January 7, 2024

by Stephen Stofka

This week’s letter examines the spending habits of seniors and the effect of that behavior on the broader economy. The growth of spending in this age group surpasses all others. Seniors spend money and they vote their interests.

In 2020, the Census Bureau estimated the population 65+ at 55.8 million, almost all of them collecting Social Security. One in six people in the U.S. is older than 65 but made up 26% of the 154.6 million voters in 2020, making them overrepresented voters, according to the Census Bureau. They vote to protect their programs, their priorities and preferences. In 2000, Social Security income represented 4% of the country’s total income. Today, it is 5%. Their assets, incomes and spending habits affect the entire population.

In 2000, seniors aged 65+ were just 3% of the labor force, according to the BLS. The 2008-9 recession dealt a blow to the retirement plans of many older folks who continued working past their retirement age. In 2020, when the pandemic rocked the economy, seniors comprised 6.8% of the labor force. Many seniors did not return to the labor force and today, almost four years after the pandemic began, their share of the labor force has remained the same, about 6.8%. Had their share of the labor force continued to grow, seniors in the labor force would total about 13.2 million. The latest data from the BLS indicates an actual level of 11.5 million, a shortage of 1.7 million. Adding in that shortage would raise the unemployment rate above 4.5% from the current level of 3.7%. The chart below shows the approximate shortage.

The Federal Reserve’s Survey of Consumer Finances shows that incomes taper off after middle-age (page 7). Senior workers were part of an age group that was particularly vulnerable to the Covid-19 virus. As many businesses shut down in March 2020, many seniors had few options except to file for Social Security to secure an alternative income source. Monthly payments to recipients rose sharply from $78.1 billion in February 2020, the month before pandemic restrictions, to $89.4 billion in February 2022, according to the Social Security Administration. Also, many seniors who had paid off their mortgages would have an “imputed” income generated by the investment in their house. Restaurants and gathering places reopened in the summer of 2020 then shut down again as Covid-19 cases surged. States reopened these venues on a gradual basis with staggered or outdoor seating only. As vaccines became available in the first quarter of 2021, seniors were the first to be eligible. Personal consumption expenditures jumped almost $1 trillion in March and April of that year and seniors led the spending surge.

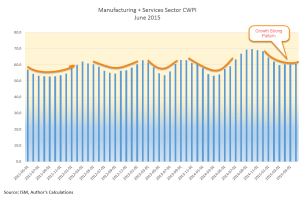

Imagine feeling forced to retire and not being able to enjoy leisure activities like movies, golf, travel, museums or dining out. These activities were mostly shut down from March 2020 to the spring of 2021. The New York Fed conducts a triannual (3x a year) survey of household spending that reveals some interesting changes in spending habits in response to the pandemic. Those under age 40 had the highest rate of large purchases. People over age 60 increased their overall spending by the most – 9.1%. In the chart below, that senior age group is the dotted green line at the top. By the first quarter of 2023, seniors were still increasing their spending while the younger age groups had cut back. Notice that spending growth by seniors, the green dotted line in the graph below, were consistently the highest of all age groups.

According to an analysis by the Pension Rights Center, half of all senior households have income less than $50,000. That same household spending survey found that those with low incomes increased their spending by the largest percentage of the income groups. In the first quarter of 2022, households in this low income group increased their spending by almost 10%, as indicated by the red dashed line in the chart below.

In the first quarter of 2023, their spending came down along with all other income groups but then sprang up again during the spring of summer of this past year. This age and income group has contributed to the strength of consumer spending this past year.

This year promises to be one of the most contentious in our history. Elections are won by a coalition of groups and for the past decade, the voting coalitions are evenly matched. The voting rules in a democracy naturally allow some groups to command a dominant voice that is out of proportion to their numbers. One out of six Americans are seniors and one out of four voters are seniors. Their vote will advantage their own interests and priorities at the disadvantage of other groups. That’s democracy.

/////////////////

[20240107TreeBench

Photo by Aaron Burden on Unsplash

Keywords: consumer finances, spending, voting, income, household income