May 4th, 2014

Employment

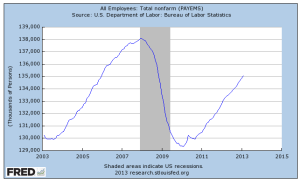

Private payroll processor ADP estimated job gains of 220K in April and revised March’s estimate 10% higher, indicating an economy that is picking up some steam. Of course, we have seen this, done that, as the saying goes. Good job gains in the early months of 2012 and 2013 sparked hopes of a strong resurgence of economic growth followed by OK growth.

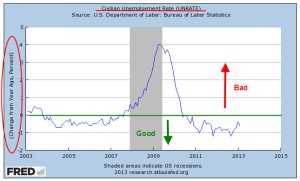

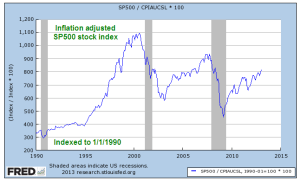

New unemployment claims this week were pushing 350K, a bit surprising. The weekly numbers are a bit volatile and the 4 week average is still rather low at 320K. In a period of resurgent growth, that four week average should continue to drift downward, not reverse direction. Given the strong corporate profit growth expectations in the second half of the year, there is a curious wariness in the market. Conflicting data like this keeps buyers on the sidelines, waiting for some confirmation. CALPERS, the California Employees Pension Fund with almost $200 billion in assets, expressed some difficulty finding value in U.S. equities and is looking abroad to invest new dollars.

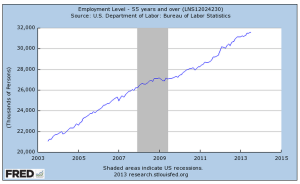

On Friday, the Bureau of Labor Statistics reported job gains of 288K in April, including 15K government jobs. Most sectors of the economy reported gains but there are several surprises in this report. The unemployment rate dropped to 6.3% from 6.7% the previous month, but the decline owes much to a huge drop in labor force participation. After poking through the 156 million mark recently, the labor force shrank more than 800,000 in April, more than wiping out the 500,000 increase in March.

To give recent history some context notice the steady rise in the labor force since the end of World War 2, followed by a flattening of growth in the past six years.

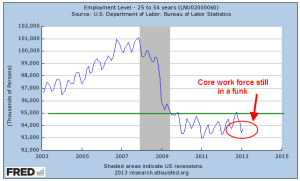

The core work force, those aged 25 – 54 years, finally broke through the 95 million level in January and rose incrementally in February and March. It was a bit disappointing that employment in this age group dropped slightly this month.

To give this some perspective, look at the employment rate for this age group. Was the strong growth of employment in the core work force largely a Boomer phenomenon unlikely to repeat? Perhaps this is why the Fed indicated this week that we may have to lower our expectations of growth in the future.

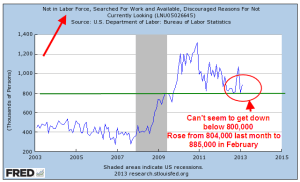

Discouraged job seekers and involuntary part timers saw little change in this latest report. On the positive side, there was no increase. On the negative side, these should decline in a growing economy. There simply isn’t enough growth. Was the strong pickup in jobs this past month a sign of a resurgent economy? Was it simply a make up for growth hampered by the exceptional winter? The answers to these and other questions will become clearer in the future. My time machine is in the shop.

************************

GDP

Go back with me now to those days of yesteryear – actually, it was last year. Real GDP growth crossed the 4% line in mid year. The crowd cheered. Then the economic engine began to slow down. The initial estimate of fourth quarter growth a few months ago was 3.2%. The second estimate for that period was revised down to 2.4%, far below a half century’s average of 3%. This week the final estimate was nudged up a bit to 2.6%, but still below the long term average.

Earlier in the week, the Federal Reserve announced that it will continue its steady tapering of bond buying and that it may have to adjust long term policy to a slower growth model. The harsh winter makes any analysis rather tentative so we can guess the Fed doesn’t want to get it wrong?

************************

Manufacturing – ISM

ISM reported an upswing in manufacturing activity in April, approaching the level of strong growth. The focus will be on the service sector which has been expanding at a modest clip. I’ll update the CWPI when the ISM Service sector report comes out next week.

************************

Income – Spending

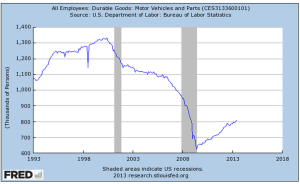

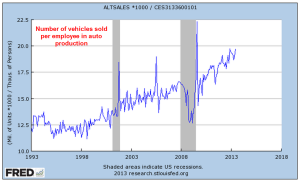

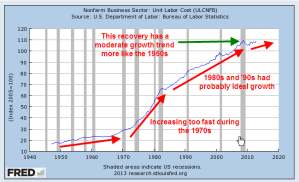

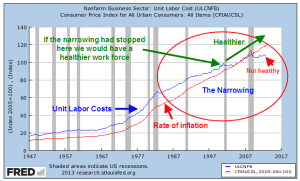

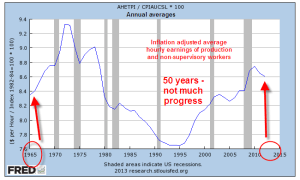

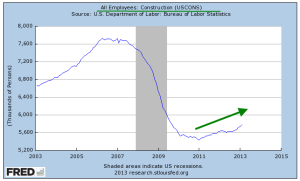

Consumer income and spending showed respectable annual gains of 3.4% and 4.0%. The BLS reported that earnings have increased 1.9% in the past twelve months. CPI annual growth is a bit over 1% so workers are keeping ahead of inflation, but not by much. Auto sales remain very strong and the percentage of truck sales is rising toward 60%, a sign of growing confidence by those in the construction and service trades. Construction spending rose in March .2% and is up over 8% year over year but the leveling off of the residential housing market has clearly had an effect on this sector in the past six months.

***********************************

Conservative and Liberals

While this blog focuses mainly on investing and economics, public policy is becoming an ever increasing part of each family’s economic heatlh, both now and particularly in the future.

Some conservatives say that they endorse policies which strengthen the family yet are against rent control, minimum wage and family leave laws, all of which do support families. How to explain this apparent contradiction? A feature of philosophies, be they political, social or economic, is that they have a set of rules. Some rules may be common to competing philosophies but what distinguishes a conceptual framework or viewpoint is the difference in the ordering of those rules. The prolific author Isaac Asimov, biologist and science fiction writer, proposed a set of three rules programmed into each robot to safeguard humans. A robot could not obey the second law if it conflicted with the first. Robots are rigid; humans are not. Yet we do construct some ordering of our rules.

A conservative, then, might have a rule that policies that protect the family are good. But conservatives also have two higher priority rules which honor the sanctity of contract and private property: 1) that government should not interfere in voluntary private contracts, and 2) that private property is not to be taken from private individuals or companies without some compensation, either money or an exchange of a good or service. Through rent control policies, governments interfere in a private contract between landlord and tenant and essentially take money from a landlord and give it to a tenant, a violation of both rules 1 and 2. Minimum wage and mandatory family leave laws enable a government to interfere in a private contract between employer and employee and essentially transfer money from one to the other, another violation of both rules.

In my state, Colorado, there is no rent control. Instead, landlords receive a prevailing market price and low income tenants receive housing subsidies and energy assistance. Under rent control, money is taken from a specific subset of the population, landlords, and given to tenants. Under housing subsidies, money is taken from general tax revenues of one sort or another and given to tenants. Of the two systems, housing subsidies seems the fairer but many conservatives object to either policy because the government takes from individuals or companies without any exchange, a violation of rule #2. All policies like housing subsidies which involve transfers of income from one person to another, are mandatory charity, and violate rule #2.

Liberals want to support families as well but they have a different set of rules that prioritizes the sanctity of the social contract: 1) individuals living in a society have an obligation to the well being of other members of that society, and 2) those with greater means have a greater obligation to the well being of the society. A government which is representative of the individuals of that society has the responsibility to facilitate the movement of wealth and income among those individuals in order to achieve a more equitable balance of happiness within the society. Flat tax policies espoused by more conservative individuals violate rule #2. Libertarian proposals for a much smaller regulatory role for government violate rule #1.

For liberals, both of the above rules are subservient to the prime rule: humans have a greater priority than things. When the preservation of property rights violates the prime rule, property rights are diminished in preference to the preservation of human well-being. On the other hand, conservatives view property rights as an integral aspect of being human; to diminish property rights is to diminish an individual’s humanity.

In the centuries old dynamic tension between the individual and the group, the liberal view is more tribal, focusing on the well being of the group. Liberals sometimes ridicule some tax policies espoused by conservatives as “trickle down economics.” In a touch of irony, it is liberals who truly believe in a trickle down approach in social and economic policies. The liberal philosophy seeks to protect society from the natural and sometimes reckless self-interest of the individuals within that society. The conservative viewpoint is concerned more with the protection of the individual from the group, believing that the group will achieve a greater degree of well-being if the individuals are secure in their contracts and property. Conservatives then favor what could be called a bottom up approach to organizing society.

Conservatives honor the social contract but give it a lower priority than private contracts. Liberals honor private contracts but not if they conflict with the social contract. Most people probably fall somewhere on the scale between the two ends of these philosophies and arguments about which approach is “right” will never resolve the fundamental discord between these two philosophies.

In the coming years, we are going to have to learn to negotiate between these two philosophies or public policy will have little direction or effectiveness. Negotiating between the two will require an understanding of the ordering of priorities of each ideological camp.

Before the 1970s political candidates were picked by the party bosses in each state, who picked those candidates they thought would appeal to the most party voters in the district. The present system of promoting political candidates by a primary system within each state has favored candidates who are fervent advocates of a strictly conservative or liberal philosophy, chosen by a small group of equally fervent voters in each state. The middle has mostly deserted each party, leading to a growing polarization. Survey after survey reveals that the views of most voters are not as polarized as the candidates who are elected to represent them. A graph from the Brookings Institution shows the increasing polarity of the Congress, while repeated surveys indicate that voters are rather evenly divided.