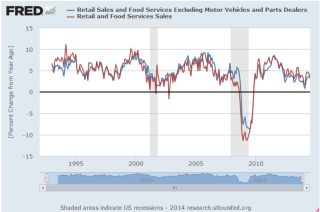

Last week I pointed to several contradictory outlooks for sales in the upcoming holiday season. Bill McBride at Calculated Risk has several charts on the import and export volume at the port of Los Angeles. The import data indicates that businesses were buying goods in late summer and the fall in anticipation of a good holiday season. Both Home Depot and Best Buy reported better than expected earnings on Tuesday but Best Buy’s sales were less than expected. The company cited increasing pressure from online retailers. E-Commerce continues to take an ever increasing share of the retail sales market.

Amazon is now making more money selling other vendors’ products than it does its own. Vendors typically turn over much of the sales, shipping and billing process to Amazon. Businesses, including mine, are increasingly turning to Amazon for parts or supplies. Why? Amazon has become an easy to search portal for so many vendors and the prices are competitive. Why spend time searching the web for long discontinued parts when Amazon has already done that? What is even more surprising is the enormous volume of third party items that Amazon now stocks and, surprisingly, the items are received from Amazon, not the vendor.

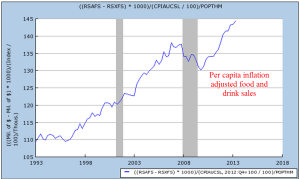

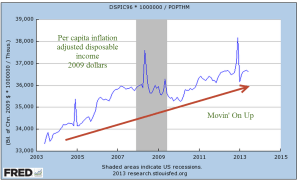

On Wednesday, the monthly report of retail sales showed a .4% month on month gain, causing analysts at Morgan Stanley to reverse their earlier dour opinion of the coming holiday season. The year over year gain is at 4% but retailers that target lower income consumers are experiencing some difficulties. J.C. Penney reported sales and earnings that were disappointing. After an earlier upbeat report from the home improvement chain Home Depot, Lowe’s reported strong sales and earnings, confirming the continuing strength in this sector. Later in the week, Target issued a disappointing earnings report. Will the ongoing decline in gas prices leave working class families with enough extra cash in their wallets this Christmas season? Wal-Mart, Target and J. C. Penney hope so.

**************************

[Revised to clarify the two separate housing indexes below]

October’s housing market index reading of 54 from the National Assoc of Homebuilders indicated continuing strength in the new home market. This index is a composite of factors, including sales, inventory, builder expectations and traffic. The series, like the industrial reports, is indexed so that 50 is the neutral mark, indicating no net growth. Although the overall index has declined from the summer peak, both sales and expectations are in the strong to robust growth.

The Federal Housing Finance Agency tracks an index of home prices (only). Major markets on both the east and west coasts are still below the bubble peaks of 2005 – 2006.

From 1983 to 1999, the average house cost 13 to 15 years worth of rent. This baseline is a good rule of thumb when pricing out houses. In 2006, at the height of the housing bubble, houses were selling for 25 years worth of the average monthly rental. Los Angeles experienced a much greater price inflation during the 2000s than either SF or NYC. Although the nationwide economy is growing steadily but slowly, Los Angeles has responded to the strong growth in manufacturing throughout the country. Asking rents for industrial properties in L.A. are rocketing upward this year, accelerating from the strong three year growth and exceeding the price levels of 2007.

http://www.loopnet.com/xNet/MainSite/Tools/WidgetHTML.aspx?WidgetType=50&CountryCode=US&StateCode=CA&State=California&CityName=Los+Angeles&SiteID=1&TrendTypeID=2&PropertyTypeID=40&ListingType=LEASE&PropertyType=Industrial&TrendType=Asking%20Rent Available Office and Industrial property in the LA area is at multi-year lows.

http://www.loopnet.com/xNet/MainSite/Tools/WidgetHTML.aspx?WidgetType=50&CountryCode=US&StateCode=CA&State=California&CityName=Los+Angeles&SiteID=1&TrendTypeID=5&PropertyTypeID=80&ListingType=LEASE&PropertyType=Office&TrendType=No.%20of%20Spaces

http://www.loopnet.com/xNet/MainSite/Tools/WidgetHTML.aspx?WidgetType=50&CountryCode=US&StateCode=CA&State=California&CityName=Los+Angeles&SiteID=1&TrendTypeID=5&PropertyTypeID=40&ListingType=LEASE&PropertyType=Industrial&TrendType=No.%20of%20Spaces

The Consumer Price Index released Wednesday showed a tiny decrease in inflation for the month. The year over year change was 1.7%, indicating that demand at many levels is positive but weak so that there is little pressure on prices. On Thursday, the Producer Price Index (PPI) confirmed that the supply chain is experiencing very low upward pressure.

***************************

The PMI Flash Index, a preview of the upcoming report on the manufacturing sector, confirmed the continuing growth in the manufacturing sector.

***************************

The Job Openings and Labor Turnover Survey (JOLTS) by the BLS was released on Friday. Unlike the timeliness of the monthly Employment report, this one lags by a month but does provide a more comprehensive analysis of the growth or decline in the labor market. The BLS surveys employers at the end of the month, September in this case, for job openings and layoffs. A job opening can be full time, part time, seasonal or temporary so the data can be skewed by seasonality factors. The longer term trend, though, is apparent.

It may be several more years before job openings reach the level attained during the tech boom of the late ’90s. Like the gold fever of the mid-19th century, investors poured money into a lot of ventures with little more than a napkin sized business plan. This pattern of bubble and bust is fairly typical when game changing technologies emerge. The spread of the telegraph and railroads led to horrific recessions in the late 19th century, culminating in the depression of 1893-94. The rise of radio in the 1920s prompted speculative fever that contributed mightily to the crash of 1929, setting the stage for the bad monetary policy and haphazaard fiscal policies that fed the depression of the 1930s. In the 1960s, a rush of investment in airlines and war funding helped fuel a frenzy of speculation that crashed in 1970.

******************************

In Washington this week, the Senate voted to change the rules for Senate confirmation of most executive and judicial appointments, the so called “nuclear option” that requires only a majority vote for confirmation. This modification of the filibuster rule should have been done ten years ago when then Democratic Senate Minority Leader Tom Daschle led filibusters to block many of George Bush’s appointments. Since then, the Senate has grown ever more dysfunctional, incapable of even ordering pizza. Under the elitist filibuster rules, each Senator could act like a despot or one of the “Knights who say ‘Nee’!” in the comic movie “Monty Python and the Holy Grail.” A Senator representing 300,000 people in Wyoming could nix or delay an executive appointment – this in a country of over 300 million. Sounds a bit like England in the 1770s. A lot of people died in the Revolutionary War so that America would not be a country ruled by a despot, be it a king or a Senator.

*******************************

The rule change makes the confirmation of Janet Yellen as the next chair of the Federal Reserve a near certainty. In a speech at the Cato Institute’s Annual Monetary Conference, Charles Plosser, President of the Philadelphia branch of the Federal Reserve, made a good case for some restraint by the Federal Reserve – not in the amount of debt the Fed purchases but the type of debt:

“[The Federal Reserve’s] purchase [of] specific (non-Treasury) assets amounted to a form of credit allocation, which targets specific industries, sectors, or firms. These credit policies cross the boundary from monetary policy and venture into the realm of fiscal policy.”

Mr. Plosser would rather see politicians, not central bankers, decide which industries to favor through bailouts or loan purchases. In a democratic republic like ours, if the politicians in Washington want to bailout banks or the housing sector, they can do so by issuing general debt obligations, Treasuries, which the Federal Reserve can buy. Gridlock in Washington has prevented them from reaching any consensus about these policies, leaving it up to the Federal Reserve to act in their place, to make political decisions which compromises the neutral stance that a central bank should have.

Now, we might say that the result is the same so what’s the big deal? Knowing that Fed chairman Ben Bernanke would come to the rescue has allowed politicians to not make difficult compromises. Why should they? If Congress does less, the Fed does more. Because it can be so difficult to enact their agenda through the political process, Presidents and political parties turn to the Fed as the fourth branch of government.

Plosser also questions the dual target of both inflation and unemployment that the Fed has assumed as its mandate. The law states that the Fed should enact monetary policy that is “commensurate” with the “long run potential to increase production.” Since the recession began in 2008, the Fed has adopted a series of “QE” short term measures designed to decrease unemployment and Plosser’s view is that these are not part of the job description. Plosser will be a voting member in 2014. His vote of restraint is unlikely to hold much sway with Janet Yellen, who is ready to keep the cornucopia money machine flowing.

****************************

In the Wall St. Journal’s Washwire Blog, Elizabeth Williamson writes that the White House is conducting a self-assessment in the wake of the health-law launch, “recognizing that administration officials missed warning signs and put too much trust in their management practices.” What on earth has given this administration any reason to trust their management practices? Was it their management of the attack on the U.S. consulate in Benghazi in September 2012? Or perhaps the “red line” that President Obama drew with Syria, promising a military response if Syria used chemical weapons against its own people? Or the terribly mismanaged mortgage relief program, HAMP, that former Treasury Secretary Tim Geithner put in place?

This is only a partial list of the persistently poor management practices that have marked this administration. It began with the poor preparation in advance of the March 2009 meeting with the nation’s largest banks, leading Obama and Geithner to offer generous terms to the banks when the banks would have accepted any terms in order to stay alive. The crafting of the stimulus bill was an example of indecisive leadership and management at one of those rare times in history when both houses of Congress were controlled by the President’s party. Using a basketball analogy, the administration blew a layup.

Now comes the news that the Obama administration wants to exempt some union health care plans from a “reinsurance tax” – about $63 per person per year – that all plans under the ACA health care law pay. How will they do this? By a carefully worded exemption that applies only to self-administered health plans. A little background. Many big companies self-insure and hire an administrator like Blue Cross to take care of the details. Under the Taft-Hartley act passed after World War 2, employers often in the same industry may collectively construct or join what is essentially a health insurance trust, offering their employees insurance through the trust. These plans are called “Taft-Hartley Multi-employer Health and Welfare Plans” and are really a benefit in the construction trade because they enable smaller employers to offer employees – usually these are unionized employees – a health plan at more affordable rates, taking advantage of the larger pool of insured offered by the trust. It also enables employees to move from one company to another and retain their health insurance. The plans are defined as self-administered even though the trust may contract out the details of daily management to a third party. So here is a plan that fills a need and offers a benefit to both employers and employees. Labor unions, like everyone else, want special treatment, of course, so they have been lobbying for an exemption from this rather small tax. In September the Huffington Post reported that the unions were having little success in lobbying for another exemption – the ability of these plans to qualify for subsidies as though they were individual health care plans.

With a history of spineless leadership from an Obama administration that can’t say no but can’t say yes either, unions will continue to press for special treatment. Finally, even they may get disgusted with an administration that can’t take a stand.

Like the Durango-Silverton narrow gauge train, the stock market chugs up the hill. Production, sales and employment reports are either strong or not too bad or neutral but not bad. Short, mid and long term volatility measures are subdued. Gold has been drifting steadily down, nearing the lows of July. Of course, some say that the time to get worried is when no one is worried.

The biggest worry for many in the coming week may be a dry turkey, or a heated discussion about politics. Do pass the sweet potatoes if asked even if that so-and-so relative of yours is dumber than the potato. Happy Turkey Day!