April 19, 2020

By Steve Stofka

Has this pandemic prompted people to have a greater respect for science? Or has the science of the internet fostered more conspiracy theories and information hoaxes typical of countries with low literacy rates? This week – the rise and fall of science in American politics.

Let’s turn the dial back to World War 2. In the space of thirty years at mid-century, scientific understanding and accomplishment leapt forward. People expected that rate of achievement to continue into this century. Flying cars. Supersonic planes. A cure for cancer and the common cold. Lifetimes of 200 hundred years.

In the health sciences, the development of vaccines and antibiotics allayed the fears of millions of parents. Many who had survived the Depression and World War 2 remembered when Calvin Coolidge Jr., the President’s son, had died from a simple blister he got while playing lawn tennis (Rhoads, 2014). Thousands of World War 1 soldiers died from simple bacterial infections on their skin. In the course of two decades, antibiotics were developed and saved thousands in the next war.

The polio vaccine, developed in the 1950s, removed the threat of death or lifelong disability from the disease. In 1916, a quarter of the people in New York City who contracted the disease died (Smithsonian, 2005). Cities imposed quarantines on individual homes and public transportation during summer months when the disease was most prevalent.

The development of plastics, vitamins, TVs, personal radios, semi-conductors and many more inventions changed our daily lives. Men (mostly) of learning and business leaders schooled in efficient business practices were recruited to government to help run a world that was increasingly complicated.

During the 1960s President Kennedy hired Robert McNamara, the head of the Ford Motor Company, to run the Defense Department. Yes, that happened. McNamara was one of the Whiz Kids, experts in management and the efficient deployment of technology that would refashion the U.S. military during the Cold War against Communism. McNamara made many mistakes in the first five years of the Vietnam War, but hid them until his autobiography in 1995 (Biography, 2019).

Whiz kids headed by economist Paul Samuelson transformed monetary and economic policy with a precise mathematical approach that modeled human economic behavior as well as the movement of money, goods and services. Inspired by the work of John Maynard Keynes, who advocated strong government intervention, the new economic thinking promised to transform fiscal policy into an efficient tool that would benefit all ranks of society.

Big government spending during the 1960s spurred higher inflation. The economic Whiz Kids could not head off a recession at the end of the decade. When the Arab oil embargo caused gasoline prices to jump, inflation bit hard, and President Nixon instituted wage and price controls to curb inflation. After he left office in ignominy, his successor President Ford, fought inflation by wearing a button on his lapel that said “WIN.” Yes, that happened. The acronym stood for Whip Inflation Now (Smithsonian, n.d.). The experts were not as knowledgeable as they thought. They had tried, they had failed and their ascendancy was at an end.

Enter Ronald Reagan. He had developed a folksy manner as a host for a TV western series. He led California during its oil boom heyday in the late 1960s and early 1970s. His tenure ended just as California’s economy hit the skids. Exit the experts. Enter charisma and myth. Mr. Reagan touted Star Wars defense ideas that were products of an illustrator’s imagination. He believed in a form of wishful thinking called supply side economics. He dismissed the evidence from his own scientists when a mysterious disease began to ravage young men in the gay community. He flaunted a simplistic campaign of “Just Say No” to drug use while he backed insurgents in Central America who used American communities to build a drug empire based on crack cocaine. Mr. Reagan was a pragmatic politician who believed that facts should bend to the will of political leaders. He led the country through the most severe recession since the 1930s Depression. His two terms in office were marked by tax reform, strong economic gains, a resurgence of conservative political ideas and repeated scandals. When the Soviet Union collapsed in 1991, the conservative myth machine concocted a narrative that Reagan was responsible for the downfall of the empire. Like the iconic sheriff in a western movie, Reagan had strode out onto the dusty street of the global town and faced down the bad guy, the USSR.

Charisma left the stage when Reagan’s Vice-President, George H.W. Bush, won the election in 1988. Bush was the compromise between charisma and expertise. He had vast experience in many corners of civilian and military government. In the 1991 Gulf War, he and his Secretary of Defense, Colin Powell, demonstrated a technical prowess and efficiency that lifted the reputation of experts once again. Mr. Bush made a bargain with Congressional Democrats to raise taxes to help balance the budget. Conservatives were angry and disaffected and an expert businessman waited in the wings.

Ross Perot was the billionaire founder of a tech company. As a hard-nosed third-party candidate, he promised to bring honesty and efficiency to government finances. He took a whopping 19% of votes from Bush and gave Clinton the election by default. A contentious three-way race had given another Democrat, President Wilson, a default victory in 1912. Clinton’s vote percentage was 43% (Wikipedia, n.d.). Wilson’s was 42%. President Lincoln holds the record with the lowest vote percentage for a winning Presidential race – less than 40%.

President Clinton was the folksy governor of a backwater state called Arkansas, home to the Walton family, the owners of Wal-Mart. He was also a Rhodes scholar. Clinton promised to join expertise and charm. As with Lincoln and Wilson, those on the other side of the political aisle regarded Clinton as an illegitimate President and were determined to remove him from office. After five years of investigation, Republicans successfully impeached him on a charge of lying to Congress about an affair – a dalliance might be a more accurate description – with a White House intern. The leader of the Republican effort, House Speaker Newt Gingrich, was himself having a long affair with a young Congressional aide. Yes, that happened.

It was the 1990s. Mr. Clinton presided over an explosion in computer technology. From its early development in research labs, government and universities, the internet became public in 1993. A different group of Whiz Kids were in charge. Dot com this. Dot com that. Too much money chasing too few opportunities in the burgeoning field of online commerce led to a bust.

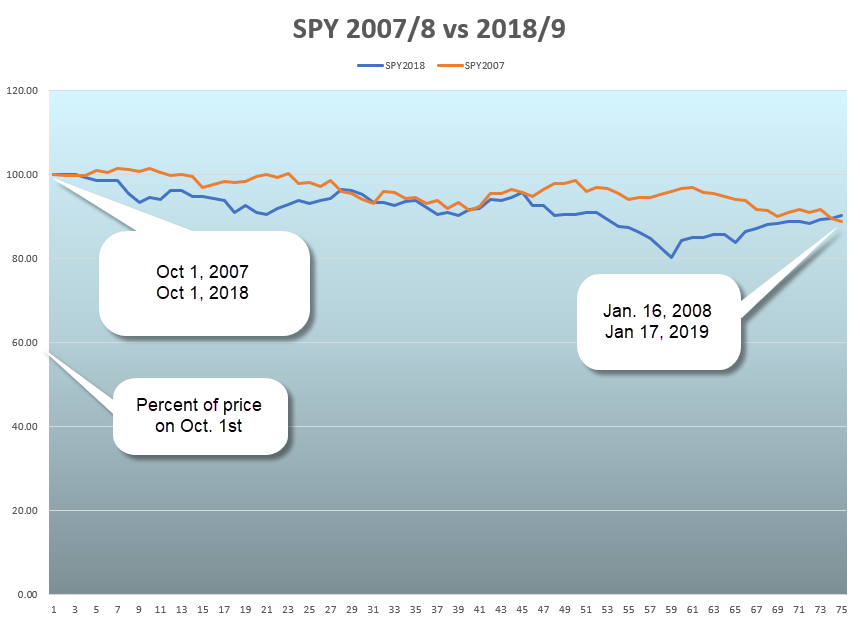

After 9-11, the invasion of Iraq demonstrated the power of science. The subsequent campaign demonstrated the even greater power of human hubris and folly. In 2007-2009, technological folly and greed produced the greatest recession since the 1930s Depression. Americans split into two factions: those who believed in expertise and those who mistrusted it.

President Obama was elected by those who were confident in experts. Policy experts would soon get the country out of the financial mess that the bankers and fast fingers on Wall Street had made of the lives of ordinary Americans on Main Street.

Mr. Obama’s two terms in office proved the inefficacy and arrogance of policy experts. The experts joined forces with vain politicians and created havoc in the lives of many Americans. A stimulus program was mismanaged, ill-timed and weighed down by burdensome regulation. An embarrassed President Obama admitted that there weren’t as many “shovel-ready” projects as he had hoped. Each agency protected its kingdom of regulatory power. Programs to help people stay in their homes floundered. A Cash for Clunkers auto buying program gave a temporary boost but its effect vanished within a few months. The promise of an efficient health care system that allowed Americans their choice of doctor was a fiasco. When the health care exchange web site debuted in 2013, it looked like the weekend effort of incompetent programmers. More embarrassment. Washington experts couldn’t be trusted to change the oil on someone’s car.

In 2016, almost half of voters rejected so-called experience, expertise and a posture of stately reserve in their President. After eight years of President Obama, they had had enough. They wanted the bluster of a pro wrestler and the charisma of a reality show star. Send in the clown!

America is home to the world’s best universities and most innovative companies and attract the best minds and the most capital from around the world. Blah, blah, blah. Americans were tired of best. They wanted great. They wanted insanely crazy great. They got crazy instead. Welcome to America.

////////////////////

Notes:

Photo by humberto chavez on Unsplash

Biography. (2019, October 3). Robert S. McNamara. Retrieved from https://www.biography.com/political-figure/robert-s-mcnamara

Rhoads, J. N. (2014, July 7). The Medical Context of Calvin Jr.’s Untimely Death. Retrieved from https://www.coolidgefoundation.org/blog/the-medical-context-of-calvin-jr-s-untimely-death/

Smithsonian Institution. (2005, February 1). Individual Rights versus the Public’s Health. Retrieved from https://amhistory.si.edu/polio/americanepi/communities.htm

Smithsonian Institution. (n.d.). Knowing the Presidents: Gerald R. Ford. Retrieved from https://www.si.edu/spotlight/knowing-the-presidents-gerald-r-ford

Wikipedia. (n.d.) 1992 United States Presidential Election. Retrieved from https://en.wikipedia.org/wiki/1992_United_States_presidential_election