April 10, 2016

CWPI (Constant Weighted Purchasing Index)

March’s survey of Purchasing Managers showed a big upsurge in new orders for the manufacturing (MFR) sector. Export orders were up 5.5% in both the manufacturing and services (SVC) sectors and overall output increased 2% or more. After contracting for several months, MFR employment may have found a bottom. The total of new orders and employment is still growing but below five year averages.

The broader CWPI is still expanding but at a slightly slower pace for the past seven months. The cyclic pattern of declining growth followed by a renewal of activity has changed. While there is no cause to make any strategic changes to allocation, it does bear watching in the months ahead.

////////////////////////

IRA Standard of Care

Financial agents – investment advisors, stock brokers and insurance agents – have had different standards of care when they deal with their clients. The first and highest standard is fiduciary: the agent should operate with the best interests of the client in mind. Registered Investment Advisors (RIA) are registered with the SEC and follow this strict standard. The second and more lax standard is suitability: the agent should not sell the client anything that is not suitable for the client based on what the client has told them about their circumstances. Here’s a short paper on the difference between the two standards.

This week the Obama administration issued new guidelines for agents servicing IRA account holders, requiring agents to maintain the higher fiduciary standard starting in 2017. This requirement was left out of the Dodd-Frank finance reform bill because many in the investment industry lobbied against it. Here is the first rule proposal in February.

Opponents will criticize the Obama administration for this “new” set of regulations but this policy has been recommended by some in the industry, on both sides of the political aisle, for at least 25 years. During the 1980s Congress made several changes that made IRA accounts available to a wide swath of savers, most of whom were unfamiliar with the marketplace of financial products now available to them.

Some in the insurance and investment industries fought against the imposition of a stricter fudiciary standard because it would require more training and would likely reduce the sales commissions of agents. The growing volume of tax deferred employee retirement plans has generated a steady stream of fees for those in the financial industry.

Keep in mind that the new policy only applies to retirement accounts.

////////////////////////

Debt

Banks are in the business of loaning money, meaning that they must loan money to stay in business. Most of the time some part of the economy wants to borrow money. Borrowers come in three types: Household, Corporate and Government. If households cut back on their borrowing, corporations may increase theirs.

A historical look at total debt as a percent of GDP shows several trends. Keep in mind the leveling of debt since the financial crisis. We’ll come back to that later.

In the thirty years following World War 2, debt levels remained fairly consistent with the pace of economic activity. The three types of borrowers offset each other. Households and corporations increased their borrowing while government, particularly the Federal government, paid down the high debt incurred to fight WW2.

In 1980 the Reagan administration and a Democratic House began running big deficits, contributing to a spike in the the total level of debt. By 1993, when President Clinton took office, Federal and State Debt as a percent of GDP was about the same as it was at the end of WW2.

A combination of higher tax rates and cost cutting by a Republican House elected in 1994 led to a reduction in government spending as household and corporations increased their spending. Total debt levels flattened during the late 1990s.

Following the 9/11 tragedy and a recession, government debt levels increased but now there was no offset in household borrowing as mortgage debt climbed. Helping to curb the pronounced rise in total debt levels, a Democratic House at odds with a Republican president dampened the growth of government borrowing in the two years before the financial crisis.

Arguably the most severe crisis in eighty years, the financial crisis caused both households and corporations to cut back on their borrowing. Offsetting this negative borrowing, the Federal government assumed an often overlooked role – the Borrower of Last Resort. We are accustomed to the role of the Federal Reserve Bank as the Lender of Last Resort, but we might not be aware that some part of the economy has to be the Borrower. That role can only be filled by the Federal government because the states and local governments are prohibited from running budget deficits.

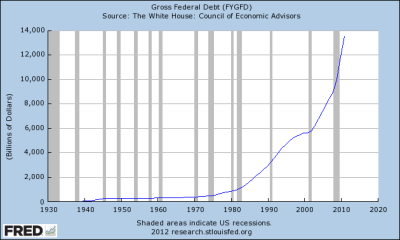

Look again at the second chart showing the huge spike in government borrowing following the financial crisis. Now remember the leveling off of total debt shown in the first graph. The Federal government has increased its debt level by more than $10 trillion. Almost $4 trillion of that has come from the lender of last resort, the Fed, but the rest of that borrowing has offset a significant deleveraging by corporations and households. Had the Federal government not borrowed as much as it did, many banks would have experienced significant declines in profits to the point of going out of business.

There is a potential bombshell waiting in the $2 trillion in corporate profits that businesses have parked overseas to delay taxes on the income. If Congress and the President were to lower tax rates so that corporations could “repratriate” these dollars, two things would happen: 1) corporations could lower their debt levels, using the cash to pay back the rolling short term loans they use to fund daily operations; and 2) the Federal government would lower its debt levels as the corporations paid taxes on those repatriated profits.

Great. Lower debt is good, right? Unless households were to step up their borrowing, total debt could fall significantly, causing another banking crisis. Although politicians on both sides like to talk about bringing profits home, such a move will have to be done slowly so that the economy and the banking system can adjust in slow increments.

Partisans cheer when candidates express strong sentiments in rousing words, but cold caution must quench hot spirits. We can only trust that candidates for public office will temper their campaign rhetoric with prudence if entrusted with the office.