April 14th, 2013

Across the land, springtime wakens the trees and flowers, birds chirp and squirrels chatter. From the buildings where the humans live comes the wailing and gnashing of teeth as many procrastinators spend this last weekend before the tax deadline in a spring ritual of angst. The lost W-2 form is finally found beneath the Netflix DVD that has lain casually on the bookcase, waiting to be watched. The 1099DIV form is found beneath a birthday card that was never sent.

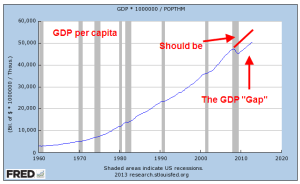

Lay aside your problems; let’s climb inside the hot air balloon and look at the big picture. A few weeks ago, economic growth for the fourth quarter of 2012 was revised marginally higher into positive territory, but dropping from the annualized growth rate of 3.1% in the 3rd quarter of 2012. Let’s look at GDP from a per person basis since WW2. Until the recession hit in late 2007, economic growth had consistently outpaced population growth. Then POOF! went the economy and blew away a big gap in GDP.

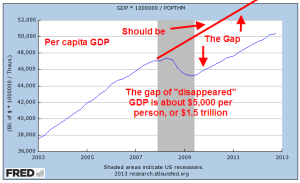

Let’s zoom in on the past ten years to see the effect. On a per person basis, the gap is $5,000 of spending that simply didn’t get spent.

Call it the GDP dust bowl of the 2000s, similar to the dust bowl of the 1930s when the wind blew the top soil from the prairie of the Oklahoma panhandle and forced many families from their farms. In this case, the wind blew away a lot of jobs and chunks of home equity.

Policy makers in Washington want to close that $5000 per person gap. If they could write a law forcing everyone to spend that $5000, they would. Instead, they keep giving away money in unemployment benefits, food stamps, disability benefits, crop subsidies – all to keep people from not spending even less and making the problem worse.

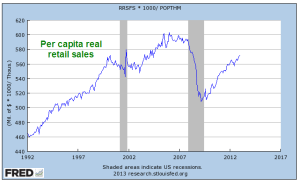

Retail sales account for about 1/3rd of the total economy. Including automobile sales and parts, consumers are still below twenty year averages.

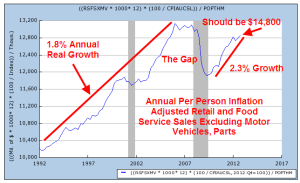

This past Friday, the monthly report on retail sales showed little change from the past month. When we look at per person real retail and food sales and take out automotive sales we get a feel for core sales, those that we make on a frequent basis. Once again, we see the same gap that we saw in GDP. Since mid-2009, this core consumer spending has grown 2.3% annually, above the 1.8% annual growth trend from 1992 through 2006, but it still down $2000 a year from what we would have spent if we had stayed on the same trend line before this past recession hit.

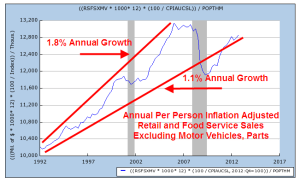

To make it a bit clearer, let’s look again at that chart and compare the 15 year annual growth rate from 1992 to the longer 21 year growth rate. It has fallen from 1.8% to 1.1% annual growth.

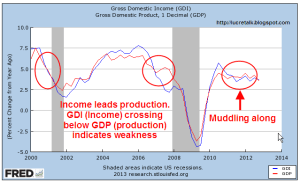

GDP measures spending; let’s look at Gross Domestic Income, or GDI. A fundamental principles of economics is that it takes money to spend money. A six year old asks a parent “Why can’t we just go out and get more money?” to which the parent replies “Whaddya think money grows on trees?!” End of Chapter One in the Parent’s Guide to Economics.

When we compare the country’s income to spending, we find that a dip in income below production precedes recessions.

After the 2008 – 2009 crash and recovery in national income and spending, both are limping along.

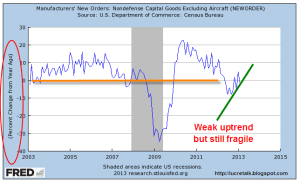

A few weeks ago came the monthly New Orders, an indication of business confidence. As regular readers know, I have been watching this declining trend since September of last year, when the percent change in New Orders was negative. The recent rise has been a welcome sign of growing confidence but new orders fell 2.7% in February and now hover around the zero growth line.

On a quarterly basis, the year over year (y-o-y) percent change is still firmly in negative territory, meaning that businesses are not putting up more money to invest in new equipment. Why? Because they are still not sure about consumer spending. The six month run up in the SP500 stock index might lead a casual observer to think that the economy and companies are gearing up. New Orders indicates that there is much more caution out there than the stock index would indicate.

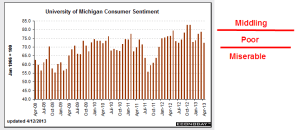

This past Friday, business’ caution to commit to new investment was only reinforced when the latest Consumer Sentiment index was released. After climbing the past few months, confidence is sinking again. Maybe it’s the extra 2% coming out of paychecks since January 1st. Whatever it is, it doesn’t inspire many business owners to put a lot of money into expanding their production.

When the stock market is trading on hope, it looks six months ahead. The recent run up is hoping for double digit profit growth in the second half of this year. When the market trades on fear, it looks ahead about 2 seconds, faster than the normal investor can or should react. Let me get out my broken record for another spin, cue the needle and play that same old song “Diversify.”

P.S. For those of you who are more active investors, check the latest post from Economic Pic in my blog link list on the right. It shows the past 40 year returns for a strategy of selling the SP500 index in May and buying the long term government / credit index. The iShares ETF that tracks this index is ITLB. A comparable ETF from Vanguard is BLV.