January 20th, 2013

I was talking with someone this week who thought that, this year or next, the financial world would melt down. This week someone else asked what I thought was going to happen this year. The S&P 500 index is approaching the highs of 2007. Is this a good time to invest in stocks?

I don’t know. In the early 1970s, Alan Greenspan, who would become head of the Federal Reserve in the late 80s, called for a bull market just a few months before the market imploded and lost almost half its value. Recently released minutes of meetings of the Federal Reserve in 2007 showed that some members were worried about contagion from the decline of the housing market to the rest of the economy but the overall sentiment was that housing and employment weakness was a needed and normal correction to an economy that had gotten a bit too frothy. No melt down anticipated there.

All any of us can know is what has happened and even that knowledge is imperfect. Regulators who are privy to information that might spook the markets often conceal that information and hope to contain the damage. Brokers and managers at large investment houses actually help build bubbles, skimming off fees and derivatives profits in the process.

With an imperfect assessment of the recent events, and a non-existent knowledge of the future, investors face the choice of putting their savings under the mattress or sending out their vulnerable savings into the economic fog.

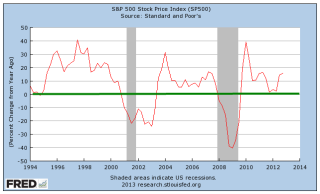

Over the past few years, I’ve looked at several indicators that have been fairly reliable foreshadowings of coming recessions. Before I look at those, let’s look at the big daddy indicator: the stock market. Over the course of a week, millions of buyers and sellers try to anticipate the direction of the economy and corporate profits. The majority of the time the market does anticipate these downturns but we need to look beyond the main index, the S&P500. Instead we look at the year-over-year percent change in the index. Below is a monthly chart of that percentage change.

The percent change drops below zero when the majority of investors do not believe that the market will increase over the next year. You may also notice that it is a good time to buy the market when the y-o-y percent change declines 15-20%.

When we look at the past twenty years, the lack of confidence has been a reliable indicator of the past two recessions. The graph below is the y-o-y percent change in a quarterly average of the S&P500.

These charts are easily available at the Federal Reserve database, FRED. Just type in “Fred SP500” into your search engine and the top result will probably be a link to a chart of the index. (Link here ) Click the “Edit Graph” button below the chart, then change the Frequency under the resulting graph to Monthly or Quarterly to smooth out the graph. Just below the Frequency field is a drop down list of what you want to chart. Select “Percent Change from Year Ago”, then click “Redraw Graph”. Fred does all the work for you.

As of right now, the majority of investors are somewhat hopeful that there will be an increase in the index in the coming months.

Another indicator I look at is the y-o-y percent change in the unemployment rate (UNRATE). This is the headline number that comes out each month. When the percentage change goes above 0, it’s probably not the best time to putting more money to work in the market.

Although the unemployment rate is still high, the yearly percent change is healthy. As someone quipped, “It’s not the fall that kills ya, it’s the change in speed when ya hit the pavement.” The change in each of these indicators is the key aspect to focus on.

Entering “Fred Unemployment” into a search engine should bring up as the top result a link to the unemployment chart. Follow the instructions I gave for the SP500 and Mr. Fred will do all the number crunching.

Looking at a broader index of unemployment, the U-6 rate, gives no indication of near term economic decline. Below is the percent change in that index.

Another indicator is New Orders in Nondefense Capital Goods Excluding Aircraft. As I noted the past few months, this has been worrisome. We don’t have sixty years of data for this indicator but a decline in the y-o-y percent change in new orders has foreshadowed the past two recessions. Recent monthly gains give some hope but the decline in equipment investment shows a lack of business confidence for the near term future.

The last index I look at is a composite indicator put together by the National Bureau of Economic Research, NBER, the agency that makes the official calls on the start and end of recessions. The Coincident Economic Index combines employment, personal income, industrial production, and manufacturing and trade sales. In a healthy or at least muddling along economy, the percent change should stay above 2.5%.

You can access this by typing “Fred Coincident” into a search engine and the top result should be the graph for this indicator. Follow the same instructions as above to show the percent change.

Except for New Orders there does not appear to be anything immediately worrisome. According to Standard and Poors, (the S&P in the name of the S&P500 index), estimated operating earnings for 2013 are about $112 (Source). At a 15.0 P/E ratio, that would put fair value of the SP500 at 1680, or 13% above its current level of 1486. The problem is that the estimates of 2013 earnings have been drifting down from $118 last March.

For the past few years there has been a pattern of declining earnings estimates. Something seems to be getting the way of early optimistic forecasts. However, even if operating earnings were to actually come in at $100 for 2013, an investor with a ten year or more time horizon couldn’t say that she had overpaid at current market levels.

A favorite theme of 1950s sci-fi movies was the underwater creatures who had been turned by nuclear radiation into a gigantic monsters lurking on the seabed. The tranquil calm surface of the water gave no hint of the monster swimming beneath the surface. Then came an upswelling of water seen from the shore, a crashing crest of wave and the creature erupted from the liquid depths. For many investors, there may be that same sense of foreboding. European banks loaded up on government debt; the Federal Reserve buying the majority of newly issued U.S. debt this past year; trillion dollar U.S. deficits; persistently high unemployment; perhaps that is why there is so much cash floating around.

The MZM money stock includes cash, checking accounts, savings accounts and other demand type accounts, money market funds and traveler’s checks; in short, it is money that people can demand now. The percentage change has moderated recently and shows neither confidence or fear, of investors not knowing whether to step left or right.

For the long term investor, a showdown over raising the debt ceiling in the next few months may present another buying opportunity before the April 15th deadline to make IRA contributions for the 2012 year.