Obamanomics, Reaganomics, Clintonomics – we love our monikers, our taglines that we lay on a President and his administration. We don’t need to bother with facts or complexity when we have a simple moniker. Proctor and Gamble have known that for years.

The conservative media often paints the Reagan years as a time of economic prosperity, appealing to romantic idealists with a highly selective memory of the facts.

Is the unemployment rate too high now? Yes. Were the Reagan years the Golden Age of Unemployment? No. During Reagan’s two terms the average unemployment rate was 7.5%, according to the Bureau of Labor Statistics. No post WW2 president has done worse, although Obama is trying.

Is 3 – 4% unemployment rate normal? No. Until the late nineties, the guideline was that an unemployment rate less than 5% was inflationary or indicated a bubble of some sort in the making. In the late 90s, there was supposedly a new paradigm, a new economy and those old guidelines no longer applied. We now know that the low unemployment rate of the late 90s was a tech bubble in the making. During the 2000s, the low unemployment rate was a housing bubble in the making. As a rule of thumb, the “ideal” UI rate would probably be 5.5% – not too hot, not too cold.

During the two Clinton administrations, the UI rate averaged 5.2%. George W. Bush maintained that same average. The single term of his Dad was marked by a 6.3% average, slightly lower than the 6.5% average of the four years under President Carter in the late 70s.

The winner in the unemployment department was Johnson, with a 4.4% average UI rate during his 6 year tenure. Not only did the Vietnam war take a lot of working age men out of the workforce but the defense spending was a boom to the economy. Within 2 years after Johnson left office, the stock market bubble deflated, losing 25% of its value.

Second place for lowest unemployment goes to Eisenhower whose 8 year term enjoyed a 4.9% unemployment rate. Eisenhower takes first place among post WW2 administrations for the number of recessions – 3. The chief reason for these were changes in monetary policy by the Federal Reserve.

Selective memory is a cornerstone of both progressive and conservative media.

Did Reagan begin the destruction of manufacturing in this country? No. Did Clinton and the signing of NAFTA in 1993 destroy manufacturing? No. As the chart below shows, manufacturing jobs actually increased after NAFTA was signed. The dramatic decline began at the beginning of the first G.W. Bush administration.

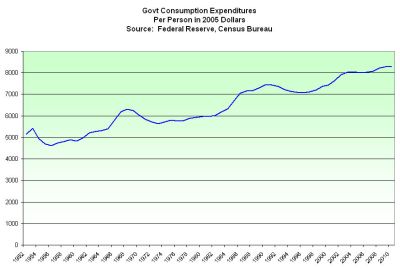

Where did those 4,271,000 manufacturing jobs go? Some of them went overseas. Almost a million of them, or 20%, went into Construction. 1.4 million went into state and local government. The majority of them went to various service industries, where the pay, on average, is lower.

With the wave of my hand, I am going to magically undo the housing bust and add back the 2 million construction related jobs lost since the height of the real estate bubble. What is the unemployment rate in this fairy land? Still a high and unacceptable 7.7%. With another wave of my hand, I am going to add back in the 4 million manufacturing jobs that have disappeared during the past decade. What is the UI rate in this Never-Never Land? 5.3%. 6 million jobs magically added to the nation’s payrolls and the unemployment rate is STILL over 5%.

That is what most in the conservative and progressive media don’t get. Stop bashing or praising Bush, Clinton, or Reagan. We have a much more serious problem in this country – structural unemployment. Broad technological changes dawned during the Reagan years, then accelerated during the Clinton and Bush administrations, sparking a widespread use of the computer, the internet and other electronic technologies. Millions of bookkeepers, cashiers, phone receptionists, stock brokers, salespeople and highly skilled fabricators are no longer needed in this economy because sophisticated machines and programming have eliminated their jobs. No political philosophy by either party, no President, no international cabal put these people out of work. Efficiency and imagination put them out of work.

Our job, as a people, is to figure out how we are going to reconfigure our society when we can anticipate having a UI rate of 7% or more. As the boomer generation phases out of the workforce, that percentage might come down to 6% for a few years but, as they are drifting out of the workforce, the “Echo Boomers” are now entering the workforce. The lower UI rates of the bubble years in the late 90s and 2000s are over, yet I occasionally talk to people in their twenties and thirties who think 4% unemployment is “normal” because it’s all they have known. 4% is not normal. Until we accept this structural unemployment and deal with it, we are doomed to escalating deficits and strained social programs which try to cope with the needs of those who are not employed, both seniors and the unemployed.

The relatively high unemployment of the Reagan years will be the standard for the coming decade and beyond. The Obama administration is on track to surpass the record that the Reagan administration set for unemployment and wishes that presidential history would repeat itself. In 1984, the Democrats put up a tired and uninspiring party hack, Walter Mondale, and Geraldine Ferraro, the wife of a possible mob boss, as competition against Ronald Reagan, who swept the vote. Obama probably wishes that the Republican party would do him the same favor. Presidents with high unemployment need help from the other party.