocket; person B has $200. The loss or gain of $100 represents only 10% of A’s wealth, but 50% of B’s wealth. Even though the chance of winning or losing is the same for each person, they perceive the outcome differently. Peter Bernstein (1998) presents an engaging narrative of Jacob’s ideas in his book Against the Gods. His trilogy of books on the history of investing, risk and gold will inform and entertain interested lay readers.

Jacob may have identified one subjective element in each person’s evaluation of risk, but a person’s stock of wealth is not the only basis for a subjective estimate of risk. There are retired folks with accumulated savings of a million dollars who keep their money in savings accounts or CDs because they perceive the stock and bond markets as risky. A $10,000 loss in the stock market is only 1% of a million-dollar wealth yet some people perceive that loss in absolute dollars, magnifying the effect of a $10,000 loss. They regard the stock and bond markets as different versions of a casino. That same person might give $10,000 to a grandchild for college or to help buy a car, reasoning that there is an exchange of something that a person values for the $10,000. A person has no sense of receiving anything when their stock portfolio shows a $10,000 decrease. The stock market should have to pay an investor for using her investment, not the other way around. Such perceptions are confirmed during crises when the stock market loses 50% of its value.

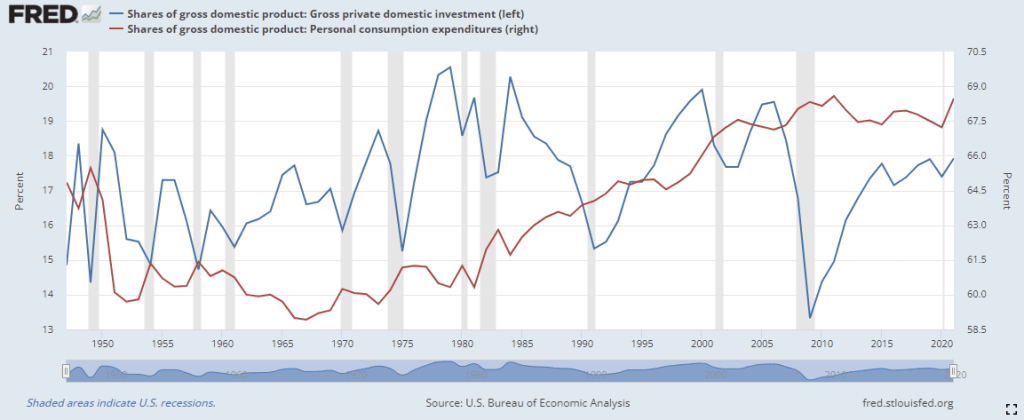

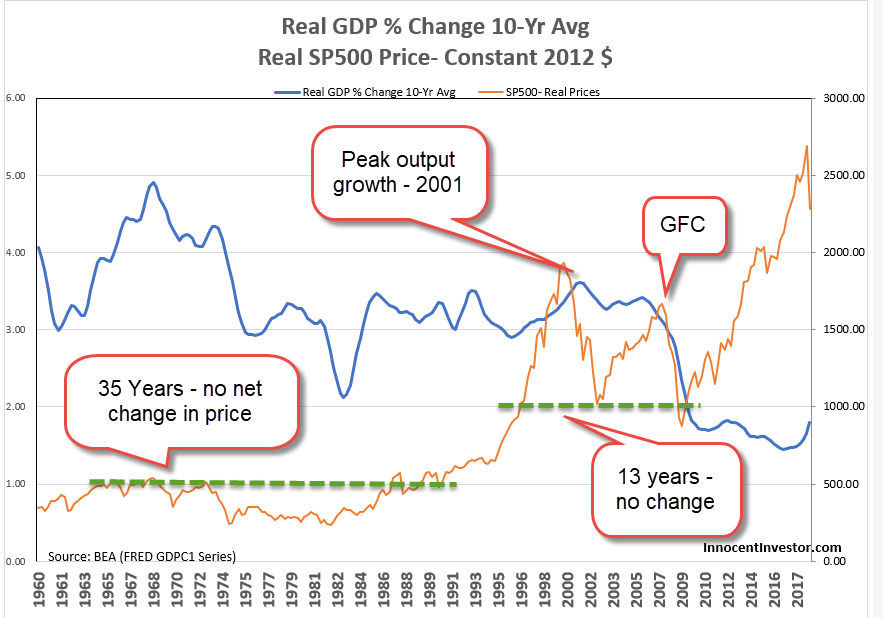

Is an investment in the stock market like putting a quarter in a slot machine? Another perspective: an investor is like an investment company selling insurance to the stock market. A century of data shows that the probability of a loss in the stock market in any specific year is about 25%, according to an article in Forbes. In 70 years, the SP500 has doubled every seven years on average. An insurance company relies on Jacob Bernoulli’s Law of Large Numbers and diversification to manage risk. An investor, like any insurance company, will experience losses in some years. In last week’s letter (see note below) I wrote about surplus as a key dynamic factor in market transactions. In most years, an investor with a surplus of funds can “sell” those funds to the market and reap a gain.

Like risk, values in the stock market are based on both objective and subjective components. Sales, profits, dividends and efficiency help anchor a stock’s price movements as objective measures of value. Price responds to changes in these variables. Objective measures also include the variation in a company’s stock as a precise measure of uncertainty. There are various less precise but objective measures of economic and financial risk. Subjective measures include an investor’s need for liquidity, the ability to turn an investment into cash without impacting the price. An investor’s wealth can act as a cushion against fear of loss, a subjective measure discussed earlier.

Index funds have grown in popularity because they take advantage of Jacob Bernoulli’s Law of Large Numbers. By owning partial shares in many companies, an investor reduces the risk exposure to the variation in the fortunes of one company. The SEC might open an investigation into the ABC company, or the company loses an important overseas market, or the company reveals that the profit margins on some of its popular products are decreasing. To an index fund investor, a 10% decrease in that company’s stock price may be barely noticeable. The investor still has a risk of a change in general conditions, like a pandemic, but has dramatically reduced the risk of local conditions specific to one company.

Investors in Bitcoin do not act as an insurance fund for Bitcoin companies who mine Bitcoin. The miners have the surplus and are the sellers of Bitcoin. In the secondary market, the sellers of access to the digital currency market are the two dozen or so ETFs that allow investors to buy interest in a fund that owns bitcoin. Price movement is like a tailless kite flying in a breeze, responding mostly to price forecasts, a characteristic of some derivatives markets. The only objective measure of value and risk is the number of Bitcoin in circulation and the reward for mining new Bitcoin. Bitcoin’s price movement has a high volatility greater than 50% because there is little economic activity that anchors the variation in Bitcoin’s price. Despite the high volatility, an asset manager at an ETF fund makes the case for investing a few percent of a portfolio in a bitcoin ETF. As in our earlier example, the loss or gain depends on the current state of one’s savings.

Understanding the two aspects of risk perception, the objective and subjective, can help us manage our personal risk profile. Through research or the advice of a financial consultant we can understand the objective measures of portfolio risk but there are subjective elements unique to our personal history and disposition. The fear of having to be in a long-term care facility may influence our yearning for safety, regardless of our current health. A parent or relative may have had a similar experience and our primary concern is the protection of our portfolio value. We may feel fragile after the loss of our entire savings in a business venture. We can only become comfortable with our apprehensions by becoming familiar with them.

Next week I will look at our perceptions of other significant factors in our lives, particularly inflation.

/////////////

Keywords: stocks, bonds, risk, investment

Bernstein, P. L. (1998). Against the Gods: the Remarkable Story of Risk. John Wiley & Sons.

In last week’s letter I wrote about surplus as a key dynamic factor in market transactions. A seller of a good or service has a surplus which it values less than the buyer. However, the seller’s cost, including opportunity cost, is more than the cost to the buyer. These two ratios of benefit and cost find an equilibrium in the market that depends on the type of good or service and general conditions.

https://etfdb.com/themes/bitcoin-etfs/

https://www.vaneck.com/us/en/blogs/digital-assets/the-investment-case-for-bitcoin/