May 10th, 2014

This week I’ll look at some short term mixed signals in economic activity, and long term trends in labor productivity and household net worth. In advance of the mid term election season in the U.S., I’ll look at several aspects of the money machine that drives elections.

*****************************

CWPI

For almost a year, I’ve been tracking a composite index, a Constant Weighted Purchasing Index, based on the Purchasing Manager’s Index produced by the Institute for Supply Management (ISM). Based on key elements of ISM’s manufacturing and non-manufacturing monthly indexes, it is less erratic than the ISM indexes and gives fewer false signals of recession and recovery. After reaching a low of 53.5 last month, the CWPI of manufacturing and service industries is on the rise again. During this recovery this index of economic activity has shown a regular wave pattern. If that continues, we should expect to see four to five months of rising activity before the next lull in late summer or early fall. Any deviation from that pattern would be cause for concern if falling and optimism if rising.

The winter probably prolonged the recent downturn in the index. In the manufacturing sector, new orders and employment are strong. In the services sector, which comprises most of the economy, new orders are strong but employment growth has slowed to a tepid pace.

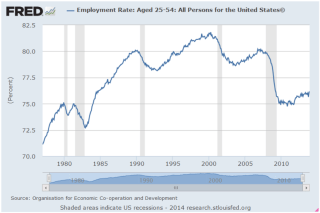

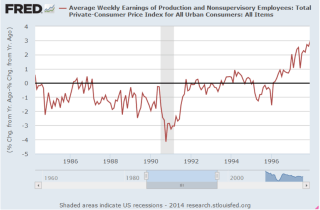

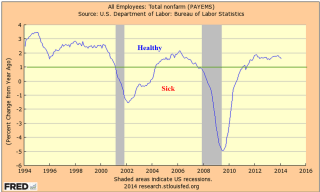

This week the Bureau of Labor Statistics released their estimate of Productivity growth for the first quarter. One of the metrics is the per hour growth in productivity, which is key to the overall growth of the economy. As seen in the chart below, the last time annual productivity growth was above 2% was in the 3rd quarter of 2010. To show the historical trend, I took the 3 quarter moving average of the year over year growth rate. We can see a remarkable shift downward in productivity.

Recovery after recessions are marked by a spike in growth above 3% simply because the comparison base during the recession is so weak. What the chart shows is the shift from steady growth of 3% to a much weaker growth pattern since the 2008 recession. In testimony before the Senate Finance Committee, Fed chairwoman Janet Yellen stated that we may have to adjust our expectations to continuing slow growth. The erosion of productivity growth has probably prompted concerns in the Fed Open Market Committee.

***************************

JOLTS – Job openings

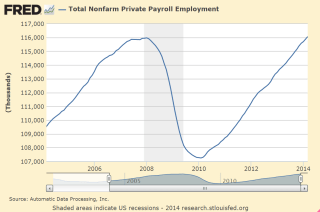

Continuing on from labor productivity, let’s look at a trend in job openings. With a month lag, the Bureau of Labor Statistics (BLS) reports on the number of job openings around the country. Preceding a recession, the number of job openings begins to decline. Recovery is marked by an increase in openings. March’s report showed a slight increase in job openings, near the high of the recovery and closer to late 2005 levels.

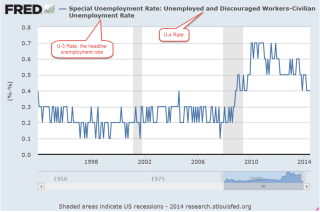

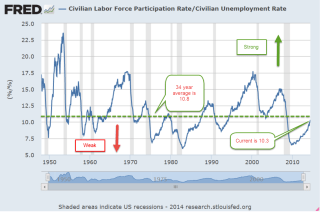

When we look at the ratio of job openings to the unemployed, the picture is less encouraging. The unemployed do not include discouraged job seekers. If we included those, we the readers might get discouraged. Almost five years after the official end of the recession, we are barely above the low point of the recession of the early 2000s.

When Fed chairwoman Janet Yellen speaks of weaknesses in the labor market that will require continued central bank support, this is one of the metrics that the Fed is no doubt keeping an eye on.

*****************************

Household Net Worth

For many of us, our net worth includes family, friends, pets, interests and passions but the Federal Reserve doesn’t count these in its quarterly Flow of Funds report. In early March, the Fed released its annual Flow of Funds report, which includes estimated net worth and debt levels of households, business and governments in the U.S. Below is a chart of household, business and government debt levels from that report.

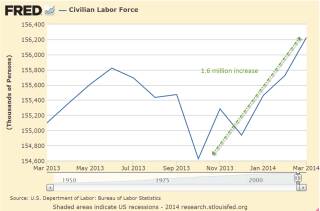

Rising stock prices and recovering home values have boosted the net worth of households.

As you can see in the chart below, the percent change in net worth has only significantly dipped below zero in the last two recessions.

The severity of this last dip was due to the falls in both the housing and stock markets. The curious thing is why earlier stock market drops in the 1970s and early 1980s did not produce a significant percentage drop in household net worth. In those earlier periods, increases in home prices were about 4%, similar to the level of economic growth, and not enough to offset significant drops in the stock market.

So what has changed in the past two recessions? The introduction of IRA accounts in the 1980s prompted individuals to put more of their savings in the stock market instead of bonds, CDs and savings accounts. Downturns in the stock market in the past two recessions affected household balance sheets to a greater degree. Inflation was greater during the 1970s, 80s and 90s, raising the value of all assets. China’s growing dominance in the international market was not a factor in the stock market drop in 2000 – 2003. It was only admitted to the World Trade Organization in 2001. In an odd coincidence, the past twenty years and particularly the past 15 years are marked by a growing and pervasive inflence of the internet in all aspects of our lives.

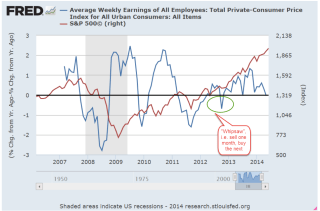

If we chart the change in a broad stock market index like the SP500 along with the percent change in net worth over the past seven years, we see a loose correlation using 40% of the change in the stock market. Rises and falls in the stock market produce a material change in the paper net worth of households and can significantly lead to a change in “mood” among consumers, something the economist John Maynard Keynes called “animal spirits.”

Because the swelling demographic tide of the Boomer generation has a significant part of their retirement nest egg in the stock market, price movements in the markets have probably had a greater effect on total net worth in the past decade.

************************

Party Favors

Now for everyone’s favorite dinner topic – political contributions. Who contributed the most to the 2012 Presidential campaign?

a) the evil Koch Bros

b) gambling king Sheldon Adelson who almost single-handedly bankrolled the Newt Gingrich campaign

c) hedge fund billionaire George Soros, the “Octopus” of liberal causes

d) the socialist commie labor unions.

Answer: Whatever answer suits your political message or opinion.

On the one hand, campaign contributions can be what economists call a “rich” data set so that an analyst can tease out several conclusions or summaries, sometimes contradictory, from the data set. On the other hand, some “social welfare” organizations do not have to reveal donor lists. An investigator wishing to discover the myriad channels of political contributions must don their spelunking equipment before descending into the caverns of political finance. In some cases private IRS data is released by accident, revealing dense networks linking moneyed individuals.

The Federal Election Commission (FEC) maintains a compilation of individual and group contributions to political campaigns. OpenSecrets.org , a project of the Center for Responsive Politics, summarizes the data. There we find that Sheldon and Miriam Adelson contributed $30 million through the Republican Restore Our Future PAC and $20 million to the Republic PAC American Crossroads.

The Democratic PAC Priorities USA did not have a single donor as generous as the Adelsons. George Soros ponied up $1 million along with many others, including Hollywood movie mogul Steven Spielberg, but the most generous donor contributed only $5 million, punk change when compared to the Adelson’s commitment to Republican causes and candidates.

In the 2012 Presidential race, the Obama campaign drew in so many more individual contributions than the Romney team that outside spending by political action groups was the only way to close the money gap. Pony up they did, outspending the Obama campaign $419 million to $131 million. The NY Times summarized the outside spending with links to the various groups.

Despite their relatively low percentage of the work force, labor unions are major contributors to the Democratic effort. A WSJ article in July 2012 revealed the extent of their political activity. The bulk of union campaign spending is not reported to the FEC but is reported to the Labor Dept. In total, unions disclosed that they spent over $200 million per year from 2005 – 2011. 54% of the spending reported to the Labor Dept was on state and local campaigns.

As a block then, are unions the largest contributors to Democratic campaigns? Some “napkin math” would get us to a guesstimate of $90 to $100 million a year on national campaigns, so surely they are at the top, aren’t they? Not so fast, you conclusion jumper, you.

As transparent as the unions are, contributors to Republican causes are not. Corporate political spending like that of the private U.S. Chamber of Commerce are not disclosed, as are many other corporate political and lobbying efforts. These are some of the largest corporations in the world with vast resources and a strongly vested interest in policy decisions that will affect their bottom line. Most of those contributions are hidden.

As this midterm election approaches rest assured, gentle reader, that you can confidently say – no matter what your political persuasion – that you have data to back up your opinion that the other side is buying the election. You can hold your head high, confident in the soundness of your opinions. And don’t we all sleep better at night, knowing that we are right?