August 30, 2015

For the past few weeks, the volatility in the stock market has been front and center. I finished last week’s blog with a note that the market would be conducting a vote of confidence in the coming weeks. In the opening minutes last Monday morning, the Dow Jones index dropped a 1000 points, almost 6%. No doubt many investors had spent the weekend worrying and put their sell orders in the night before. By Friday’s close, however, the SP500 had gained almost 1% for the week.

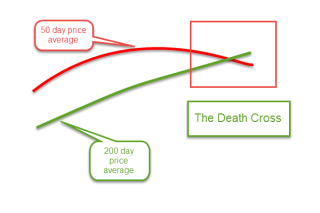

A few weeks ago the Dow Jones index, composed of just 30 large company stocks, marked a death cross. The death cross is the crossing of the 50 day price average below the 200 day average. See last week’s blog if you are unfamiliar with this. This week the broader SP500 index, composed of the largest 500 U.S. companies, marked it’s own death cross.

Two weeks ago, I noted the attitude of one Wall St. Journal reporter to the dreaded death cross. In one word: blarney. In two words: hocus-pocus. So why do some investors and the press give this any attention? Used as a trading system in the broader SP500 the death cross (sell) and it’s companion golden cross (buy) signal have produced a winning trade 4 out of 5 times. Where do I sign up?, you might be thinking. In an almost sixty year period of the SP500, however, the extra annual return is slight – about 8/100ths of a percent, or 8 basis points – over no timing strategy, i.e. buy and hold. To the average small investor, taxes and other fees more than offset this negligible advantage.

In contrast to any technical stock market price indicators, the fundamentals of the U.S. economy are mostly strong or expanding. Consumer Confidence rose above 100 this past month, surpassing the optimism of the benchmark set in 1985. The second estimate of GDP growth released this past week was above some of the high estimates. After inflation, real GDP growth continues at 2.65%.

Corporate profits are growing at 7.3%, home prices are up 5%. Real, or inflation-adjusted, consumption spending and income is growing at more than 3%, equaling the heights of pre-recession spending and income growth in early 2007.

Housing prices are increasing for a good reason. Inventory of homes for sales is relatively low. In the middle of the 2000s, prices rose even though inventory of homes for sale were going up, a sign of a speculative bubble. Ah, things look so clear in the rear view mirror.

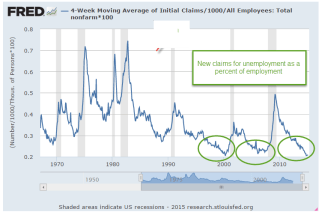

New jobless claims remain at historically low levels and job growth has been consistently solid. There are more involuntary part-timers than we would like to see and the participation rate is low. Gloom and doomers will tend to focus on the relatively few negative points in an otherwise optimistic economic panorama. Gloom and doomers think that those who disregard negative signs are Pollyannas. Eventually, years later, the gloom and doomers are right. “My timing was off but, see, I was right!” they exclaim. The lesson of the death cross and the golden cross are this: a person can be right most of the time. The secret to successful investing is knowing when we are wrong and acting on it.

For the individual investor, signals like the death cross can be calls to check our assets and needs. Older investors may depend on some stability in their portfolio’s equity value for income, selling some equities every quarter to generate some cash. Financial advisors will often recommend that these investors keep two to five years of income in liquid, low volatility investments. These include cash, savings accounts, and short to medium term corporate bonds and Treasuries. Younger investors may see this price correction as an opportunity to put some cash to work.