November 5, 2017

How do numbers feel to us? Numbers are hard like rocks. Feelings are squishy. Numbers are left-brained. Feelings are right-brained. Deep in the vaults of our brains, tiny elves translate one into another. Here’s an example.

This past week, House Republicans released an initial proposal of tax reform. A feature of the plan is the limitation of state and local tax deductions (SALT) to $10,000. Under current tax law, taxpayers have been able to deduct state and local taxes without limit.

This will hurt taxpayers in high-tax blue states which are overwhelmingly Democratic. Wisconsin, a purple state, is the lone exception among the top ten states (Forbes ranking of state tax burden).

Expecting no votes from Democrats in passing a tax reform/cut bill, Republicans included few provisions in the bill that would pacify voters in Blue Democratic states. Republican congresspersons in those states are faced with a dilemma. One Republican congressperson in New Jersey, one of the top high tax states, claimed that the average SALT deduction in his district was $21,000, more than double the allowance in the tax reform proposal.

Knowing that the SALT limitation will hurt their constituents, do Republican House members vote with their party or in the interests of their constituents? Numbers can make politicians anxious.

For some taxpayers in those states, the feeling is anger. “I don’t want to pay taxes on my taxes,” one New Jersey resident growled.

That same N.J. congressperson claimed that incomes less than $200,000 were middle-class. According to this calculator based on the Census Bureau’s Current Population Survey, an income of $200K is in the 97th percentile of all incomes. Less than 3% of households have incomes greater than $200K. Hardly middle-class.

What is middle class? Some studies use the 25th – 75th percentile. Some use the 30th – 80th percentile. Using the latter definition, 2016 incomes from $24,000 to $75,000 were considered middle-class. These classifications use national data. Many coastal states have far higher incomes and living costs.

People living in some east and west coastal states feel middle class even though the income numbers do not classify them as such. Take for example, a household in Silicon Valley, where the median household income is almost $100K, $40K more than the national median. They are rich, right?

Not so fast. The median price of a home in Santa Clara County (San Jose) is almost $1.2 million (See here ). Spending $40,000 annually for housing on an income of $95,000 feels middle class. The percentage of housing cost to income, 42%, is far higher than the 30% HUD guideline, and is more typical of poor working-class families.

Californians have counties with the highest incomes in the U.S. – and some of the poorest. The state has a median household income that is 12% higher than the national average.

But that’s not how it feels. That extra income is eaten up by higher housing costs, high car insurance premiums, and higher taxes at all levels. California sends about 12% more taxes to Washington than it gets back in various national programs. The additional federal taxes paid by higher income coastal states helps pay for benefits to those in lower income states, particularly those in southern states. Blue states subsidize Red states.

The Red states control the national agenda in Washington. The Republican tax proposal in its current form takes tax pebbles from the Red scale and puts them on the Blue scale. That feels spiteful. Voters in those Blue states feel angry.

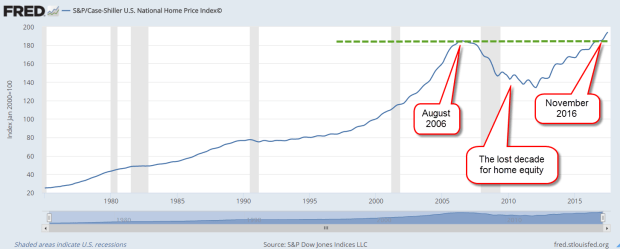

Interest groups around the country feel angry. The National Association of Home Builders claims that the SALT limit will lower home valuations, particularly in coastal states. They have promised a considerable effort and expense to defeat this version of the tax proposal.

When I recalculated my family’s 2016 taxes using the new proposal, we saved $752, a bit less than the $1200 average savings for a family of four. The monthly tax savings – the numbers – are relatively small. I feel neither angry or joyful. Those of us who are little affected by the proposal are unlikely to raise our voices in protest or support.

Angry people act. They call, they shout, they organize.

Joyful people – the CEOs of large corporations who will benefit greatly from this proposal – are not shouting. They calmly make claims that lower taxes will create more jobs, although the evidence is rather weak. They are organizing. They are calling talk shows. But most of all they are donating.

Political donations can speak more loudly than the shouts of angry people. In the political game of Rock, Scissors, Paper, cash covers a rock thrown in anger. Angry people must take up the more precise and patient tool of the scissors if they hope to best cash in a contest.

Lastly, this tax proposal further divides earners into groups. Income earners above the median will learn that this $1 is not the same as that $1 to the taxman. According to an analysis done for the Wall St. Journal,

The $1 earned in wages and salary will be taxed more than

The $1 earned by the small manufacturer, which will be taxed more than

The $1 earned by the real estate investor, which will be taxed more than

The $1 earned by a stock or bond investor, which will be taxed more than

The $1 paid to an inheritor, who will pay $0.

Republicans criticize the identity politics practiced by Democrats. With this tax proposal, Republicans have stamped identities on the very $$$$ we earn. Those numbers don’t feel good.