May 21, 2023

by Stephen Stofka

This week’s letter is about the role of assumptions in our lives. They play an important part in the claims we make to others so they are implicated in our self-esteem and personal relationships. They become integrated in our decision making process, affecting choices that have a lasting influence in our lives.

An assumption is an unspoken part of claims and assertions. The technical term in the study of rhetoric is an enthymeme. An example of an enthymeme is that people should be encouraged to vote because democracy depends on the full participation of citizens. The unspoken assumption or premise is that democratic government is good for citizens. A syllogism makes a claim based on two clearly stated premises. The enthymeme leaves out one of those premises and it is this mutual understanding of the unspoken premise that binds people together. However, if both parties do not accept this unspoken premise, the issue cannot be resolved. This lack of agreement in an unspoken premise is a key aspect of religious and political debates. Our decision making often consists of enthymemes containing vague assumptions. This rhetorical tactic explains how we can fool ourselves into thinking we are above average investors.

Researchers construct an assumption that becomes a hypothesis when they design an experiment to test that assumption. Most of us don’t follow such a formal process. Our assumptions are tested by our observations, by the natural experiments of unfolding events. All too often, we fool ourselves by paying particular attention to those events which confirm our assumptions. We form a growing conviction that our assumptions are confirmed by the reality we observe around us. We make predictions of the future by converting our assumption into a conviction and we are shocked when events upset that conviction.

An example is the recent bankruptcy of Silicon Valley Bank (SVB). Depositors assumed that Gregory Becker, the company’s CEO and member of the board of directors at the Federal Reserve’s San Francisco branch, would be a prudent manager of depositor funds. They were stunned when they learned that Becker and Daniel Beck, the company’s CFO, did not hedge the bank’s interest rate risk, a management practice finance majors learn in school. Both men resigned but benefitted handsomely from their employment at the bank. At a Senate hearing this week Becker rejected responsibility for the fiasco, blaming regulators and customers for the bank’s downfall. His financial survival depends on minimizing his role in the whole affair and defending himself against accusations of fraud.

Economists assume that people are rational, that they are capable of making choices that will maximize their welfare. They make a further simplifying assumption that each person is both principal and agent, making the decision and realizing the benefits and costs of that decision. In a principal-agent relationship, however, the agent and principal are separate. They have different motivations because the benefits and costs are not the same. As a society becomes more complex, the principal-agent problem grows geometrically. The voices we hear most are those of the agents – Becker, the Senators, the regulators – whose actions must satisfy their own welfare while they serve the principals – teh citizens and depositors.

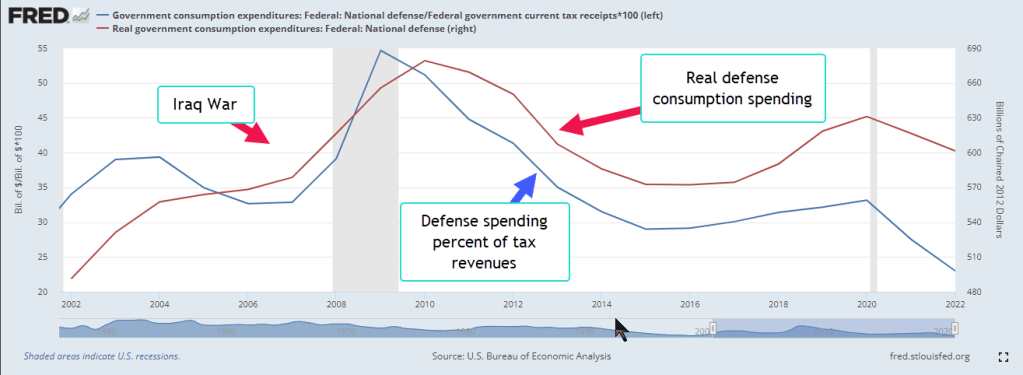

Objections to raising the U.S. debt limit go like this: the country is spending more than it receives in taxes. Like any household, we must cut our spending and live within our budget. The unspoken assumption is that the government’s budget is a scaled up version of a household’s budget. Politicians often court this fallacy of composition because they know that people yearn for simple explanations of complex issues. The U.S. currently spends over 20% of its income on defense, as the chart below shows. This would be equivalent of a family making $80,000 a year and spending $16,000 on a security system.

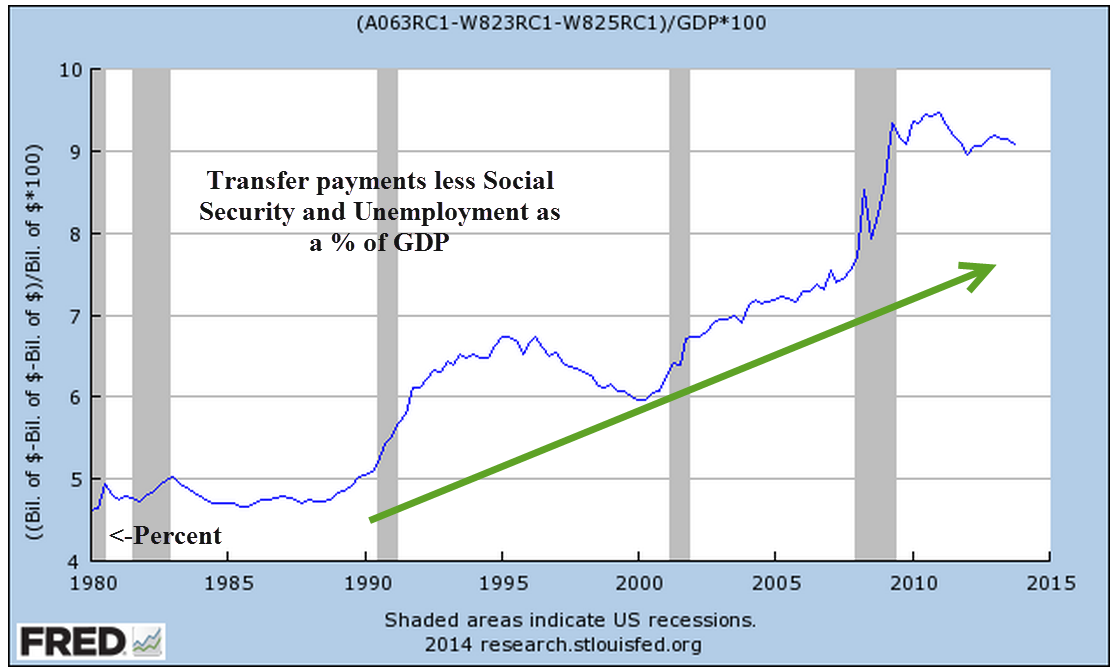

According to the Treasury Department (n.d.), 38% of tax collections are FICA taxes used to fund Social Security and Medicare. Imagine if a family sent 38% of their income to their parents or grandparents. These are just two examples that might lead us to reject the assumption that a family’s finances are like those of a government. In political debates like these, one side clings to the unspoken assumption because it is the linchpin of their argument.

Investors are cautioned not to put all their eggs in one basket. Diversification spreads the risk among asset classes. When we buy our first house, the down payment may take all of our savings, making us vulnerable to economic changes that impacts our income. We may make this gamble based on the assumption that in a worse-case scenario, we can sell the house for at least the same price we paid for it. During the financial crisis, homeowners were shocked to learn that their home values had declined. Many assumed that rising home prices were a natural law like steam that rises from a pot of boiling water. Ten million families that had gambled their savings on this assumption were wiped out during the crisis.

February’s reading of the 20-City Case-Shiller home price index showed no change in home prices in the past year. Home prices have fallen in some western cities where prices increased strongly in the past five years. From June 2022 to February 2023, Denver’s home prices have declined 6%. While the change in inflation has moderated, there is disagreement within the Fed’s interest setting committee whether to pause interest rate hikes. Continued rate increases could exacerbate price declines in some western states. Home owners may have to reevaluate their assumption that home prices only go up.

///////////////

Photo by israel palacio on Unsplash

Keywords: Defense spending, tax revenue, budget, household debt, debt

S&P Dow Jones Indices LLC, S&P/Case-Shiller 20-City Composite Home Price Index [SPCS20RSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SPCS20RSA, May 18, 2023

U.S. Bureau of Economic Analysis, Federal government current tax receipts [W006RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/W006RC1Q027SBEA, May 18, 2023.

U.S. Bureau of Economic Analysis, Government consumption expenditures: Federal: National defense [A997RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A997RC1A027NBEA, May 18, 2023.

U.S. Bureau of Economic Analysis, Real government consumption expenditures: Federal: National defense [A997RX1A020NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A997RX1A020NBEA, May 18, 2023.

U.S. Treasury. (n.d.). Fiscal Data explains federal revenue. Government Revenue | U.S. Treasury Fiscal Data. https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/#:~:text=So%20far%20in%20FY%202023,U.S.%20Department%20of%20the%20Interior.