March 17, 2019

by Steve Stofka

Imagine a world where, each year, the U.S. government (USG) gave $1000 to each of it’s approximately 300 million citizens (Note #1). The annual cost of the program would be $300 billion, about $120 billion more than the 2017 tax cuts (Note #2). As it does every year, the USG would borrow the money and issue Treasury bills, which are traded around the world. Although there is more than $23 trillion of Treasury debt – a plentiful supply – there is not enough to meet world demand.

Let’s say that the American people spent 80% of that $300 billion each year and saved the rest (Note #3). Let’s also calculate a multiplier of 1.5 so that the extra $240 billion of spending generates $360 billion of GDP (Note #4), about 1.7% of last year’s GDP. The increase in GDP would return about $60 billion to the USG in tax revenues (Note #5). The net cost to the USG is $300 billion less $60 billion in additional tax revenue = $240 billion.

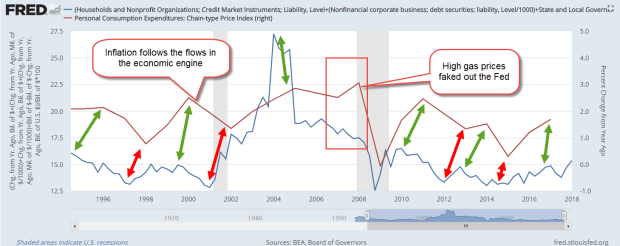

Will the slight increase in GDP each year generate higher inflation? Inflation occurs when too much money chases too few goods and resources. Efficiencies in world production of goods and services has caused a continuing deflation in developed economies. Against those headwinds, inflationary pressures will be modest.

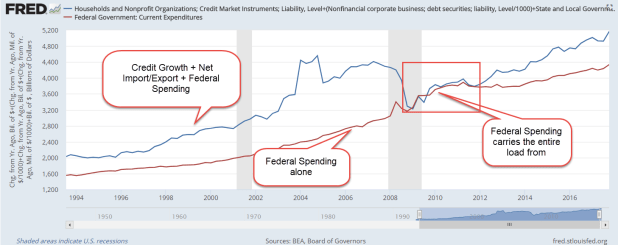

At the end of ten years, this program would create an additional $3.5 trillion in U.S. debt, the same amount of debt that the Federal Reserve accumulated in 2008 to protect the jobs and bonuses of Wall St. bankers. The Fed still owns most of that debt (Note #6). Which is fairer? A program to distribute money equally to everyone or a program to distribute the same amount to a select few?

Implementation of such a program is unlikely but illustrates the lack of a moral rudder in our Congress. Self-branded fiscal conservatives in both parties promote the fiction that the Social Security and Medicare funds will “run out of money” at a certain date in the future. These funds are part of the Federal government and are nothing more than bookkeeping entries on the Federal government’s books. The Social Security Administration explains this: “[the funds] provide 1) an accounting mechanism for tracking all income to and disbursements from the trust funds, and (2) they hold the accumulated assets. These accumulated assets provide automatic spending authority to pay benefits” [my emphasis] (Note #7). The accumulated assets are paper IOUs from the government to itself so that Social Security benefits are beyond the reach of Congressional infighting and debate each year. When it was created, President Roosevelt called Social Security an insurance program because it was insured against Congressional tampering.

Republicans propose to privatize Social Security while Democrats propose additional taxes to “fully fund” Social Security. These schemes are built on accounting fictions and sold to the general public as prudent solutions. Will the trust funds run out of money? Congress can change this with a stroke of a pen. Just as they “borrowed” from the funds, they can “loan” to the funds (Note #8). Both parties are trying to convince voters that big changes must be made because Congress is too incompetent to make a small legislative change. Will voters buy this nonsense and let them keep their jobs?

Around the world, the value of US Treasury debt is more trusted than gold. It is more than a bond because it trades among commercial banks like currency. The U.S. enjoys a unique position. Its debt is a trusted part of the world’s savings. This country has worked hard and prudently to make the U.S. dollar the world’s money. Over the past century, the U.S. has managed its economy and debt better than other large developed countries. Let us take advantage of that position. Let’s stop the political ploys around Social Security and other federal entitlement programs. Let’s have a serious discussion about investing in building new schools and transportation solutions, as well as needed infrastructure repairs. Let’s stop posturing like buffoons and start behaving like the leader we are.

//////////////////////

Notes:

1. Census Quick Facts

2. Annual loss of tax revenue about $180 billion times 10 years = $1.8 trillion per CBO estimate

3. Americans usually save about 5% of income.

4. More on fiscal multipliers. 1.5 is an average of various multipliers.

5. USG revenues average 17% of GDP.

6. Fed’s balance sheet over time. The Fed buys Treasury debt in the secondary market from large banks that buy the debt at Treasury auctions. The Fed continues to hold $1.6 trillion of mortgage-backed securities, the same kind of debt that led to the Financial Crisis. Current balance sheet.

7. Social Security Administration FAQ #1 on the nature of the funds . Also, see their page debunking SS myths promoted on the Internet

8. The Federal government pays below market interest rates for the money that it “borrowed” from the SSA funds. Decades ago, the interest rate was set at approx. the five-year average for funds “borrowed” for several decades. If 20 or 30 year rates had been used, the SS funds would be much larger. There would be no “crisis” to argue about.