December 9th

An eventful week in what I will call the BUT economy: GDP revisions, Corporate Profits, Consumer Confidence and the Labor Report. Let’s get into it!

At the end of last week, the Commerce Dept issued their customary revisions to 3rd quarter Gross Domestic Products (GDP).The first number that came out in October was a preliminary estimate. As more data comes in, the Commerce Dept. revises its figures, and will have another revision in December. From the initial estimate of 2.0% annualized growth, the Commerce Dept revised 3rd quarter GDP growth up to 2.7%, below the historical average of about 3% but good news is YAAY! Right? Wait for it now…BUT upward revisions were due largely to companies building inventories. Final sales actually declined from the initial estimate of 2.1% to 1.9%. Excluding exports, final sales were revised from a growth of 2.3% to 1.7%.

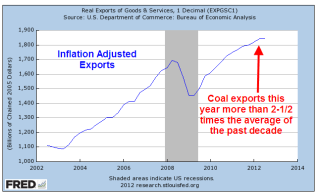

The boom in natural gas production has led many power generators to convert their plants from coal to natural gas, when they can. Total coal production is down this year (Source) but exports of U.S. coal to the rest of the world have surged, so that we are exporting a record 25% of the total coal production in this country. The U.S. Energy Information Administration (EIA) estimates that coal exports will total about 133 million short tons this year, or 2-1/2 times the average of the past decade. (EIA Source)

The process of drilling for natural gas, called Fracking, has also led to a high production of crude oil (EIA source).

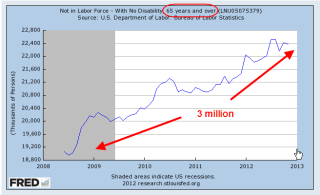

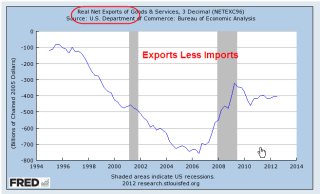

GDP includes both exports (+) and imports (-), what is called “net exports” and it has been negative for several decades as we import far more goods than we export. This serves as a negative drag on GDP growth.

Exports have risen over the past decade. As natural gas prices have fallen, surging coal exports in the past few years have helped buoy up lackluster GDP growth.

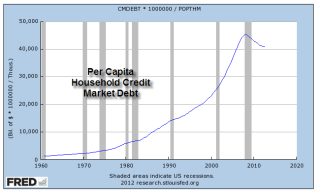

Another contributor to GDP growth has been a more confident consumer, in contrast to the rather cautious attitude of businesses in the past six months. An upswing in student debt and car loans has halted the decline as households have shed debt (delevered) either by foreclosure, default, paying down balances or not charging as much. Household Credit Market Debt outstanding (includes mortgages, car loans, student loans, revolving credit) indicates a growing willingness of consumers to take on more debt.

On a per person basis, our debt has declined slightly from the peak of 2007 but is still way too high, leaving many of us vulnerable to a subsequent downturn, slight though it might be.

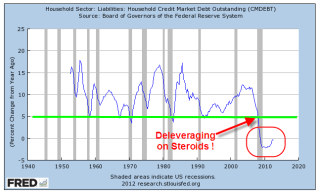

Just how bad has this recession been? In previous recessions, households cut back their debt to “only” a 5% growth rate. For the first time ever, the American people reduced their debt growth rate below 0. It is only in the past two years that this rate of negative debt growth is approaching 0.

Here’s the BUT. The underlying fragility of confidence was revealed this past Friday when the U. of Michigan Consumer Sentiment poll showed a plunge in confidence from over 82 in September to 74 in October. For the first time since the recession started in late 2007, the consumer confidence index had finally surpassed 80, only to fall back again the following month. In a relatively healthy economy, this index is above 90.

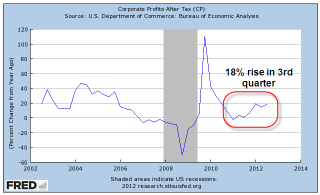

To summarize so far, we have a consumer slowly and haltingly gaining more confidence, spending more and keeping the growth rate of her debt in check. We have an overall economy that is behaving rather tiredly, growing tepidly as though on the downhill of a long boom cycle; that’s a problem since this has not been a boom cycle in the past few years. So how are corporate profits doing? Fine! Thank you!

In this past quarter, profits rose by 18%.

Starbucks, the coffee giant, announced this week that they would voluntarily pay some British income tax this year instead of moving the profits to some low tax country and avoiding British income taxes. It appears that their customers discovered that they had been (legally, mind you) avoiding paying income taxes and were mobilizing to boycott Starbucks’ stores in Great Britain.

Interest rates kept near zero by the Federal Reserve have been a feast for many international corporations. At the end of October, U.S. companies have issued $1.1 trillion in investment grade and high yield bonds (Source), responding to investors’ thirst for higher yields. That is an increase of 26% over last year’s bond issuance. International companies are, quite rationally, borrowing at the lowest interest rate they can find around the world, then spread that money to their subsidiaries in other countries. They pay the lowest income taxes they can find internationally and shuffle the paper profits around the world.

Ok, where were we? Oh yeah, cautious but more confident consumer, tepid but possibly improving GDP growth and record corporate profits. Oh yeah, and record Federal Debt – over $16 trillion and counting.

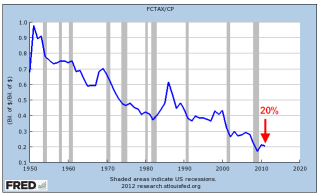

Pity the poor corporations who pay the highest income tax rate in the world – except that they don’t. In 2011, it was about 20%.

Record corporate profits, record low effective corporate tax rates, record low borrowing costs for corporations and record high Federal Debt. The largest companies heavily lobby Congress to keep their tax rates low. No matter how high profits are, companies publicly worry about their profit forecast and the economic outlook. These large companies have become adept at convincing Congress that they are struggling. Half of the Congress thinks that they must help these poor companies create jobs; key committee members craft more tax goodies and bury these goodies inside large appropriations bills. Congress underfunds regulatory agencies so that they are effectively outmanned by corporate legal departments.

The lack of corporate tax revenues contributes to the Federal debt; over the past fifty years that share has declined from 20% of Federal revenues to about 10%. If the share of Federal revenues had remained at the 20% level of the 1960s, the Federal Debt would be $7.4 trillion today, not $16 trillion. Calculating savings on interest paid on the smaller debt would lower the actual debt to about $6.8 to $7 trillion.

Big increases in productivity have helped fuel the strong rise in profits. Investments in technology as well as higher skill and education levels have enabled American workers to record levels of production but they have not shared in the gains from those increasing levels of production. The U.S. has risen to the same levels of income inequality as some emerging countries: China, Venezuela, Ecuador and Argentina.

To recap: record high corporate profits due to record high worker productivity which has not benefited the workers, record low effective corporate tax rates and share of the costs of government, record low borrowing costs for corporations, and record high Federal Debt.

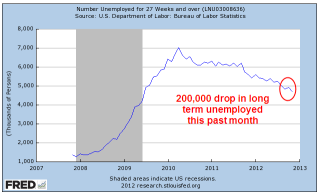

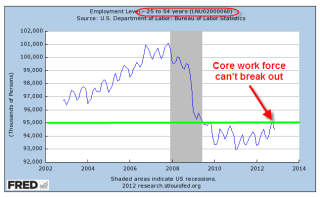

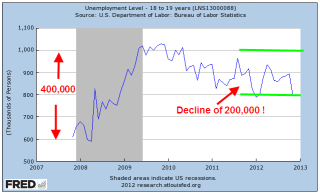

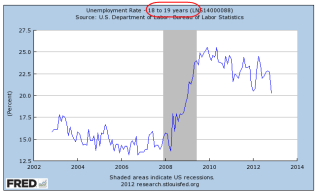

All of this largesse to multi-national U.S. corporations begs the question: Where are the jobs? But that I’ll leave for next when we look at the November Labor Report released this past Friday.