January 11, 2015

Price movement continued to be volatile in this second week of the year. Despite all the price gyration, the SP500 is down only 1% since the first of the year. On Monday, light crude oil broke below the $50 price barrier, helping to usher in a rush to safety, namely U.S. government debt. As the prices of long term Treasuries climb upwards, who is buying this Federal debt? As the chart below shows, foreigners already hold the majority of Federal Debt.

As the dollar continues to strengthen, institutional investors around the world buy Federal Debt to enhance the return on their savings. Let’s say a European investor bought $132 of Treasury debt on September 1, 2014 for €100. Now that same investor cashed in that U.S. Treasury bill this past Friday. What does the investor get back? €111.46, without any accrued interest or fees included. In a little over 3 months, they have made almost 11-1/2% return, an annual rate of more than 40%.

On the other hand, the “carry trade” is getting squeezed. The carry trade involves borrowing money in a country with a low interest rate, or borrowing low, and buying debt in another country with a higher interest rate, or loaning high. This is a great deal – easy money – IF the currency of the country where an investor borrowed the money doesn’t start rising in value as the U.S. dollar has done recently. The problem is particularly acute in emerging countries which have higher interest rates to attract capital.

To keep the example simple, let’s use the euro again. On September 1st, a European investor bought €100 of French BTFs paying 5%. Because interest rates are so low in the U.S., the European investor was able to borrow the money in the U.S. for 1/2%, making 4.5% for doing nothing. The investor borrowed $131.30, converted it to €100 and bought the BTFs.

This past Friday, the U.S. bank calls the investor’s loan so the investor cashes in her €100 BTF and gets only $118.42 at the current exchange rate. They are short $12.88, an annualized loss of almost 36%. What makes this simple scenario even more dangerous is that, in the real world, the investor has often leveraged their money, multiplying the losses.

The problem becomes particularly acute for companies headquartered in an emerging market (EM) country but which have a U.S. subsidiary. The subsidiary borrows money at a low interest rate in the U.S., much lower than the prevailing rate in the EM country, then converts those dollars to the currency of the EM country to fund expansion. If the EM currency loses value against the dollar, the company finds it increasing difficult to make payments on their loan because each time they convert their EM currency to U.S. dollars, the EM currency buys fewer dollars. This is another kind of squeeze that may cause the bank to call the loan, or escalate the loan to a higher interest rate, creating even more financial pressure on the company.

This is the first time in fifteen years that the U.S. dollar has gained in strength against all major currencies.

***********************

Purchasing Manager’s Index

As expected a few months ago, a composite of employment and new orders in the services sector continued to moderate in December. In September, these two key factors of production were at the highest levels in 17 years, so some decline was anticipated toward the end of the year.

The CWPI, a composite of manufacturing and services sector activity in the country, continues to run strong, although it has also moderated from the higher peak set in October 2014. The wave like pattern of economic activity is getting stronger over the past several years. The peaks are coming closer together and now the strength of activity has quickened.

Despite these strong economic indicators, investors are worrying again (see October blog) that the rest of the global economy is faltering. Why investors showed less concern about the global economy in November and December remains a puzzle. To longer term investors, the market seems to have the attention span – and frenetic activity – of a three year old.

************************

Employment

In December, employment rose 2.1% year over year, almost besting the high set in March 2006 for yearly growth.

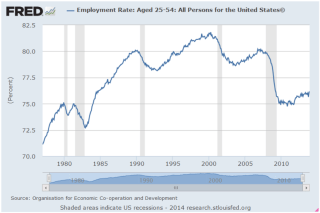

There were several positives in this report. Job gains for October and November were revised up 50,000 total. The core work force, those aged 25 – 54, continued a steady rise. The number of people employed at part time jobs because they couldn’t find full time work fell again in December by 60,000 and is down 13% over the past year. However, there are still 50% more involuntary part-timers than during the 2000s.

The number of long term unemployed people has fallen 28% in the past year but – that word “but” rears its ugly head again – are still high.

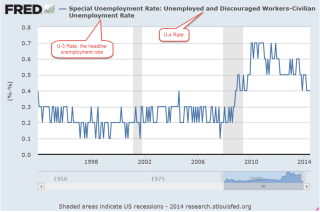

Investors tended to focus on the negatives in this month’s report. The number of discouraged workers, those who are available for work but haven’t looked in the past month, was up 42,000.

As a percent of the labor force, the long term unemployed and discouraged are still at historically high levels – more than five years after the official end of the recession.

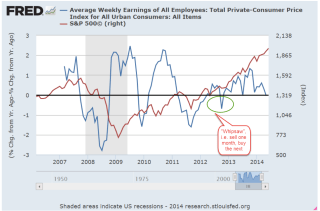

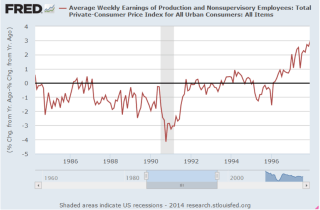

Hourly wages declined by .05 to $24.57 but the influx of seasonal and part time jobs at the holidays and year end may have had some impact. Last month’s slight increase in hourly wages sparked hope that employees might be gaining some pricing power, indicating an underlying strong demand from employers. This month’s data suggests that lower gasoline prices will have to substitute for wage growth in the near term.

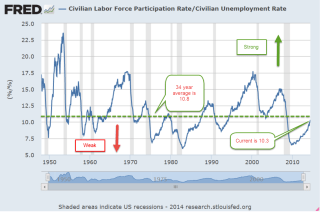

The Labor Force Participation rate edged down .2 and seems to be stuck in a range just under 63% for the past year. If the labor market were really growing strongly, we would expect to see some upward movement as more people tried to enter or re-enter the job market.

************************

Social Security Calculator

Last year the Wall St. Journal reviewed several social security claiming calculators. Social Security (SSA) has some very complex rules, particularly for married couples. Remember that this is a system designed by politicians and the Washington bureaucracy, the same people who, after 9-11, designed the multi-colored terror threat warning system that seemed permanently stuck on yellow, or elevated threat.

Given the complexity of the Social Security rules, noted economist Lawrence Kotlikoff heads a team that designed an online calculator to help people maximize their benefit. The program has a fee of $40 and looks very easy to use. An 11 minute video demonstrates using the tool for a married couple born in 1958 and 1952. Curl up on the couch and get out the popcorn.

The mutual fund giant Fidelity has a good discussion of various claiming options for married couples. The third example is rather interesting. The younger person in a married couple files early and receives a reduced benefit. The older person files and suspends his own benefits at full retirement age (FRA) but takes a spousal benefit based on the fact that his wife has already retired. Here’s the kicker: his spousal benefit is based on what her benefit would have been at FRA, not the reduced benefit she receives because she retired early.

*************************

Allocation

We learned about allocation while playing Monopoly. It is better to put up a few houses on both the Green and Purple property groups than put all of our money into hotels on the pricey Green group only.

Vanguard has a questionnaire to help investors determine an appropriate allocation mix of stocks, bonds and cash. You don’t need to be a Vanguard customer to answer the questionnaire.

*************************

Final Word

The price of oil is unusually low. The U.S. dollar is unusually strong. Interest rates have been unusually low for several years. Central banks around the world have provided an unusual level of support for their economies. A confluence of unusualness, a new word, leads to greater price swings. Market volatility (VIX) has been low – below 20 – for most of the past two years and this relative calm tends to bring more people into the market, helping to lift stock prices. We may see a return to higher volatility levels similar to early 2012 and late 2011.