December 21, 2014

In preparation for today’s solstice, the market partied on in a week long saturnalia. The week started off on a positive note. Industrial production increased 1.3% in November, gaining more than 5% over November of 2013.

Capacity utilization of factories broke above 80%, a sign of strong production. Production takes energy. I’ll come to the energy part in a bit.

The Housing Market Index remained strong at 57, indicating that builders remain confident. Tuesday’s report of Housing Starts was a bit of a head scratcher. After a strong October, single family starts fell almost 6%. Multi-family starts fell almost 10% in October, then rebounded almost 7% in November. Combined housing starts fell 7% from November 2013.

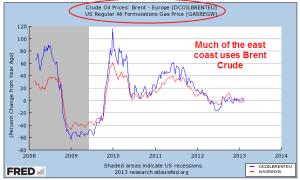

The market continued to react to the change in oil prices. For the big picture, let’s go back a few years and compare the SP500 (SPY) to an oil commodity index (USO). For the past five years, USO has traded in a range of $30 to $40, a cyclical pattern typical of a commodity. In October, the oil index broke below the lower point of that trading range.

On Tuesday, oil seemed to have found a bottom in the high $50 range. USO found a floor at $21, about a third below its five year trading range. Beaten down for the past three weeks, energy stocks began to show some life (see note below).

Encouraging economic news helped lift investor sentiment on Tuesday morning. Some bearish investors who had shorted the market went long to close out their short positions. Growth in China was slowing down, Japan was in recession, much of Europe was at stall speed if not recession and the continued strength of the U.S. dollar was making emerging markets more frail. While the rest of the world was going to hell in a hand basket, the U.S. economy was getting stronger. Thee Open Market Committee at the Federal Reserve, FOMC, began its two day meeting and traders began to worry that the committee might react to the strengthening U.S. economy with the hint at an interest rate increase in the spring of 2015. This helped sent the market down about 2% by Tuesday’s close.

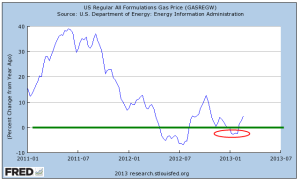

Wednesday’s report on the Consumer Price Index (CPI) was heartening. Falling gas prices were responsible for a .3% fall in the index in November, lowering inflation pressures on the Fed’s decision making about the timing of interest rate hikes. The core CPI, which excludes the more volatile energy and food prices, had risen 1.7% over the past year, slightly below the Fed’s 2% target inflation rate. Traders piled back into the market on Wednesday ahead of the Fed announcement Wednesday afternoon. Back and forth, up and down, is the typical behavior when investors are uncertain about the short term direction of both interest rates and economic growth.

The Fed’s announcement that they would almost certainly leave interest rates alone till mid-2015 gave a further 1% boost upwards on Wednesday afternoon. Twelve hours later, the German market opened up at 3 A.M. New York time. Early Thursday morning, the price of SP500 futures began to climb, indicating that European investors were reacting to the Fed’s decision by putting their money in the U.S. stock market. Those of you living in the mountain and pacific time zones of the U.S. might have caught the news on Bloomberg TV before going to bed. Maybe you got your buy orders in before brushing your teeth and putting your nightgown on. Very difficult for an individual to compete in a global market on a 24 hour time frame. On Thursday, the market rose up as high as 5% above Wednesday’s close, before falling back to a 2.5% gain.

Still, a word of caution. Both long term Treasuries, TLT, and the SP500, SPY, have been rising since October 2013.

As long as inflation remains low and the Fed continues its zero interest rate policy (ZIRP), long term Treasuries and stocks will remain attractive. Something has to break eventually. ZIRP helps recovery from the aftermath of the last crisis but helps create the next crisis. Abnormally low interest rates over an extended period are bad for the long term stability of both the markets and the economy.

**********************

Sale – Energy Stocks – Limited Time Only

(Note: this was sent out to a reader this past Tuesday. Energy stocks popped up 4 – 5% the following day, a bit more of rebound than I expected. The week’s gain was almost 9% and the ETF closed above its 200 week average.)

As oil continues its downward slide, the prices of energy stocks sink. XLE, a widely traded ETF that tracks energy stocks, has dropped below the 200 week (four years!) average. (A Vanguard ETF equivalent is VDE). Historically, this has been a good buying opportunity. In the market meltdown of October 2008, this ETF crashed through the 200 week average. A year later, the stock was up 38% and paid an additional 2% dividend to boot. Let’s go further back in time to highlight the uncertainty in any strategy. The 2000 – 2003 downturn in the market was particularly notable because it took almost three years for the market to hit bottom before rising up again. The 2007 – 2009 decline was more severe but took only 18 months. In June 2002, XLE sank below its 200 week average. A year later, the stock had neither gained nor lost value. While this is not a sure fire strategy – nothing is – an investor is more likely to enjoy some gains by buying at these lows.

****************************

Emerging Markets Stocks

Also selling below the 200 week average are emerging market (EM) stocks. These include the BRICs (Brazil, Russia, India, China) as well as other countries like Mexico, Vietnam, Turkey, Indonesia and the Philipines. When a basket of stocks is trading below its four year average, there are usually a number of good reasons. Several money managers note the negatives for EM. Also included are a few voices of cautious optimism. Sometimes the best time to buy is when everyone is pretty sure that this is not the right time to buy. Another blog author recounts two strategies for emerging markets: a long term ten year horizon and a short term watchful stance. The long term investor would take advantage of the low price and the prospect for higher growth rates in emerging economies. The short term investor should be cognizant of the fickleness of capital flows into and out of these countries and be ready to pull the sell trigger if those flows reverse in the coming months.

******************************

Welfare

What are the characteristics of TANF families? When the traditional welfare program was revised in the 1990s, lawmakers coined a new name, Temporary Assistance to Needy Families, to more accurately describe the program. The old term carried a lot of negative connotations as well. Two years ago Health and Human Services (HHS) published their analysis of a sample of 300,000 recipients of TANF income in 2010. Although the recession had officially ended in 2009, the unemployment rate in 2010 was still very high, above 9%. It is less than 6% today.

There were 4.3 million recipients, three-quarters of them children, about 1.4% of the population. By household, the percentage was also the same 1.4% (1.8 million families out of 132 million households). In 2013, the number of recipients had dropped to 4.0 million, the number of families to 1.7 million (Congressional Research Service)

In 2010, average non-TANF income was $720 per month, or about $170 a week. To put this in perspective, this was about the average daily wage at that time The average monthly income from TANF averaged $392. Recipients were split evenly across race or ethnic background: 32% were white, 32% black, and 30% Hispanic. For adult recipients only, 37% were white, 33% black, and 24% Hispanic.

Rather surprising was how concentrated the recipients were. 31% of all TANF recipients in 2010 lived in California. 43.3% of all recipients lived in either New York, California or Ohio. The three states have 22% of the U.S. population and almost 44% of TANF cases.

HHS data refutes the notion that welfare families are big. 50% of TANF families had only one child. Less than 8% of TANF families had more than 3 children. 82% of TANF families also receive SNAP benefits averaging $378 per month.

In 2014, Federal and State spending on the TANF program was less than $30 billion, about 1/2% of the $6 trillion dollars in total government spending. The Federal government spends a greater percentage on foreign aid (1%) than the TANF program. Yet people consistently overestimate the percentage of spending on both programs (Washington Post article). The average estimate for foreign aid? A whopping 28%. Cynical politicians take advantage of these public misperceptions.

**********************

Omnibus

Aiming to overhaul the health care insurance programs throughout the country, the Affordable Care Act (ACA) was a big bill. No, it wasn’t 2700 pages as often quoted by those who didn’t like it. The final, or Reconciled, version of the bill was “only” 900 pages. The House and Senate versions were also about 900 pages each; hence, the 2700 pages.

At 1600 pages in its final form, the recently passed Omnibus Spending bill makes the ACA look like a pamphlet. As specified in the Constitution, all spending bills originate in the House. Past procedure has been to pass a series of 12 spending bills. Majority leader John Boehner has found it difficult to get his fractious members to agree on anything in this Congress so all 12 bills were crammed into this behemoth bill just in time to avoid a government shutdown. Just as with the ACA, most members of the House and Senate did not have adequate time to digest the details of the bill. The bill is sure to hold many surprises for those who signed it and we, the people, who must live under the farcical law-making of this Congress. Here is a primer on the budget and spending process.

**********************

Home Appraisals

They’re back! A review of 200,000 mortgages between 2011 and 2014 showed that 14% of homes had “generous” appraisals, inflating the value of the home by 20% or more. Loan officers and real estate agents are putting increasing pressure on appraisers to adjust values upwards.

**********************

Personal Income

You may have read that household income has been rather stagnant for the past ten years or more. In the past fifty years household formation has increased 78%, far more than the 50% increase in population. The nation’s total income is thus divided by more households, skewing the per household figure lower. During the past thirty years, per person income has actually grown 1.7% above inflation each year. Inflation adjusted income is now 66% higher than what it was in 1985.

In 2013, the Bureau of Economic Analysis released median income data for the past two decades. Median is the middle; half were higher; half were lower. This is the actual dollars not adjusted for inflation. Except for the recession around the time of 9-11 and the great recession of 2008 – 2009, incomes have risen steadily.

The 3.7% yearly growth in median incomes has outpaced inflation by almost 25%.

Why then does household income get more attention? A superficial review of household data paints a negative picture of the American economy. Negative news in general tugs at our eyeballs, gets our attention. The majority of the evening news is devoted to negative news for a reason. News providers sell advertising in some form or another. They are in the business of capturing our attention, not providing a balanced summary of the news. In addition, a story of stagnating incomes helps promote the agenda of some political groups.

***********************

Merry Christmas and Happy Chanukah!