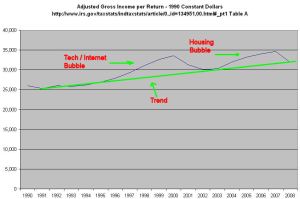

Continuing my review of 20 years of tax data from the IRS, I’ll look at incomes vs income taxes paid. As the chart below shows, the top half of households in this country pay all the personal income taxes collected. (Click graph to enlarge)

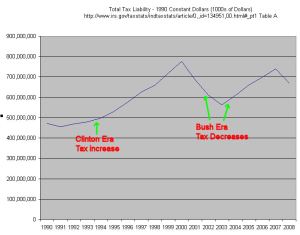

In 2000, net tax rates for the top half of households topped out at about the same level of the mid 80s – just under 20%. The Bush tax cuts of 2001 and 2003 lowered net tax rates for the top half of household to under 15%.

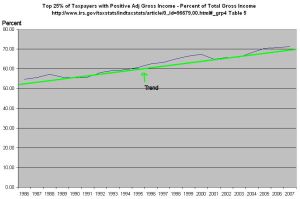

The top half of households are making 90% of the personal income in this country and paying almost 100% of the personal income tax. The top 25% of households are making 70% of the income and paying about 83% of personal income taxes.

Half of households pay the bills both for themselves and for the other half. In a democratic society, those on the lower half of the economic ladder will vote for politicians who promise more programs to help them out. Those on the upper half will vote for politicians that promise to reduce their tax burden.

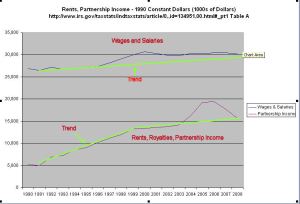

The core of the problem, however, is not tax rates or taxes paid but the rising gaps between economic groups, particularly those households at the very top of the economic ladder and the rest of the population. Until that inequity in income is reduced, the top 25% of households will pay an ever increasing share of the tax burden. Policymakers in Washington have been and continue to create a two tiered society.

What are some solutions to reduce the income gaps? We have found that we can not have a healthy economy which is based almost entirely on the service sector.

1) Encourage businesses to relocate manufacturing facilities back to the U.S. This can be done with tax incentives for those businesses that hire American workers. Where will we get the money to afford these tax incentives? The only place possible – those in the top 10% of households. Increase the tax rates on those in the upper income brackets but target the additional money specifically for tax breaks for small manufacturing businesses – those with 100 employees or less – that hire American workers. In Obama’s 2010 budget, he proposes to let the Bush era tax cuts expire for upper income taxpayers and use the additional tax money to reduce the country’s deficit. It is a noble goal but it does not address the long term structural defects in this economy. Right now, deficit reduction is a temporary bandaid on a much larger problem that will make large budget deficits a structural component of our economy in the coming decades.

2) Relax some of the stringent environmental codes enacted over the past several decades which drove up costs for U.S. based manufacturers and hastened their departure for other countries with cheaper labor costs and less onerous environmental requirements. This may upset some people who want a perfect world. We can’t have a perfect world. We never could.

3) Manufacturing requires capital and will absorb some of the excess money reserves that are looking for a return. Too much U.S. savings is being used to invest in the manufacturing output of other countries. Too much U.S. savings is being used to buy federal, state and local debt, all of which will continue to increase as the tax base decreases. Let’s get our savings to work producing.

4) Have a minimum tax that all but the poorest households pay each year – even if it is only $100 a year. 25% of households in this country have no “skin in the game.” Target that tax money for those in the helping professions who are generally paid less for the work they do and the education they work hard to achieve. That includes social workers, LPNs, nurses aides and counselors.

Any other ideas?