This past Friday, the Bureau of Labor Statistics (BLS) released their monthly report for August and the employment gains of 96,000 were below the already muted expectations of 120,000 jobs gained. Many economists estimate that it takes 150,000 jobs per month just to keep up with population growth. On the day before the BLS report, the large payroll processing company, ADP, released their estimate of 201,000 private job gains in August, leading some to speculate that total job gains for the month would be above 150,000. As you can see below, the BLS and ADP counts of private employment closely track each other. (Click to enlarge charts in a separate tab)

On Thursday afternoon before the Friday morning release of the BLS report, the White House is notified of the numbers. The disappointing numbers may have led President Obama to tone down the rhetoric of his speech that evening at the Democratic National Convention. He did not seem to have the “fire in the belly” when he delivered his acceptance speech. The unemployment rate ticked down from 8.3% to 8.1% because 368,000 dropped out of the work force and are no longer counted as unemployed. Some of this number retired, either voluntarily or involuntarily. Some have simply become discouraged. Some have gone back to school. The average number of weeks of unemployment is still at high levels.

Some of this is due to changes in BLS reporting since Obama took office. Before January 2011, the BLS allowed a maxiumum of 2 years, or 104 weeks in their survey. Starting in 2011, the BLS allows a maximum of five years, or 260 weeks. Since a small number of unemployed forces the average number higher, the BLS recommends using the mean for comparison. (BLS Source)

Most of Europe is in recession; growth in South America, China and India have slowed. Several strong economic reports in the winter and spring of this year led many to think that the U.S. economy might be less tethered to this global malaise. The stock market rose over 10% in the first few months of 2012; then China reported contracting manufacturing and real estate sectors, and European leaders showed their continued inability to resolve the fiscal and monetary policy challenges that threaten to crack the European Union. We realized that we were not immune to the global financial flu and the stock market fell 10% in May, wiping out the gains of the winter and spring. The monthly employment gains dropped during the summer.

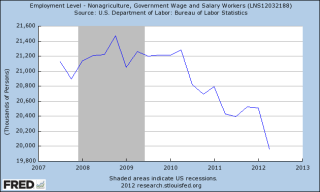

Recent employment and industrial reports have showed that our growth, while still positive, is struggling. Private job growth has been hampered by the layoffs of government workers, as the chart below shows.

The shedding of government jobs halted this past month as Federal employees actually gained about 3,000. Those on the left have criticized the Republican House for aggravating job losses in state and local governments by blocking any further federal aid to the states. A comparison with the first term of the Reagan administration shows a similar decline in government employment during the 1981 – 1982 recession. However, following the end of the recession, government employment increased in the last two years of his first term and helped Reagan get elected to a second term. The Democratic House was kinder to Reagan than the current Republican House is to Obama.

The slow growth of the past several months has fueled speculation that the Federal Reserve will once again come to the rescue with a bond buying program. Since the beginning of June, the stock market has “melted up” on very low volume. Once again, it is at the peak reached earlier this year and in 2007 before the recession began.

The uninspiring lack of job growth among what I call the core labor force, those aged 25 – 54, is a predictor of a sluggish economy in the near future. These workers buy a lot of stuff. No jobs, no stuff.

The larger group of adult workers, those aged 25 plus, continues to show gains, indicating that older workers are continuing to keep and get jobs. The old are simply not making way for the young. Severe declines in house values and the loss of value in their retirement funds has forced many older workers to continue working longer than they may have planned. Older workers do no buy a lot of stuff.

During the 2010 elections, Republican candidates for the House promised that job programs would be first priority. We have been waiting two years. Both houses of Congress have historically low voter approval ratings yet the burden of the sluggish job growth continues to fall on the President’s shoulders. Politicians on the Republican side of this dysfunctional Congress point to the President as the cause of the muddle through labor market; they know most voters can’t remember what they learned in civics class in grade school and don’t understand that it is Congress, not the President, that initiates legislation. It is Congress, both Democrats and Republicans in the House and Senate, that is responsible for the lack of job growth. Who elected these men and women to the Congress? Look in the mirror. That’s who’s responsible for the slow job growth.