June 4, 2023

by Stephen Stofka

This week’s letter is about household debt and income. First I’ll touch on the latest news in the debt ceiling debacle. In a late Thursday session, the Senate passed a debt ceiling bill 63-36 and the President is expected to sign it before Monday, the day when Treasury Secretary Janet Yellen said the country would start delaying or defaulting on payments. There were few significant cuts to social and military spending, the biggest contributors to the nation’s rising debt. The CBO’s recent outlook estimates that the debt will rise by almost 50% in the next decade.

Although the issue is laid to rest until 2025, neither side is willing to pass a law that voids the 105 year old debt ceiling law. Since the passage of the 17th Amendment in 1913, only the Democratic Party has ever held a filibuster proof 60 vote majority in the Senate. For Republicans, the debt ceiling is a critical bargaining chip to undo Democratic spending priorities. When Democrats had a filibuster proof majority in 2009-2010, they could have undone the debt ceiling law but chose other priorities like Obamacare and banking reform. In 2021, ten Republicans joined Senate Democrats to bypass the 60 vote filibuster threshold and permit a vote to raise the debt ceiling, the Hill reported. Last year, Janet Yellen asked Democrats to lift the debt ceiling while they held majorities in both chambers of Congress but Chuck Schumer probably didn’t have the votes in a narrowly divided Senate.

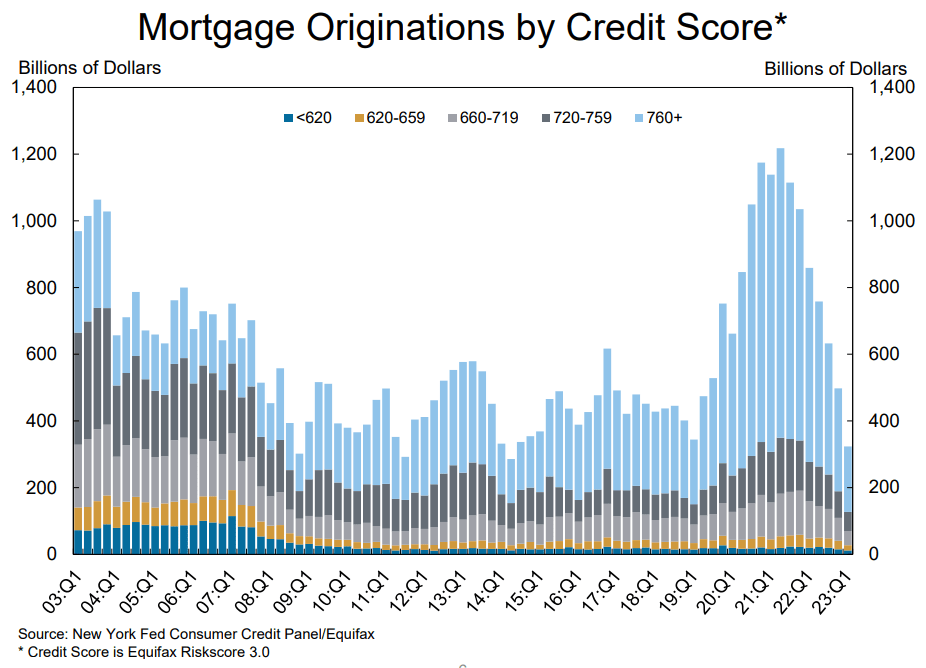

The latest report on household debt from the New York Federal Reserve (2023) reveals some interesting trends in mortgage debt. During the pandemic, the surge in mortgage originations was particularly strong among those with the best credit scores of 760 and above.

Those with the greatest house buying power are now “locked” into historically low interest mortgages below 4%. How low is 4%? The 50 year average of the 30-year fixed mortgage rate is 7.74%, according to Trading Economics. An entire generation was accustomed to very low rates after the financial crisis. Those low mortgages will create a resistance to sell that will likely dampen the housing market for a decade to come. A $400,000 mortgage at 4% costs $1900 per month. At a 6.5% rate that same monthly payment covers only a $300,000 mortgage. How many people will be willing to downsize into a more affordable mortgage?

In the past 15 years, Americans have reduced their debt load to a level less than their disposable income but how long can that continue? For the past 20 years, real disposable personal income per household has grown at only 1% annually, half of the rate of growth from 1982-2002. (Disposable income is what remains after taxes). In the graph below, that is the blue line. That same income series per job, not household, has grown at 1.25% annually (red line), down from 1.5% annual growth in the previous 20 year period. I’ve charted the two series on a log scale to demonstrate the different growth rates. The difference indicates that those with higher paying jobs have enjoyed higher growth of after tax income for the past two decades. The two series show the cumulative effect of favorable tax policies for those with higher incomes.

Because the growth of household income is tepid, families are more likely to increase their debt burden. In a decade this could provoke a credit crisis similar to the great recession 15 years ago. Republicans are fiercely resistant to higher taxes on the top income earners and equally resistant to any reductions in military spending or agricultural supports. Democrats continue to promote social programs without the additional tax revenues to support that spending. A higher federal debt level will reduce the federal government’s capacity to support families when the next crisis arrives.

//////////////////

Photo by Leio McLaren on Unsplash

Keywords: fiscal cliff, public debt, household debt, mortgage, disposable income

Federal Reserve Bank of New York. (2023, May). Quarterly report on household debt and credit. https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2023Q1

U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DSPIC96, June 2, 2023. Other series shown are Total Nonfarm Payroll (PAYEMS), the Census Bureau’s estimate of households (TTLHHM156N)