Jerry referred me to an article by Dana Milbank at the Washington Post, relating comments by the departing Christina Romer, Chairman of Obama’s Council of Economic Advisors. According to Mr. Milbank, Ms. Romer said “she still doesn’t understand exactly why [the economic collapse] was so bad.” Ms. Romer, well respected in her field, will probably share some of the blame for underestimating the deep structural weakness of an economy in which all the players had become over leveraged. In Ms. Romer’s defense, the cautious Federal Reserve, including the former chairman, Alan Greenspan, and the stock market underestimated the problem as well. The Fed called for a recovery in the latter part of 2009. The market’s rise from the March 2009 lows signalled the same outlook. The stock and bond markets reflected the opinions of a majority of economists at investment houses, mutual funds, hedge funds. How could so many educated people be wrong?

Ms. Romer is a proponent of Keynesian economics, a theory that government spending can offset the lack of demand in the private sector during recessions. When John Maynard Keynes proposed his theory in 1930, his remedy of government spending was an antidote to smooth the regular ups and downs of business and economic cycles. In his theory, Keynes proposed that governments then run surpluses during good times to counteract the overly heated demand of the private sector. As such, Keynes could not have imagined that governments would run up the large amounts of debt that they have in the past decades. His theory was never designed for a recession or depression resulting from such a massive over-leveraging of both public and private debt.

Misjudging the scope and severity of the collapse of this asset and debt bubble led economists like Ms. Romer to think that Keynesian solutions like the stimulus bill passed in early 2009 would provide a substantial “kick” to the economy. The stimulus bill has helped stopped the bleeding but the wound is deep. Government tax credits for house and car purchases did little more than shift those purchases forward in time. Stimulus payments to states helped avoid state and local government employee layoffs – for a while. They did nothing to fix the central problem: businesses and consumers are paying down debt that they have spent almost a decade accumulating. That de-leveraging is going to take time.

Economists who have a more classical view of the mechanics of commerce predicted that we might tip into a double dip recession, at worst, or a very slow “U” shaped recovery starting in 2010. As a number of economic indicators turned positive in the early part of 2010, these same economists thought they might be wrong. Some Keynesians felt vindicated as this economic data seemed to show that their model of government spending could shorten even a severe recession.

In February, government deficits in Greece and several other European nations revealed the structural weakness of their economies and caused the stock and bond markets to question whether these smaller economies could withstand the relatively high ratio of government spending and debt as a percentage of each country’s GDP. Germany, a paradigm of conservative fiscal policy, was forced to step in to help support these less fiscally responsible nations. The European Central Bank, supported by the Federal Reserve, professed a firm support for the bonds of these weaker European nations. With the magic that only central banks possess, the Federal Reserve pumped $1.2 trillion into U.S. government backed mortgage securities, signalling that it would not allow the newly recovering economy to fall back. In the spring of 2010, the market once again turned to the recovering economy.

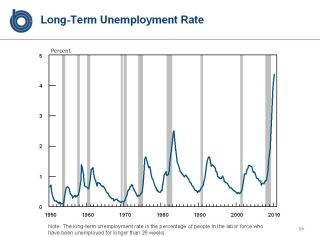

Employment usually lags in any recovery and so many expected the unemployment rate to stay high going into the early part of 2010. In April, after 8 or 9 months of expansion in the manufacturing sector and a recovering service sector, economists were expecting at least some reduction in the unemployment rate. By late June and early July there appeared to be little increase in hiring. Those who believed in a more traditional “V” shaped recovery began to have doubts and the market dropped to reflect these lowering expectations.

Week after week come conflicting economic reports, the Federal Reserve is running out of tools other than the rampant printing of money and the unemployment rate stubbornly hangs from the cliff of 10%. Classical economic models seem to more accurately reflect the slow, tortuous climb out of the debt pit.

Decades from now, regardless of what happens, Keynesian economists will still profess that Keynes’ economic model was right – with perhaps a few modifications to their theory. Classical economists who agree with the models of Hayek and Friedman will maintain that they are right – with a few modifications. Fifty or a hundred years from now, our kids’ grandkids will get to do it all over again because too many policymakers would rather cling to their theories than learn from experience.