The end of another month ending involving billing customers, paying taxes, balancing the bank accounts and closing the books. Each month it becomes apparent that one of the reasons why there is not more robust job creation is the “invisible” employee costs, both in dollars and in the business owner’s liability. By invisible, I mean that these costs are typically out of sight and out of mind to most employees. These costs are quite visible to the owner who, failing to account for them in their business pricing, soon goes out of business.

These costs were designed to be invisible to employees because if most employees knew all the costs, some politicians might lose their jobs. A paycheck with a gross amount of $1000 might have $200 or more taken out for taxes and health care premiums. The net amount of the paycheck is $800, which is what we get to spend on bills, rent/mortgage, food, transportation and a movie. We grouse about the $200 in taxes but that $200 pales in comparison to the invisible costs that don’t show on that paycheck stub. Most of these costs are mandated by either Federal or State law and include Workmen’s Compensation insurance, Unemployment Insurance, Liability Insurance, and Social Security and Medicare taxes (employer’s half). The cost of these mandates goes into neither your pocket or the employer’s pocket. Benefit costs include health insurance, retirement contributions, education reimbursements, vacation and sick pay. Mandated costs and benefits can easily add $500 to $1000 in cost to that $1000 gross paycheck amount. In addition, there are indirect costs which include office and production equipment, rent, utilities, and transportation, as well as the internal costs of accounting, supervision, and training. After those costs, that $1000 gross paycheck can have a final cost of $2500 or more.

The indirect costs are simply a part of any business; they are the costs of producing a dollar of revenue to the business. My chief concern is the invisible insurance and tax mandates whose costs are hidden from employees. By making the employer, not the employee, responsible for the payment of these costs, politicians could more easily sweep them under the rug. Some people strongly object to the health insurance mandate but how many protest or are even aware of the Unemployment Insurance mandate or the Workmen’s Compensation Insurance mandate? Many are not aware simply because the cost is paid by the employer. While the employer may write the check, the employer “deducts” the cost from the employee by lowering the gross amount that they can pay to an employee.

I am not making a case against these insurances and taxes that add a safety net for workers. What I do object to is the surreptitious way that lawmakers have enacted them in order to hide the magnitude of the costs of these safety programs. Because these mandates are structured as a payment from the business and not the employee, Workmen’s Comp, Liability, and Unemployment Insurance are rated based on the company’s industry classification and claims history. An employee who has worked twenty years without an accident is charged the same amount of money as his/her co-worker who does not pay attention to safety regulations and common sense. The same holds true for liability insurance; a thoughtful employee and a careless employee pay the same amount. In some construction industries, Workmen’s Comp and Liability insurance can be 20% or more of gross pay – not a trivial amount. Should a careless driver and an accident-free driver pay the same amount in auto insurance? Of course not. Yet that is how Workmen’s Comp, Liability and Unemployment Insurance are rated. Since there is no individual worker history, no individual experience rating, there is no direct cost tied to a worker’s actions. An employee can become naturally divorced from the consequences of their actions. Often an employer will not add another employee if they are not sure whether he/she will be able to keep them on six months from now. The reason is that many, if not all, states will increase the unemployment insurance rate for that business when the employee is let go in six months and files for unemployment insurance. It can be more cost efficient for an employer to pay some overtime to existing employees to make up the extra work till the employer is sure that business volume is on the increase.

Unlike the other insurance mandates, the health care mandate at least makes individuals personally responsible for their own insurance. With no direct responsibility for their own Workmen’s Comp, Liability and Unemployment insurance, employees are effectively treated, in the eyes of lawmakers, like teenage children. A host of state and federal employment regulations only confirms that status. In the eyes of our laws, employees are not quite adults. Employers are treated by state employment agencies as though they were the parents of not quite fully responsible teenagers and the burden of proof is on the employer to show that the employer complied fully with regulations.

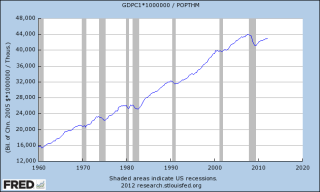

How did we get here? During the second World War, the Federal Government was running up extremely large war costs and experiencing severe cash flow problems. One problem the government had was that tax payments were not due till March 15th of each year (in 1954 the date was changed to the current April 15th), which meant the government had to borrow a lot of money each month. Many people were not paying all of their taxes, either income or the Social Security tax enacted several years prior. The problem of collecting delinquent taxes presented yet another costly headache for the government. A noted economist of the time, John Kenneth Galbraith, suggested a solution last used eighty years earlier during the Civil War: make employers withdraw the taxes before they paid their employees. This would both solve the problem of timely collection of taxes and curb much of the delinquency. It would be much easier for the government to go after the far fewer businesses in the country than millions of individual taxpayers. Thus the withholding system was born again. (A history of taxes)

Once the mechanism of withholding was in place, politicians realized what a boon this was. Taxpayers dislike taxes and the politicians who enact them. Politicians could now increase existing insurance costs and mandate new ones without the taxpayers – the voters – constantly being reminded of these now invisible costs. Politicians simply had to change the law, then notify a relatively small number of businesses to pay more. That created a new problem for business owners. Politicians had effectively deflected the disapproval of voters onto employers. When an insurance cost goes up, it is difficult for an employer to say to an existing employee that the employer will have to reduce an employee’s hourly wage or salary to make up for this increased cost. For subsequent hires, an employer can reduce the hourly wage or salary that they will offer to a new employee. The employer has two alternatives: raise the price it sells its product or service; or eat the increased cost. Employers complain about this state of affairs long and loud. They form trade groups and lobby their state legislatures. The politicians get the better of a bad situation: listen to loud protests from a lot of voters and possibly get thrown out of office or have to listen to a relatively few employer lobbyists.

I am not advocating the abandonment of the withholding system, which does solve the problem of timely tax payments. I am advocating for a system that directly charges those who are going to benefit from the safety net that exists – the employees. This is no longer the paper and pencil age of World War 2. Digitized records would enable most state and federal agencies to assign individual ratings to employees based on their history. A new or existing employee presents their individual rating for various types of insurance to the employer and the employer deducts the amounts and sends to the appropriate agency, just as they do now. The difference is that the employee gets to see what he/she is being charged for and might in some cases be able to control some of those costs. Instead of being paid $20 an hour, an employee might be paid $34 an hour. The cost to the employer is the same. For many of these mandated costs, the tax write offs to the employer are the same; it is a cost of producing business income.

What can we do about it? Press your elected representatives for individual ratings for these insurances. An employee who has never filed for unemployment insurance pays the same as a person who has collected six months of unemployment insurance last year. Does that seem fair? Why have an employee half and an employer half of the Social Security and Medicare tax? It all comes out of the employee’s pocket in the long run. Why the game of hiding the costs?

Imagine a world where an employer can have a bit more sales volume, hire an employee and let them go if sales subsequently fall off. An employee who is let go would then make the choice of whether to collect unemployment. They might absolutely need the unemployment insurance and that would affect their individual unemployment rating the same as it does when we file an auto insurance claim. They might try harder to get another job or switch to a different job in order to keep their individual unemployment rating pristine. It would be the employee’s choice.

Imagine a world where the employee controls what they put away for retirement. If you want to put away $6,000 a year tax free into a 401K retirement plan, why shouldn’t you? Why have the charade of the employer matching your contribution by some percentage? How did we get to the point where employee compensation is a haunted house of smoke and mirrors?

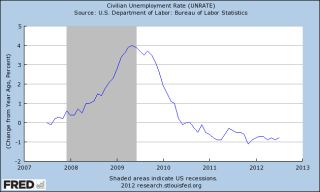

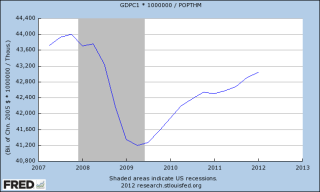

Imagine a world where an employee is not bound to an employer for insurances and benefits and tax benefits. Imagine a world where the employee has choices. Imagine a world where the employer pays the total of the employee cost to the employee and the employee then sees the true scope of deductions. In fact, we do have that world now. Employers are increasingly using subcontractors and temporary agencies as a way to sidestep the burdens of employment. From the BLS July Labor Report: “Temporary help services has recovered 98 percent of the jobs lost during the most recent downturn.” (Source). Tell your state and federal representatives that you would like a different world – one in which you are treated like an adult.